Answered step by step

Verified Expert Solution

Question

1 Approved Answer

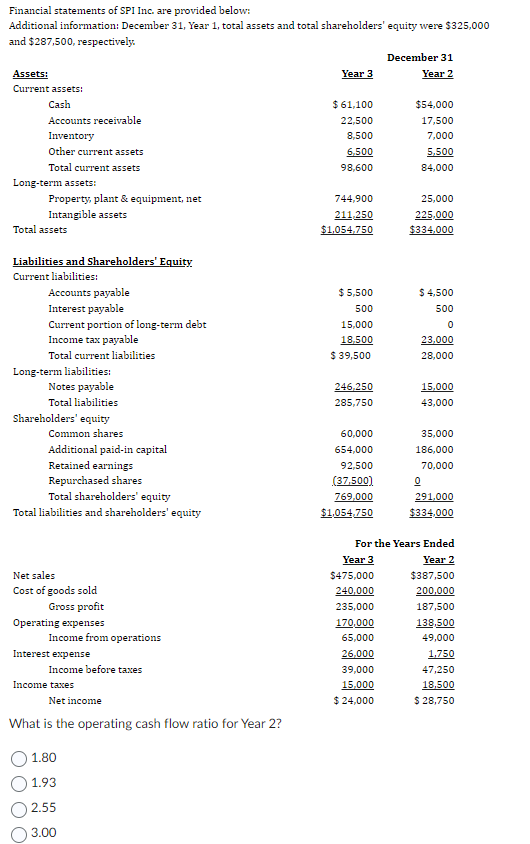

Financial statements of SPI Inc. are provided below: Additional information: December 31, Year 1, total assets and total shareholders' equity were $325,000 and $287,500,

Financial statements of SPI Inc. are provided below: Additional information: December 31, Year 1, total assets and total shareholders' equity were $325,000 and $287,500, respectively. Assets: Current assets: Cash Accounts receivable Inventory Other current assets Total current assets Long-term assets: Property, plant & equipment, net Intangible assets Total assets Liabilities and Shareholders' Equity Current liabilities: Accounts payable Interest payable Current portion of long-term debt Income tax payable Total current liabilities Long-term liabilities: Notes payable Total liabilities Shareholders' equity Common shares Additional paid-in capital Retained earnings Repurchased shares Total shareholders' equity Total liabilities and shareholders' equity Net sales Cost of goods sold Gross profit Operating expenses Income from operations Interest expense Income before taxes Income taxes Net income What is the operating cash flow ratio for Year 2? 1.80 1.93 2.55 3.00 Year 3 $ 61,100 22,500 8,500 6,500 98,600 744,900 211,250 $1,054,750 $5,500 500 15,000 18,500 $ 39,500 246.250 285,750 60,000 654,000 92,500 (37,500) 769,000 $1,054,750 Year 3 $475,000 240,000 235,000 December 31 Year 2 170,000 65,000 26,000 39,000 15,000 $ 24,000 $54,000 17,500 7,000 5,500 84,000 25,000 225,000 $334,000 $ 4,500 500 0 23,000 28,000 15,000 43,000 35,000 186,000 70,000 For the Years Ended 0 291,000 $334,000 Year 2 $387,500 200,000 187,500 138,500 49,000 1,750 47,250 18,500 $ 28,750

Step by Step Solution

★★★★★

3.50 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below To calc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started