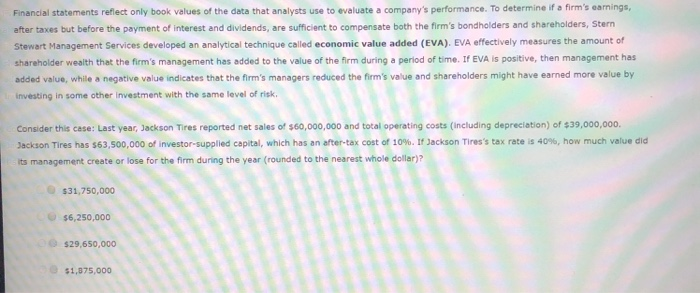

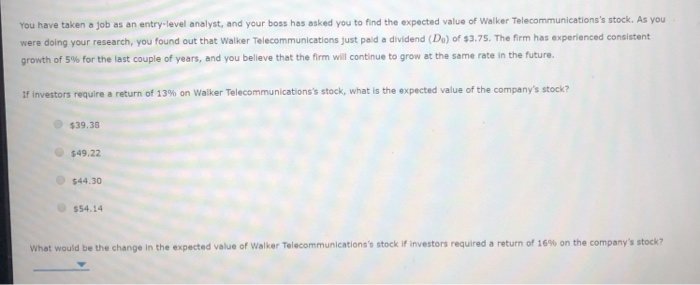

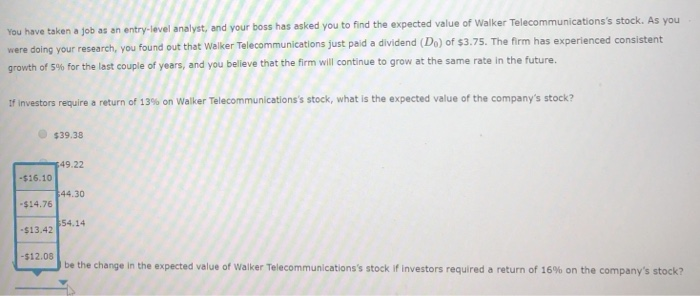

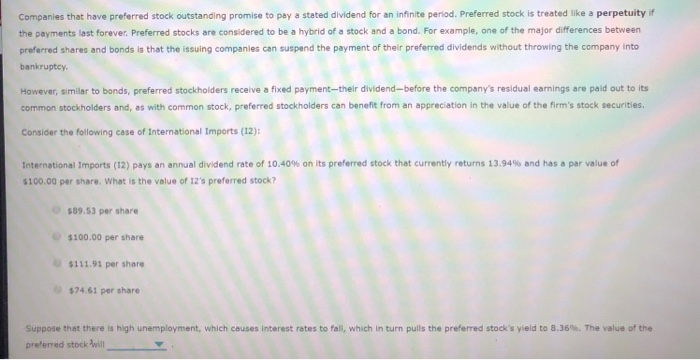

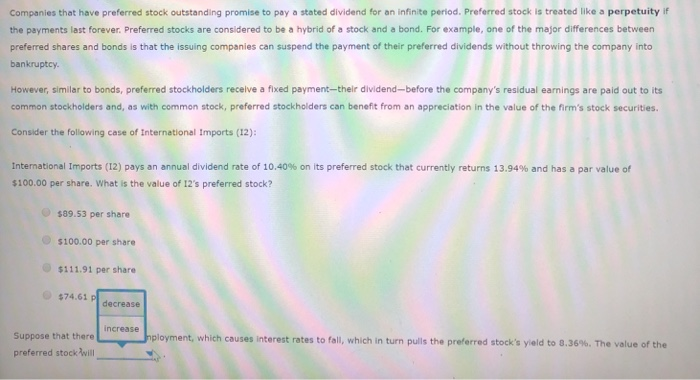

Financial statements reflect only book values of the data that analysts use to evaluate a company's performance. To determine if a firm's earmings after taxes but before the payment of interest and dividends, are sufficient to compensate both the firm's bondholders and shareholders, Stern Stewart Management Services developed an analytical technique called economic value added (EVA). EVA effectively measures the amount of shareholder wealth that the firm's management has added to the value of the firm during a period of time. If EVA is positive, then management has added value, while a negative value indicates that the firm's managers reduced the firm's value and shareholders might have earned more value by investing in some other investment with the same level of risk. Consider this case: Last year, Jackson Tires reported net sales of $60,000,000 and total operating costs (including depreciation) of $39,000,000. Jackson Tires has S63,500,000 of investor-supplied capital, which has an after-tax cost of 10%. If Jackson Tires's tax rate is 40%, how much value did its management create or lose for the firm during the year (rounded to the nearest whole dollar)? $31,750,000 $6,250,000 $29,650,000 $1,875,000 You have taken a job as an entry-level analyst, and your boss has asked you to find the expected value of Walker Telecommunications's stock. As you were doing your research, you found out that Walker Telecommunications just paid a dividend (Da) of $3.75. The firm has experienced consistent growth of 5% for the last couple of years, and you believe that the firm will continue to grow at the same rate in the future. If investors require a return of 13% on walker Telecommunications's stock, what is the expected value of the company's stock, 39.38 $49.22 $44.30 54.14 what would be the change in the expected value of walker Telecommunications, stock if investors required a return o, 16% on the company's stock? You have taken a job as an entry-level analyst, and your boss has asked you to find the expected value of Walker Telecommunications's stock. As you were doing your research, growth of 5% for the last couple of years, and you believe that the firm will continue to grow at the same rate in the future. you found out that Walker Telecommunications just paid a dividend (Do) of $3.75. The firm has experienced consistent If investors require a return of 13% on walker Telecommunications's stock, what is the expected value of the company's stock? $39.38 49.22 $16.10 $14.76 $13.42 $12.08 44.30 54.14 be the change in the expected value of Walker Telecommunications's stock if investors required a return of 16% on the company's stock? Companies that have preferred stock outstanding promise to pay a stated dividend for an infinite period. Preferred stock is treated like a perpetuity if the payments last forever. Preferred stocks are considered to be a hybrid of a stock and a bond. For example, one of the major differences betweer preferred shares and bonds is that the issuing companies can suspend the payment of their preferred dividends without throwing the company into bankruptcy. However, similar to bonds, preferred stockholders receive a fixed payment-their dividend-before the company's residual earnings are paid out to its common stockholders and, as with common stock, preferred stockholders can benefit from an appreciation in the value of the firm's stock securities. Consider the following case of International Imports (12) International Imports (12) pays an annual dividend rate of 10.40% on its preferred stock that currently returns 13.94% and has a par value of 100.00 per share. What is the value of 12's preferred stock? $89.53 per share $100.00 per share U SI 11.91 per share $74.61 per share Suppose that there is high unemployment, which causes interest rates to fan, which in turn pulls the preferred stock's yield to 8.36%. The value of the preferred stock will Companies that have preferred stock outstanding promise to pay a stated dividend for an infinite period. Preferred stock is treated like a perpetuity if the payments last forever. Preferred stocks are considered to be a hybrid of a stock and a bond. For example, one of the major differences between preferred shares and bonds is that the issuing companies can suspend the payment of their preferred dividends without throwing the company into bankruptcy However, similar to bonds, preferred stockholders recelve a fixed payment-their dividend-before the company's residual earnings are paid out to its common stockholders and, as with common stock, preferred stockholders can benefit from an appreciation in the value of the firm's stock securities. Consider the following case of International Imports (12): International Imports (12) pays an annual dividend rate of 10.40% on its preferred stock that currently returns 13.94% and has a par value of $100.00 per share. What is the value of 12's preferred stock? $89.53 per share $100.00 per share $111.91 per share $74.61 decrease Suppose that there preferred stockl ployment, which causes interest rates to fall, which in turn pulls the preferred stock's yield to 0.36%. The value of the