Question

Financial structure mandates Suppose the TIC= I = $329,994 We have the following variables pertaining to the financial structure of the project: I = total

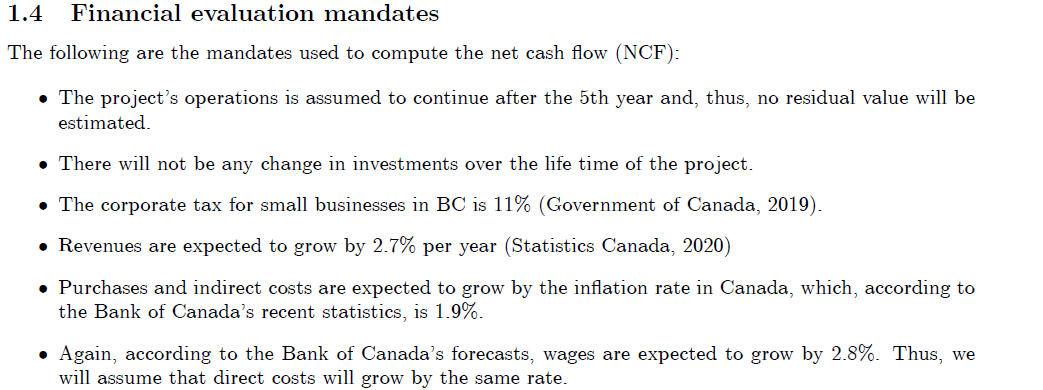

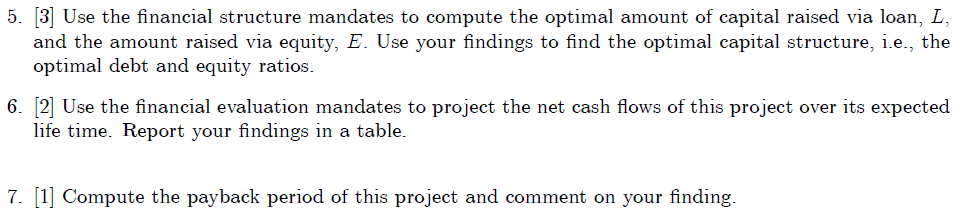

Financial structure mandates

Suppose the TIC= I = $329,994

We have the following variables pertaining to the financial structure of the project: I = total investment cost (TIC), r = return on investment, L = loan, R = repayment of the loan, ib = interest rate on borrowings, s = number of installments.

The following are the assumptions used to compute the optimal capital structure. The rate of return, r, is estimated by taking the average rate of return on investment of two similar assets from the Toronto Stock Exchange (TSX); namely, MTY Food Group Inc. and Recipe Unlimited Corp. The return on investment of MTY and Recipe are 9.75% and 9.89% respectively. Therefore, the return on investment for our business is estimated to be r = 9:8%. Because our business is eligible to participate in the Canada Small Business Financing Program, the maximum interest rate on borrowing is the banks prime rate plus 3% (Government of Canada, 2017). Currently, as per the Bank of Canada statistics, the average prime rate is 3.95%. Therefore, the interest on borrowing can be anywhere in the range of 3.95% to 6.95%. Taking the geometric mean of these bounds, we estimate ib = 5:24%. We assume that the total investment cost, I, will be financed via debt (loan) and equity. The loan is assumed to be paid over 5 installments.

Questions

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started