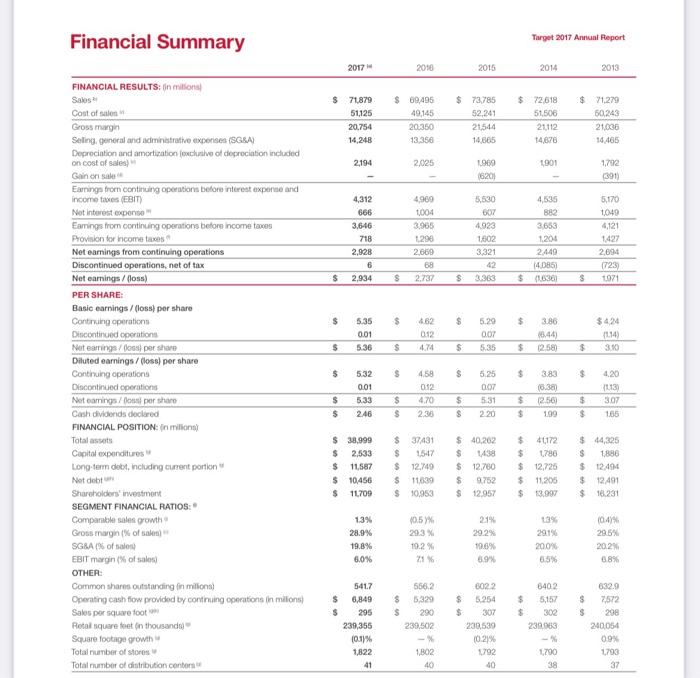

Financial Summary \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|} \hline & & 201714 & & & & 2015 & & 2014 & & 2013 \\ \hline \multicolumn{11}{|l|}{ FINANCIAL RESULTS: (in millons] } \\ \hline Salos 2 & $ & 71.879 & $ & 69,495 & $ & 73,785 & $ & 72,618 & $ & 71,279 \\ \hline Cost of salen in & & 51,125 & & 49,145 & & 52,241 & & 51,506 & & 50,243 \\ \hline Gross margin & & 20.754 & & 20350 & & 21,544 & & 21,112 & & 21,036 \\ \hline Seling general and adminatratice expenses (SGSA) & & 14,248 & & 13,356 & & 14,665 & & 14,876 & & 14,465 \\ \hline Deprociationandamcrtizationforchuniveofdeprociationincludedoncostofsales)"if & & 2,194 & & 2,025 & & 1969 & & 1901 & & 1,792 \\ \hline Gain sri sabes & & - & & - & & (620) & & - & & (391) \\ \hline Earningsfromcontinuingoperationsbeforeinterestexponaeandincometaxes(EBIT) & & 4,312 & & 4,909 & & 5,530 & & 4,535 & & 5,170 \\ \hline Not interest eqponso m & & 666 & & 1,004 & & 607 & & 882 & & 1,049 \\ \hline Eamings from continuing operations before income taves & & 3,646 & & 3,965 & & 4923 & & 3,653 & & 4,121 \\ \hline Provition for hicome taxes? & & 718 & & 1,290 & & 1,602 & & 1,204 & & 1,427 \\ \hline Net earnings from continuing operations & & 2,928 & & 2,669 & & 3,321 & & 2,449 & & 2,694 \\ \hline Discontinued operations, net of tax & & 6 & & 68 & & 42 & & (4,085) & & \\ \hline Net earnings / (loss) & s & 2,934 & 8 & 2,737 & $ & 3,363 & $ & & 3 & 1971 \\ \hline \multicolumn{11}{|l|}{ PER SHARE: } \\ \hline \multicolumn{11}{|l|}{ Basic earnings / (loss) per share } \\ \hline Controing operations & $ & 5.35 & $ & 4.62 & $ & 5.29 & $ & 3.86 & & $4,24 \\ \hline Discontinued coerations & & 0.01 & & 012 & & 0,07 & & (6.44) & & (12:14) \\ \hline Not earings / (0oss) per shave & $ & 5.36 & $ & 4.74 & s & 5.35 & $ & (2.58) & $ & 300 \\ \hline \multicolumn{11}{|l|}{ Diluted earnings / (loss) per share } \\ \hline Contruing operations & $ & 5.32 & s & 4.58 & $ & 5.25 & $ & 3.83 & $ & 4.20 \\ \hline Discontinued cperations & & 0.01 & & 012 & & & & (6.38) & & (4t3) \\ \hline Not earnings / possi per thaco & s & 5.33 & $ & 4,70 & $ & 5.51 & $ & (2.56) & $ & 307 \\ \hline Cash dividends doclared & $ & 246 & $ & 2,36 & $ & 220 & $ & 199 & $ & 165 \\ \hline \multicolumn{11}{|l|}{ FINANCIAL POSITION: in millonsi } \\ \hline Total asseets & s & 38,999 & $ & 37,431 & $ & 40,262 & $ & 4,172 & $ & 44,325 \\ \hline Cepital expenditures " & s & 2,533 & $ & 1547 & $ & 1,438 & $ & 1,786 & $ & 1,896 \\ \hline Long-tem debt, including cument portion w & $ & 11,587 & s & 12,749 & s & 12,760 & $ & 12,726 & s & 12,494 \\ \hline Not debt wit & s & 10,456 & s & 11,639 & $ & 9.752 & $ & 11,205 & $ & 12.491 \\ \hline Shareholders' inventment & s & 11709 & s & 10,953 & s & 12,957 & $ & & $ & 16.231 \\ \hline \multicolumn{11}{|l|}{ SEGMENT FINANCIAL RATIOS: * } \\ \hline Compankte sales gromit : & & 1.3% & & $0.5%%1 & & 21% & & 13% & & (0.4)% \\ \hline Grossmargin ( % of sales) & & 28.9% & & 29.3 & & 29.2% & & 291% & & 295% \\ \hline SGBA (0) of saled & & 19.8% & & 19.2%1 & & 196% & & 20006 & & 20.2% \\ \hline EBIT margin (\% of salos) & & 6.0% & & z% & & 69% & & 65% & & 68% \\ \hline \multicolumn{11}{|l|}{ OTHER: } \\ \hline Common shares outstanding (in millons). & & 541.7 & & 566.2 & & 602.2 & & 6402 & & 632.9 \\ \hline Operating cash flow provided by contruing operations (in millons) & s & 6,849 & s & 5,329 & $ & 5.254 & $ & 5,157 & $ & 7,5072 \\ \hline Sales per squave foot in & s & 295 & s & 290 & $ & 30 & $ & 302 & $ & 298 \\ \hline Retal square toet (n) thousands) = & & 239,355 & & 239,502 & & 230.539 & & 239063 & & 240,054 \\ \hline Square footage growh = & & (001)% & & & & 0.2)% & & & & 09% \\ \hline Total namber of stores v & & 1,822 & & 1,B02 & & 1792 & & 1,790 & & 1,793 \\ \hline Total number of distribution centent 4 & & 41 & & 40 & & 40 & & 38 & & 37 \\ \hline \end{tabular} 5. Assuming Target's industry had an average current ratio of 1.0 and an average debt to equity ratio of 2.5 , comment on Target's liquidity and long-term solvency using your answer for above question 4. 6. By what name does Target label its income statement? 7. What amounts did Target report for the following items for the year ended February 3, 2018? a. sales b. gross margin c. earnings from continuing operations before income taxes d. net earnings from continuing operations e. net earnings 8. Does Target report any items as part of its comprehensive income? If so, what are they? 9. Does Target prepare the statement of cash flows using the direct method or the