Financial

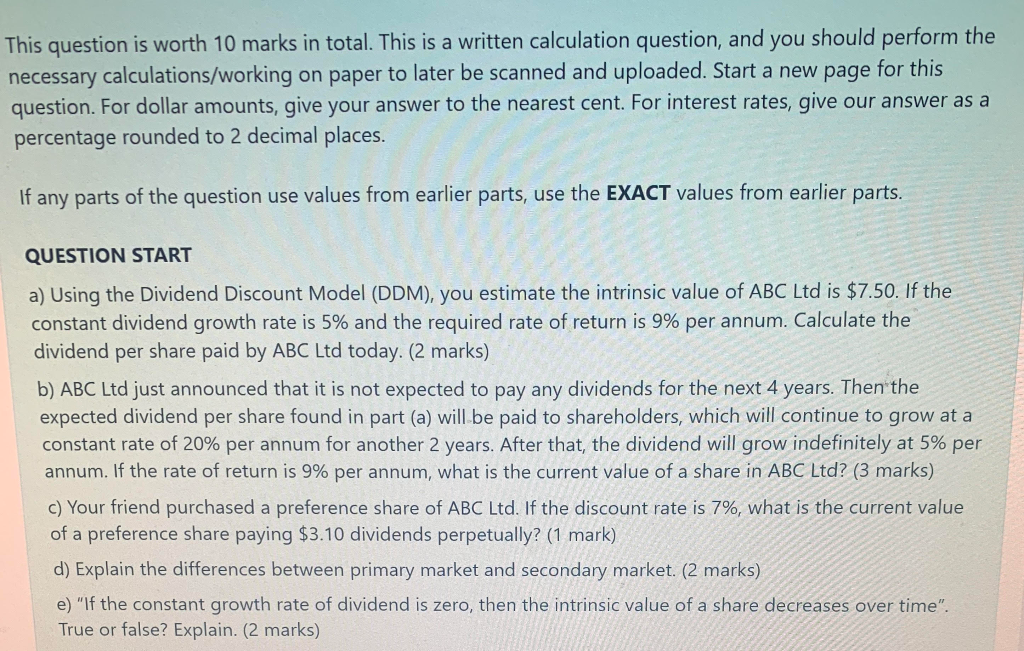

This question is worth 10 marks in total. This is a written calculation question, and you should perform the necessary calculations/working on paper to later be scanned and uploaded. Start a new page for this question. For dollar amounts, give your answer to the nearest cent. For interest rates, give our answer as a percentage rounded to 2 decimal places. If any parts of the question use values from earlier parts, use the EXACT values from earlier parts. QUESTION START a) Using the Dividend Discount Model (DDM), you estimate the intrinsic value of ABC Ltd is $7.50. If the constant dividend growth rate is 5% and the required rate of return is 9% per annum. Calculate the dividend per share paid by ABC Ltd today. (2 marks) b) ABC Ltd just announced that it is not expected to pay any dividends for the next 4 years. Then the expected dividend per share found in part (a) will be paid to shareholders, which will continue to grow at a constant rate of 20% per annum for another 2 years. After that, the dividend will grow indefinitely at 5% per annum. If the rate of return is 9% per annum, what is the current value of a share in ABC Ltd? (3 marks) c) Your friend purchased a preference share of ABC Ltd. If the discount rate is 7%, what is the current value of a preference share paying $3.10 dividends perpetually? (1 mark) d) Explain the differences between primary market and secondary market. (2 marks) e) "If the constant growth rate of dividend is zero, then the intrinsic value of a share decreases over time". True or false? Explain. (2 marks) This question is worth 10 marks in total. This is a written calculation question, and you should perform the necessary calculations/working on paper to later be scanned and uploaded. Start a new page for this question. For dollar amounts, give your answer to the nearest cent. For interest rates, give our answer as a percentage rounded to 2 decimal places. If any parts of the question use values from earlier parts, use the EXACT values from earlier parts. QUESTION START a) Using the Dividend Discount Model (DDM), you estimate the intrinsic value of ABC Ltd is $7.50. If the constant dividend growth rate is 5% and the required rate of return is 9% per annum. Calculate the dividend per share paid by ABC Ltd today. (2 marks) b) ABC Ltd just announced that it is not expected to pay any dividends for the next 4 years. Then the expected dividend per share found in part (a) will be paid to shareholders, which will continue to grow at a constant rate of 20% per annum for another 2 years. After that, the dividend will grow indefinitely at 5% per annum. If the rate of return is 9% per annum, what is the current value of a share in ABC Ltd? (3 marks) c) Your friend purchased a preference share of ABC Ltd. If the discount rate is 7%, what is the current value of a preference share paying $3.10 dividends perpetually? (1 mark) d) Explain the differences between primary market and secondary market. (2 marks) e) "If the constant growth rate of dividend is zero, then the intrinsic value of a share decreases over time". True or false? Explain. (2 marks)