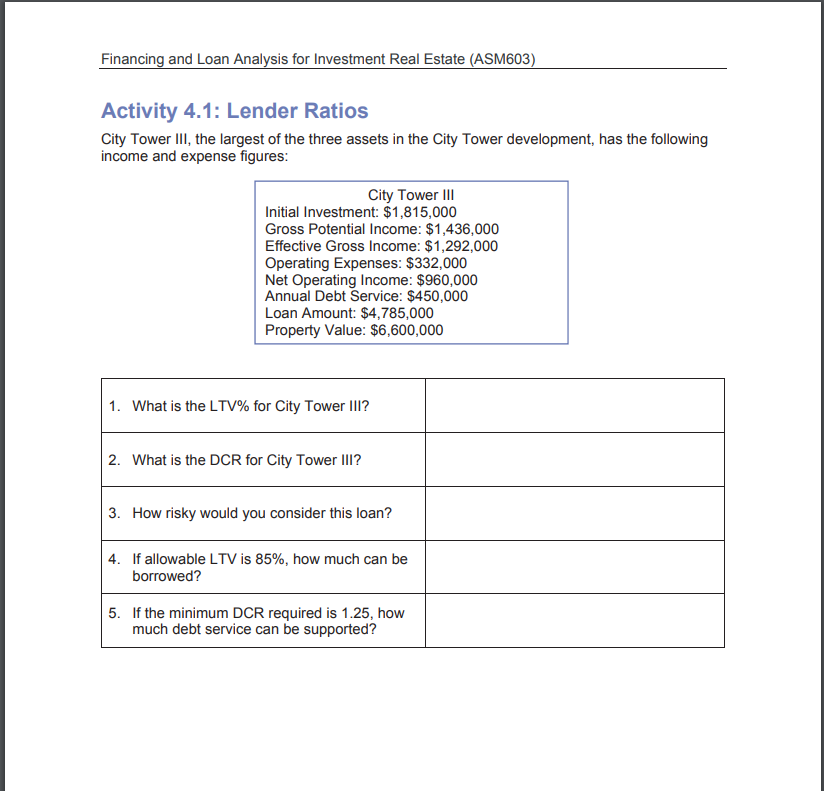

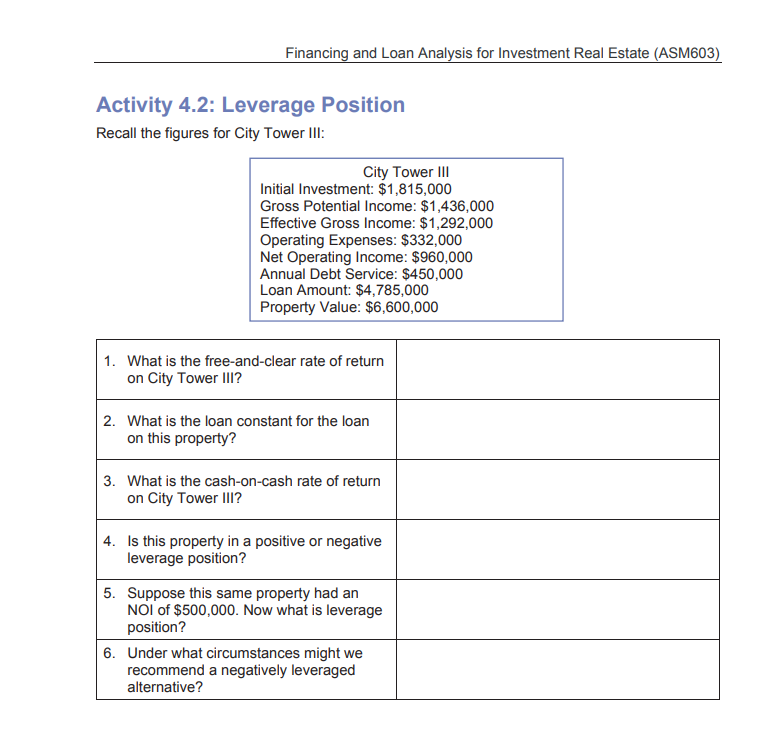

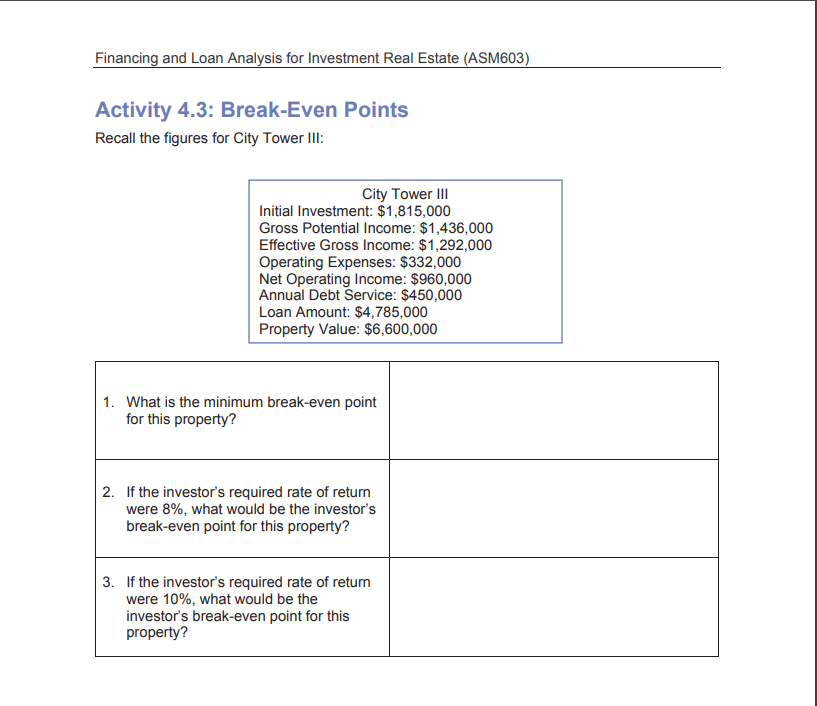

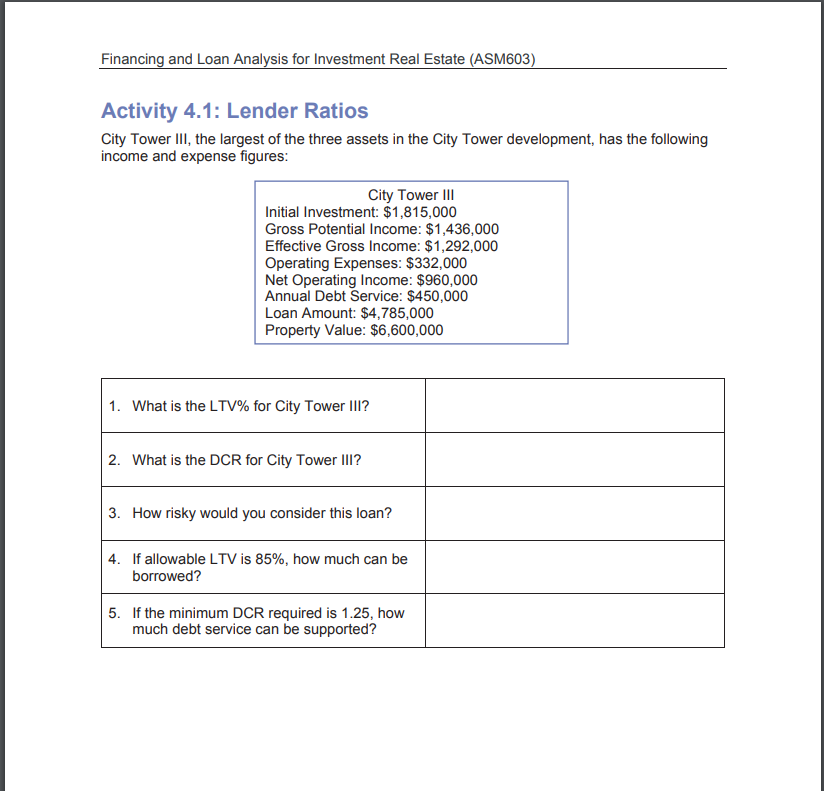

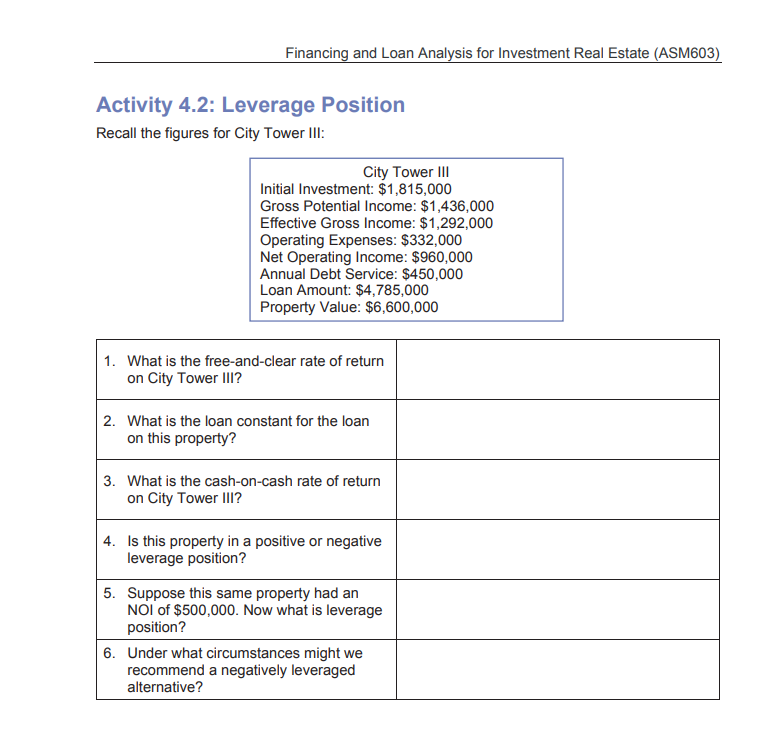

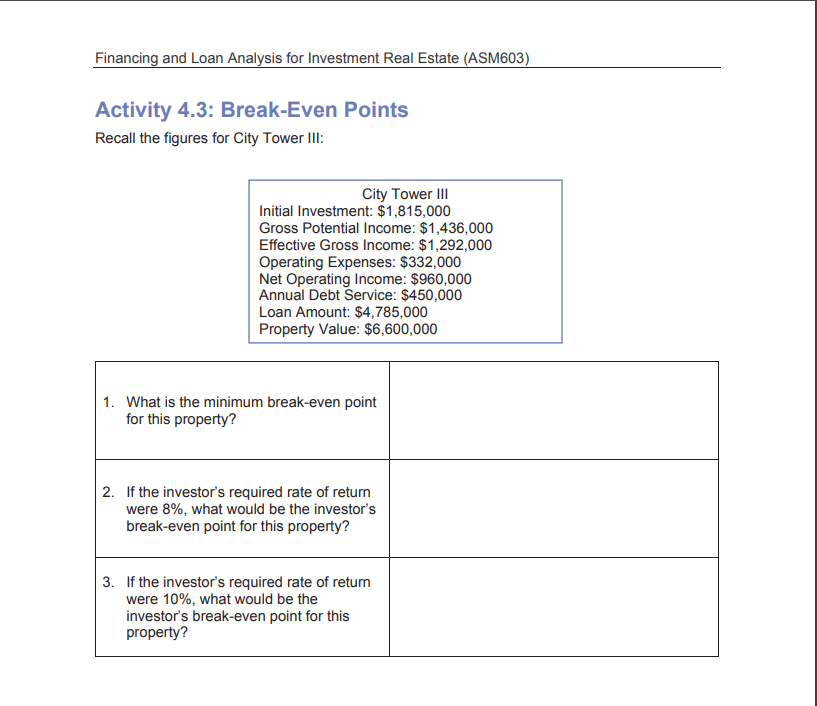

Financing and Loan Analysis for Investment Real Estate (ASM603) Activity 4.1: Lender Ratios City Tower III, the largest of the three assets in the City Tower development, has the following income and expense figures: City Tower III Initial Investment: $1,815,000 Gross Potential Income: $1,436,000 Effective Gross Income: $1,292,000 Operating Expenses: $332,000 Net Operating Income: $960,000 Annual Debt Service: $450,000 Loan Amount: $4,785,000 Property Value: $6,600,000 1. What is the LTV% for City Tower 111? 2. What is the DCR for City Tower III? 3. How risky would you consider this loan? 4. If allowable LTV is 85%, how much can be borrowed? 5. If the minimum DCR required is 1.25, how much debt service can be supported? Financing and Loan Analysis for Investment Real Estate (ASM603) Activity 4.2: Leverage Position Recall the figures for City Tower III: City Tower III Initial Investment: $1,815,000 Gross Potential Income: $1,436,000 Effective Gross Income: $1,292,000 Operating Expenses: $332,000 Net Operating Income: $960,000 Annual Debt Service: $450,000 Loan Amount: $4,785,000 Property Value: $6,600,000 1. What is the free-and-clear rate of return on City Tower Ill? What is the loan constant for the loan on this property? 3. What is the cash-on-cash rate of return on City Tower Ill? 4. Is this property in a positive or negative leverage position? 5. Suppose this same property had an NOI of $500,000. Now what is leverage position? 6. Under what circumstances might we recommend a negatively leveraged alternative? Financing and Loan Analysis for Investment Real Estate (ASM603) Activity 4.3: Break-Even Points Recall the figures for City Tower III: City Tower III Initial Investment: $1,815,000 Gross Potential Income: $1,436,000 Effective Gross Income: $1,292,000 Operating Expenses: $332,000 Net Operating Income: $960,000 Annual Debt Service: $450,000 Loan Amount: $4,785,000 Property Value: $6,600,000 1. What is the minimum break-even point for this property? If the investor's required rate of return were 8%, what would be the investor's break-even point for this property? 3. If the investor's required rate of return were 10%, what would be the investor's break-even point for this property