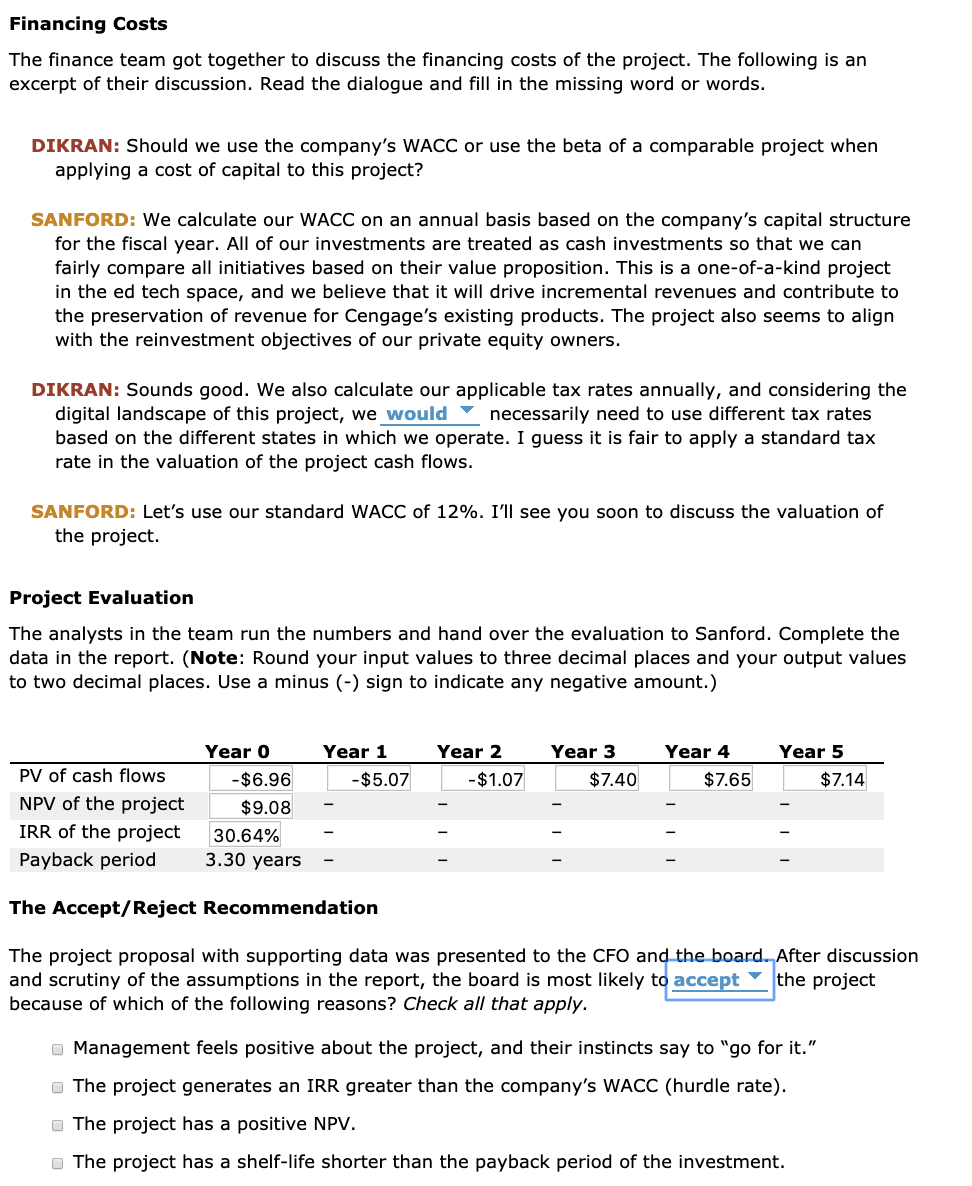

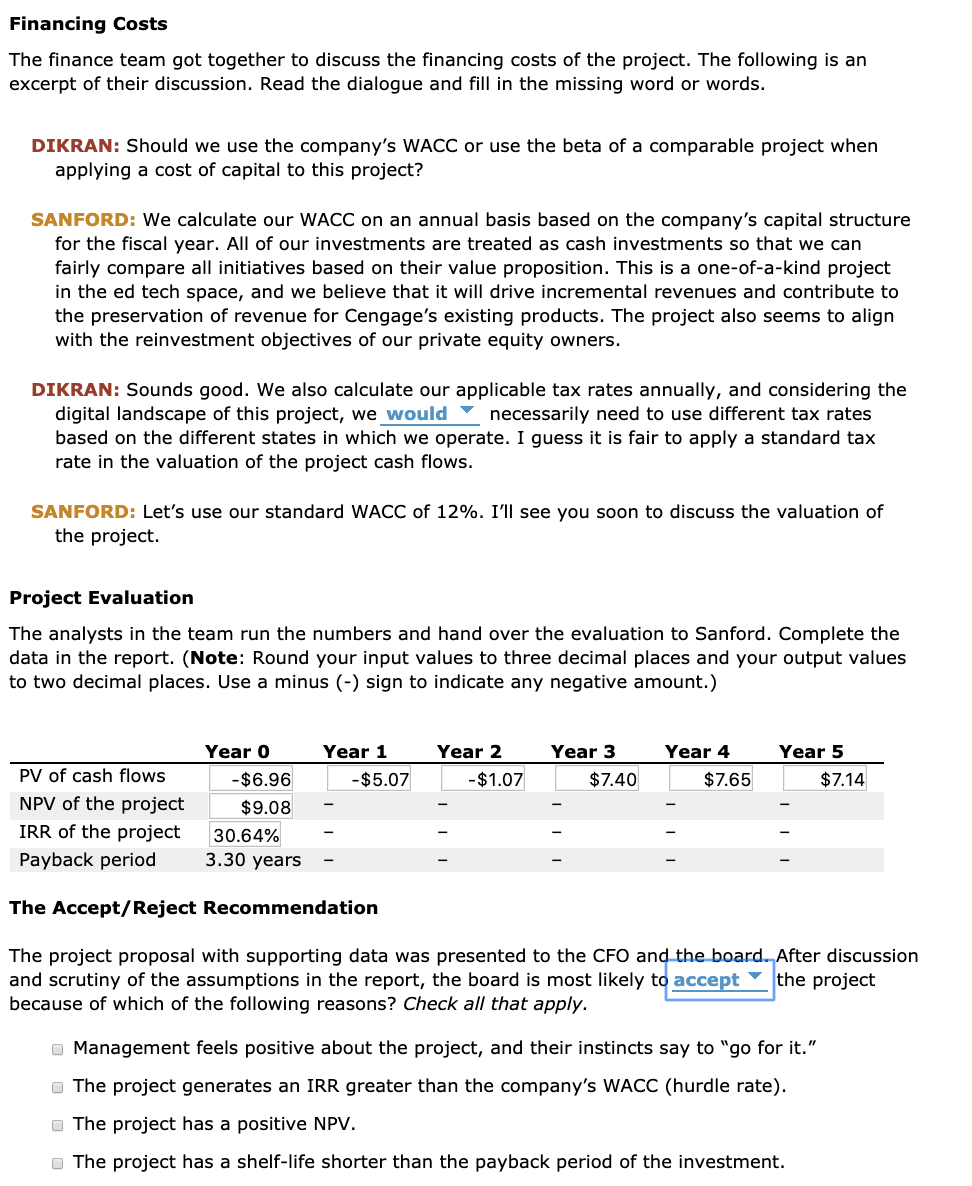

Financing Costs The finance team got together to discuss the financing costs of the project. The following is an excerpt of their discussion. Read the dialogue and fill in the missing word or words. DIKRAN: Should we use the company's WACC or use the beta of a comparable project when applying a cost of capital to this project? SANFORD: We calculate our WACC on an annual basis based on the company's capital structure for the fiscal year. All of our investments are treated as cash investments so that we can fairly compare all initiatives based on their value proposition. This is a one-of-a-kind project in the ed tech space, and we believe that it will drive incremental revenues and contribute to the preservation of revenue for Cengage's existing products. The project also seems to align with the reinvestment objectives of our private equity owners. DIKRAN: Sounds good. We also calculate our applicable tax rates annually, and considering the digital landscape of this project, we would necessarily need to use different tax rates based on the different states in which we operate. I guess it is fair to apply a standard tax rate in the valuation of the project cash flows. SANFORD: Let's use our standard WACC of 12%. I'll see you soon to discuss the valuation of the project. Project Evaluation The analysts in the team run the numbers and hand over the evaluation to Sanford. Complete the data in the report. (Note: Round your input values to three decimal places and your output values to two decimal places. Use a minus (-) sign to indicate any negative amount.) Year 1 -$5.07 Year 2 -$1.07 Year 3 $7.40 Year 4 $7.65 Year 5 $7.14 PV of cash flows NPV of the project IRR of the project Payback period Year 0 $6.96 $9.08 30.64% 3.30 years - - The Accept/Reject Recommendation The project proposal with supporting data was presented to the CFO and the board. After discussion and scrutiny of the assumptions in the report, the board is most likely to accept the project because of which of the following reasons? Check all that apply. Management feels positive about the project, and their instincts say to "go for it." The project generates an IRR greater than the company's WACC (hurdle rate). The project has a positive NPV. The project has a shelf-life shorter than the payback period of the investment