Question

FINANCING NEW VENTURES Chapter 3 - Unique cash flow and risk dynamics of early stage ventures Could someone answer several questions of the following? Just

FINANCING NEW VENTURES Chapter 3 - Unique cash flow and risk dynamics of early stage ventures

Could someone answer several questions of the following? Just please answer what you make sure, don't need all of them:

How many people here have taken a corporate finance class? Well forget everything you learned!

Well not permanently! You'll need it if you work for a big corp. But VC is completely different. Well almost everything.

Below is a standard corporate financial investment. Say a new machine that costs $300k and will generate $100k in cash flow per year

|

| Year 0 (time of investment) | Year 1 | 2 | 3 | 4 | 6 | Year x -Depending on life of item |

| Outflows | -300 |

|

|

|

|

|

|

| Inflows | 0 | 100 | 100 | 100 | 100 | 100 | 100 |

| Cumulative | -300 | -200 | -100 | 0 | 100 | 200 | 300 |

What do we know about this?

- 3 year payback

- predictable cash flows

- good quantitative analysis is all that is needed. No judgment required

- easy to calc NPV or IRR

How would you finance this? A) Debt or a lease. Certainly not costly equity. Why?

Well, it's low risk. So bankers will like it. And they can put a lien on it and repossess it if they don't pay

And low risk = low return. So it will be a relatively low rate. And why is debt always cheaper than equity?

Who gets paid first in a bankruptcy? Yes the debt holders. Stock holders are last in line.

Compare the above to a venture capital investment on page 50 in the textbook (entrepreneur's view).

Revenues - totally unpredictable (new product or idea, plus entrepreneurs are always optimistic, who wants a pessimistic entrepreneur!)

Costs - somewhat predictable (again new product or idea or new market)

Net profit - Doubly volatile. (actually many times X and depends on the gross margin %! This is why high GMs are required.)

Cumulative cash need? Highly unknowable. There is no initial investment. Entity requires multiple cash infusions before starting to pay back.

So how do VC investors analyze?

- How many months, in a down scenario, to achieve next milestone? That why they ask, whats the monthly cash burn rate?

- revenues always seem to be half as much and take twice as long to come!

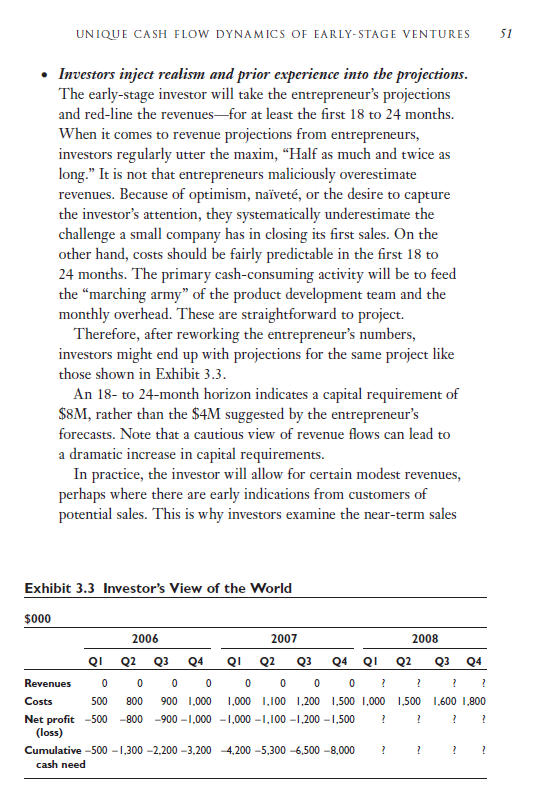

So see page 51 for the "investors" view. Cumulative cash need is $8m instead of $4m!

Interestingly VC investors tend to be focused on either the short term (next year or so), that is, to the next milestone and funding

OR

On the long term (5 to 7+ years) to the exit to cash out (IPO or sale)

UNIQUE CASH FLOW DYNAMICS OF EARLY-STAGE VENTURES 51 Investors inject realism and prior experience into the projections. The early-stage investor will take the entrepreneur's projections and red-line the revenuesfor at least the first 18 to 24 months. When it comes to revenue projections from entrepreneurs, investors regularly utter the maxim, Half as much and twice as long." It is not that entrepreneurs maliciously overestimate revenues. Because of optimism, navet, or the desire to capture the investor's attention, they systematically underestimate the challenge a small company has in closing its first sales. On the other hand, costs should be fairly predictable in the first 18 to 24 months. The primary cash-consuming activity will be to feed the marching army" of the product development team and the monthly overhead. These are straightforward to project. Therefore, after reworking the entrepreneur's numbers, investors might end up with projections for the same project like those shown in Exhibit 3.3. An 18- to 24-month horizon indicates a capital requirement of $8M, rather than the $4M suggested by the entrepreneur's forecasts. Note that a cautious view of revenue flows can lead to a dramatic increase in capital requirements. In practice, the investor will allow for certain modest revenues, perhaps where there are early indications from customers of potential sales. This is why investors examine the near-term sales Exhibit 3.3 Investor's View of the World Q4 ? $000 2006 2007 2008 QI Q2 Q3 Q4 QI Q2 Q3 Q4 QI Q2 Q3 Revenues 0 0 0 0 0 0 0 0 Costs 500 800 900 1,000 1,000 1,100 1,200 1.500 1.000 1.500 1,600 1,800 Net profit -500-800-900-1.000 - 1,000 -1,100 -1,200 -1,500 ? (loss) Cumulative -500 - 1,300 -2,200 -3,2004,200 -5,300 -6,500 - 8,000 cash need ? UNIQUE CASH FLOW DYNAMICS OF EARLY-STAGE VENTURES 51 Investors inject realism and prior experience into the projections. The early-stage investor will take the entrepreneur's projections and red-line the revenuesfor at least the first 18 to 24 months. When it comes to revenue projections from entrepreneurs, investors regularly utter the maxim, Half as much and twice as long." It is not that entrepreneurs maliciously overestimate revenues. Because of optimism, navet, or the desire to capture the investor's attention, they systematically underestimate the challenge a small company has in closing its first sales. On the other hand, costs should be fairly predictable in the first 18 to 24 months. The primary cash-consuming activity will be to feed the marching army" of the product development team and the monthly overhead. These are straightforward to project. Therefore, after reworking the entrepreneur's numbers, investors might end up with projections for the same project like those shown in Exhibit 3.3. An 18- to 24-month horizon indicates a capital requirement of $8M, rather than the $4M suggested by the entrepreneur's forecasts. Note that a cautious view of revenue flows can lead to a dramatic increase in capital requirements. In practice, the investor will allow for certain modest revenues, perhaps where there are early indications from customers of potential sales. This is why investors examine the near-term sales Exhibit 3.3 Investor's View of the World Q4 ? $000 2006 2007 2008 QI Q2 Q3 Q4 QI Q2 Q3 Q4 QI Q2 Q3 Revenues 0 0 0 0 0 0 0 0 Costs 500 800 900 1,000 1,000 1,100 1,200 1.500 1.000 1.500 1,600 1,800 Net profit -500-800-900-1.000 - 1,000 -1,100 -1,200 -1,500 ? (loss) Cumulative -500 - 1,300 -2,200 -3,2004,200 -5,300 -6,500 - 8,000 cash need

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started