Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ex 5-35 (Algo) ABC; Selling Costs (LO 5-2, 5-4) Textile Crafts Company (TCC) sells craft kits and supplies to retail outlets and through online sites

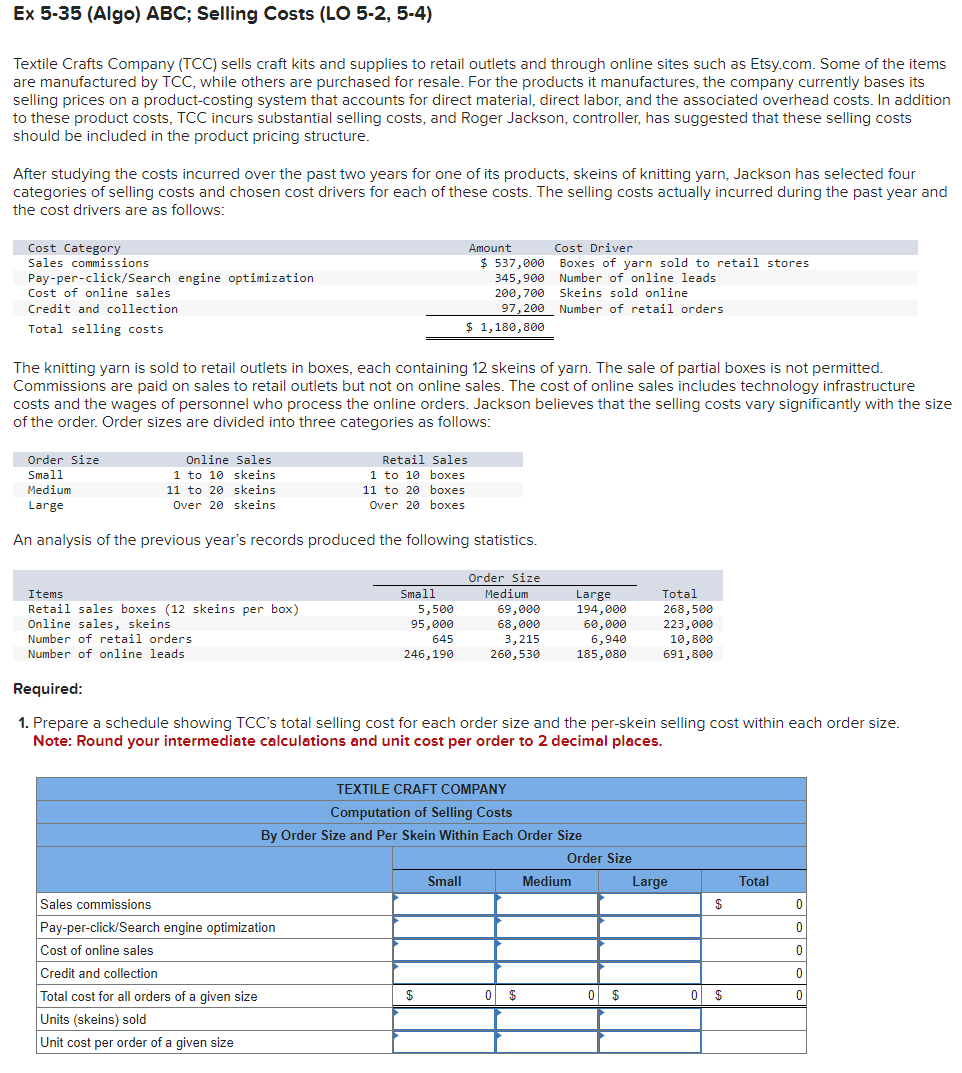

Ex 5-35 (Algo) ABC; Selling Costs (LO 5-2, 5-4) Textile Crafts Company (TCC) sells craft kits and supplies to retail outlets and through online sites such as Etsy.com. Some of the items are manufactured by TCC, while others are purchased for resale. For the products it manufactures, the company currently bases its selling prices on a product-costing system that accounts for direct material, direct labor, and the associated overhead costs. In addition to these product costs, TCC incurs substantial selling costs, and Roger Jackson, controller, has suggested that these selling costs should be included in the product pricing structure. After studying the costs incurred over the past two years for one of its products, skeins of knitting yarn, Jackson has selected four categories of selling costs and chosen cost drivers for each of these costs. The selling costs actually incurred during the past year and the cost drivers are as follows: The knitting yarn is sold to retail outlets in boxes, each containing 12 skeins of yarn. The sale of partial boxes is not permitted. Commissions are paid on sales to retail outlets but not on online sales. The cost of online sales includes technology infrastructure costs and the wages of personnel who process the online orders. Jackson believes that the selling costs vary significantly with the size of the order. Order sizes are divided into three categories as follows: An analysis of the previous year's records produced the following statistics. Required: 1. Prepare a schedule showing TCC's total selling cost for each order size and the per-skein selling cost within each order size. Note: Round your intermediate calculations and unit cost per order to 2 decimal places

Ex 5-35 (Algo) ABC; Selling Costs (LO 5-2, 5-4) Textile Crafts Company (TCC) sells craft kits and supplies to retail outlets and through online sites such as Etsy.com. Some of the items are manufactured by TCC, while others are purchased for resale. For the products it manufactures, the company currently bases its selling prices on a product-costing system that accounts for direct material, direct labor, and the associated overhead costs. In addition to these product costs, TCC incurs substantial selling costs, and Roger Jackson, controller, has suggested that these selling costs should be included in the product pricing structure. After studying the costs incurred over the past two years for one of its products, skeins of knitting yarn, Jackson has selected four categories of selling costs and chosen cost drivers for each of these costs. The selling costs actually incurred during the past year and the cost drivers are as follows: The knitting yarn is sold to retail outlets in boxes, each containing 12 skeins of yarn. The sale of partial boxes is not permitted. Commissions are paid on sales to retail outlets but not on online sales. The cost of online sales includes technology infrastructure costs and the wages of personnel who process the online orders. Jackson believes that the selling costs vary significantly with the size of the order. Order sizes are divided into three categories as follows: An analysis of the previous year's records produced the following statistics. Required: 1. Prepare a schedule showing TCC's total selling cost for each order size and the per-skein selling cost within each order size. Note: Round your intermediate calculations and unit cost per order to 2 decimal places Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started