Question

Financing Options Option 1 Option 1 utilizes 100% debt. The JSL group would take out a private loan in the amount of $35 million (or

Financing Options Option 1 Option 1 utilizes 100% debt. The JSL group would take out a private loan in the amount of $35 million (or 48% of the total cost) at 6% interest. The city would back the remaining $37 million (that is, 52% of the total cost) by issuing bonds at 3.75% interest. This would be partially backed with general obligation bonds from San Marcos residents (which still requires voter approval), and partially with revenue from the facility itself. The annual debt payment on this form of financing (interest + principal) is $5,314,176.00.

Option 2 Option 2 utilizes 60% city-backed debt at 4.25% interest. This would be paid back through a visitor tax increase on hotels and rental cars, as well as revenue from the facility itself. This tax increase does not require voter approval. The remaining 40% would be offered to preferred limited stockholders. This preferred stock would be offered at $45/share. The dividend expected would be $5 per share and the flotation cost is an inexpensive $1.50 per share. The annual debt payment on this form of financing (interest + principal) is $3,180, 526.00.

Option 3 Option 3 utilizes a mix of private loans and public ownership of the facility. In this option, JSL owns 25% of the facility through a limited private stock offering to its internal partners. This would be offered at $43/share, with a $3 dividend and $2 flotation cost. Then, JSL finances an additional 30% through private bank loans (so that its total controlling share is 55%). These loans are issued at 6%. The final 45% of the facility will be offered as common stock to the residents of San Marcos, then surrounding communities. This stock will sell for $20/share with a $2 dividend, $2 flotation cost, and 1.5% growth rate. The annual debt payment on this form of financing (interest + principal) is $2,275,482.00.

Your Task After this initial leg-work, the task force has hired you as a consultant to help them make their final analysis and recommendations on the project. Your job is to utilize the revenue and cost to calculate the cash flows from the facility, calculate the WACC of the three project options, and then compute the returns (using NPV and IRR) of the three options. After a full analysis of the cash flows and the returns, you are to prepare a recommendation to the city and JSL concerning the best course of action for financing the new facility, from both political and financial perspectives. Note: you do not need to analyze whether or not the project is feasible, but only the best financing option given the projected cash flows from the project. Please follow the outline below in preparing your report:

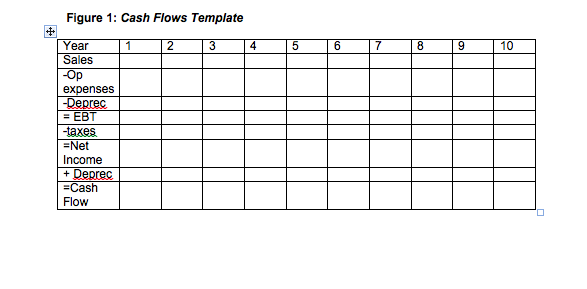

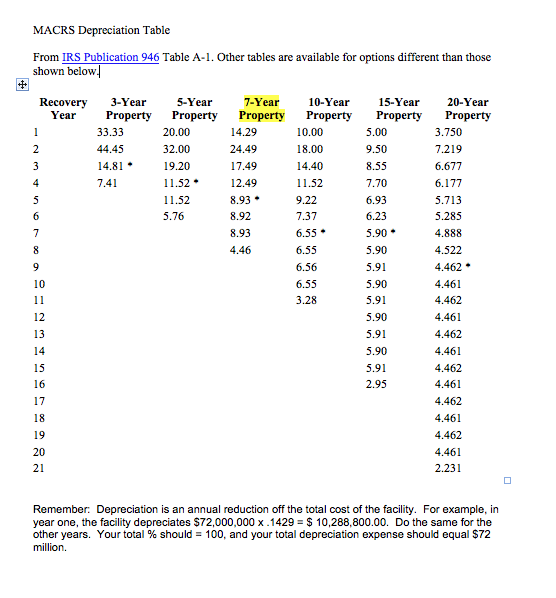

1. Estimate the cash flows from the project over a 10 year project life. (Use the 7 year depreciation schedule attached with no depreciation in years 9, 10). You can use the template provided below. You will probably want to use a spreadsheet program (e.g., Microsoft Excel) as the numbers are rather large and unrounded.

2. Use the cash flows table and Time Value of Money Table D to calculate the IRR for the project over a 10 year time period.

3. Calculate the WACC for each of the financing options provided above.

4. Use the Time Value of Money Table B to calculate the NPV for each of the financing options. Use the WACC for each option as the discount rate for that option.

5. List 3 strengths and 3 weaknesses of each financing optionbe sure to consider your ability to make your debt payments on top of existing operational costs (i.e., after you have your final cash flows for each yearcould you make the debt payment for each option?).

6. Provide an overall recommendation to the city based on your analysis. Your recommendation should include both financial and socio-political considerations. Figure 1: Cash Flows Template Sales -Op expenses -Deprec = EBT -taxes =Net Income + Deprec =Cash Flow

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started