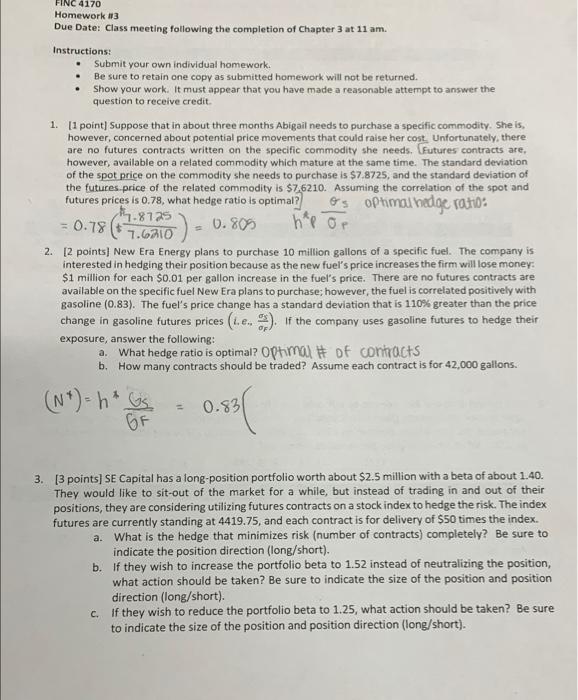

FINC 4170 Homework 13 Due Date: Class meeting following the completion of Chapter 3 at 11 am. Instructions: Submit your own individual homework. Be sure to retain one copy as submitted homework will not be returned. Show your work. It must appear that you have made a reasonable attempt to answer the question to receive credit. 1. [1 point Suppose that in about three months Abigail needs to purchase a specific commodity. She is. however, concerned about potential price movements that could raise her cost. Unfortunately, there are no futures contracts written on the specific commodity she needs. Futures contracts are, however, available on a related commodity which mature at the same time. The standard deviation of the spot price on the commodity she needs to purchase is $7.8725, and the standard deviation of the futures price of the related commodity is $7,6210. Assuming the correlation of the spot and futures prices is 0.78, what hedge ratio is optimal? Os optimal hedge rato 7.8725 = 0.78 0.805 hep or 7.6210 2. 12 points) New Era Energy plans to purchase 10 million gallons of a specific fuel. The company is interested in hedging their position because as the new fuel's price increases the firm will lose money: $1 million for each $0.01 per gallon increase in the fuel's price. There are no futures contracts are available on the specific fuel New Era plans to purchase; however, the fuel is correlated positively with gasoline (0.83). The fuel's price change has a standard deviation that is 110% greater than the price change in gasoline futures prices (t.e.). If the company uses gasoline futures to hedge their exposure, answer the following: a. What hedge ratio is optimal? Optimax # of contracts b. How many contracts should be traded? Assume each contract is for 42,000 gallons. 6) (N+) = h Us = 0.83 GF 3. [3 points) SE Capital has a long-position portfolio worth about $2.5 million with a beta of about 1.40. They would like to sit-out of the market for a while, but instead of trading in and out of their positions, they are considering utilizing futures contracts on a stock index to hedge the risk. The index futures are currently standing at 4419.75, and each contract is for delivery of $50 times the index. a. What is the hedge that minimizes risk (number of contracts) completely? Be sure to indicate the position direction (long/short). b. If they wish to increase the portfolio beta to 1.52 instead of neutralizing the position, what action should be taken? Be sure to indicate the size of the position and position direction (long/short). c. If they wish to reduce the portfolio beta to 1.25, what action should be taken? Be sure to indicate the size of the position and position direction (long/short)