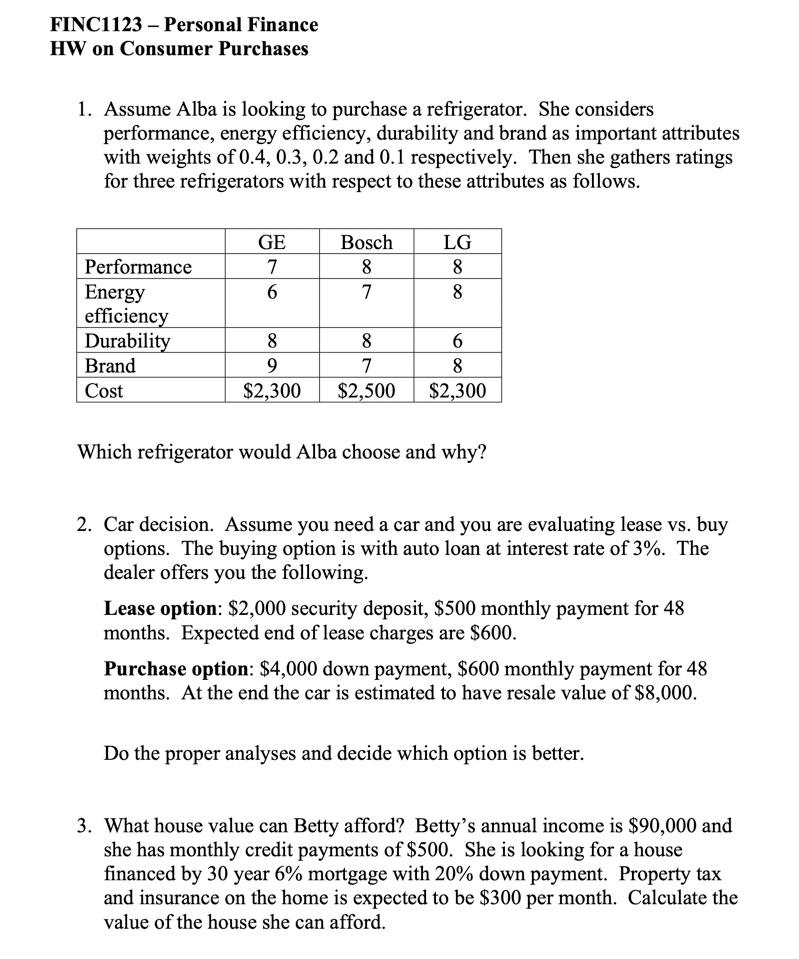

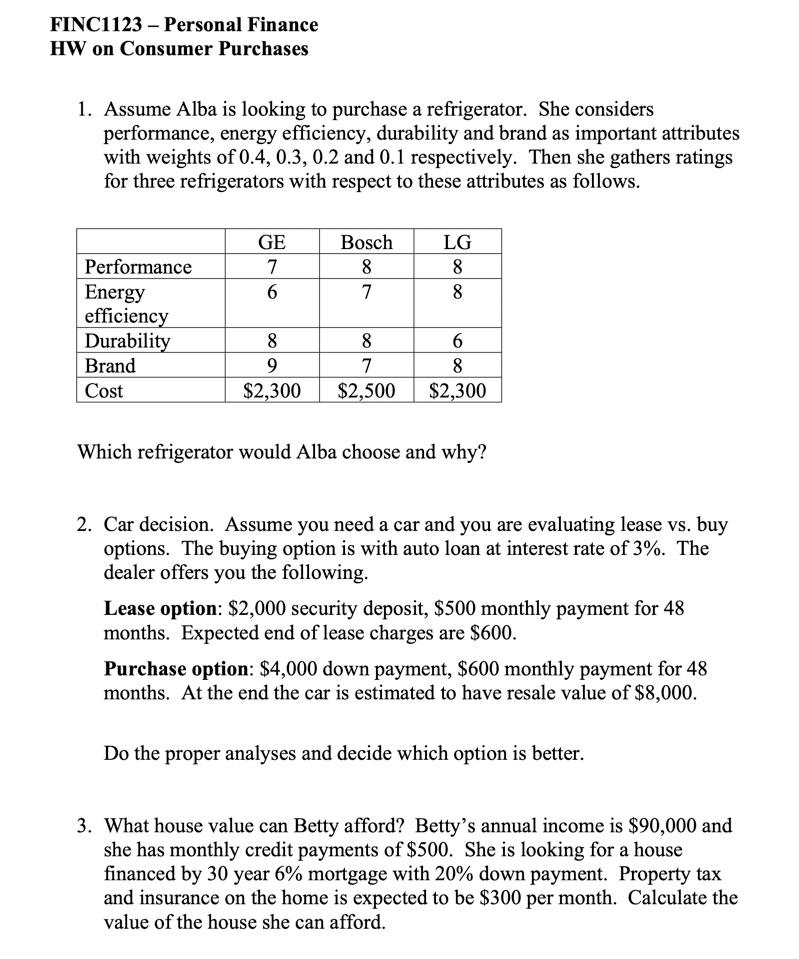

FINC1123 - Personal Finance HW on Consumer Purchases 1. Assume Alba is looking to purchase a refrigerator. She considers performance, energy efficiency, durability and brand as important attributes with weights of 0.4, 0.3, 0.2 and 0.1 respectively. Then she gathers ratings for three refrigerators with respect to these attributes as follows. GE 7 6 Bosch 8 7 LG 8 8 Performance Energy efficiency Durability Brand Cost 8 9 $2,300 8 7 $2,500 6 8 $2,300 Which refrigerator would Alba choose and why? 2. Car decision. Assume you need a car and you are evaluating lease vs. buy options. The buying option is with auto loan at interest rate of 3%. The dealer offers you the following. Lease option: $2,000 security deposit, $500 monthly payment for 48 months. Expected end of lease charges are $600. Purchase option: $4,000 down payment, $600 monthly payment for 48 months. At the end the car is estimated to have resale value of $8,000. Do the proper analyses and decide which option is better. 3. What house value can Betty afford? Betty's annual income is $90,000 and she has monthly credit payments of $500. She is looking for a house financed by 30 year 6% mortgage with 20% down payment. Property tax and insurance on the home is expected to be $300 per month. Calculate the value of the house she can afford. FINC1123 - Personal Finance HW on Consumer Purchases 1. Assume Alba is looking to purchase a refrigerator. She considers performance, energy efficiency, durability and brand as important attributes with weights of 0.4, 0.3, 0.2 and 0.1 respectively. Then she gathers ratings for three refrigerators with respect to these attributes as follows. GE 7 6 Bosch 8 7 LG 8 8 Performance Energy efficiency Durability Brand Cost 8 9 $2,300 8 7 $2,500 6 8 $2,300 Which refrigerator would Alba choose and why? 2. Car decision. Assume you need a car and you are evaluating lease vs. buy options. The buying option is with auto loan at interest rate of 3%. The dealer offers you the following. Lease option: $2,000 security deposit, $500 monthly payment for 48 months. Expected end of lease charges are $600. Purchase option: $4,000 down payment, $600 monthly payment for 48 months. At the end the car is estimated to have resale value of $8,000. Do the proper analyses and decide which option is better. 3. What house value can Betty afford? Betty's annual income is $90,000 and she has monthly credit payments of $500. She is looking for a house financed by 30 year 6% mortgage with 20% down payment. Property tax and insurance on the home is expected to be $300 per month. Calculate the value of the house she can afford