Answered step by step

Verified Expert Solution

Question

1 Approved Answer

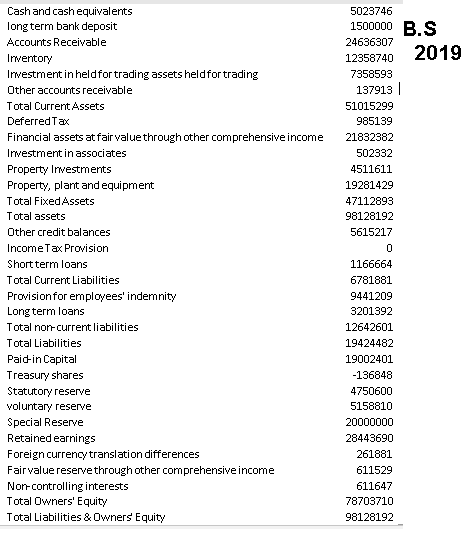

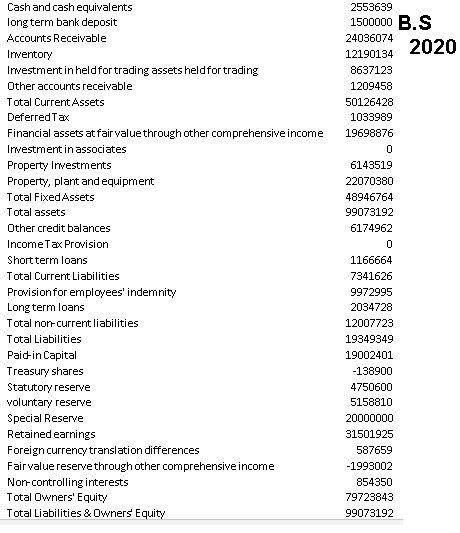

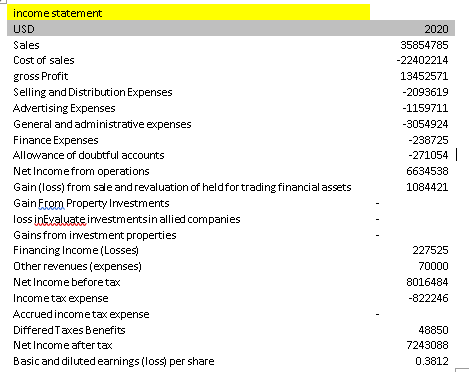

FIND: 1)operating cash flow 2) capital spending 3) net working capital 4) cash flow to creditors 5) cash-flow to stockholders Cash and cash equivalents long

FIND: 1)operating cash flow 2) capital spending 3) net working capital 4) cash flow to creditors 5) cash-flow to stockholders

Cash and cash equivalents long term bank deposit Accounts Receivable Inventory Investment in heldfor trading assets heldfor trading Other accounts receivable Total Current Assets Deferred Tax Financial assets at fair value through other comprehensive income Investment in associates Property Investments Property, plant and equipment Total Fixed Assets Total assets Other credit balances Income Tax Provision Short term loans Total Current Liabilities Provision for employees'indemnity Long term loans Total non-current liabilities Total Liabilities Paid-in Capital Treasury shares Statutory reserve voluntary reserve Special Reserve Retained earnings Foreign currency translation differences Fairvalue reserve through other comprehensive income Non-controlling interests Total Owners' Equity Total Liabilities & Owners Equity 5023746 1500000 B.S 24636307 12358740 2019 7358593 137913 51015299 985139 21832382 502332 4511611 19281429 47112893 98128192 5615217 0 1166664 6781881 9441209 3201392 12642601 19424482 19002401 -136848 4750600 5158810 20000000 28443690 261881 611529 611647 78703710 98128192 Cash and cash equivalents long term bank deposit Accounts Receivable Inventory Investment in heldfor trading assets heldfor trading Other accounts receivable Total Current Assets Deferred Tax Financial assets at fair value through other comprehensive income Investment in associates Property Investments Property, plant and equipment Total Fixed Assets Total assets Other credit balances Income Tax Provision Short term loans Total Current Liabilities Provision for employees'indemnity Long term loans Total non-current liabilities Total Liabilities Paid-in Capital Treasury shares Statutory reserve voluntary reserve Special Reserve Retained earnings Foreign currency translation differences Fair value reserve through other comprehensive income Nor-controlling interests Total Owners' Equity Total Liabilities & Owners Equity 2553639 1500000 B.S 24036074 2020 12190134 8637123 1209458 50126428 1033989 19698876 0 6143519 22070380 48946764 99073192 6174962 0 1166664 7341626 9972995 2034728 12007723 19349349 19002401 -138900 4750600 5158810 20000000 31501925 587659 -1993002 854350 79723843 99073192 income statement USD Sales Cost of sales gross Profit Selling and Distribution Expenses Advertising Expenses General and administrative expenses Finance Expenses Allowance of doubtful accounts Net Income from operations Gain(loss) from sale and revaluation of heldfor trading financial assets Gain From Property Investments loss in Evaluate investmentsin allied companies Gains from investment properties Financing Income (Losses) Other revenues (expenses) Net Income beforetax Income tax expense Accrued income tax expense DifferedTaxes Benefits Net Income after tax Basic and diluted earnings (lossi per share 2020 35854785 -22402214 13452571 -2093619 -1159711 -3054924 -238725 -271054 | 6634538 1084421 227525 70000 8016484 -822246 48850 7243088 0.3812 Cash and cash equivalents long term bank deposit Accounts Receivable Inventory Investment in heldfor trading assets heldfor trading Other accounts receivable Total Current Assets Deferred Tax Financial assets at fair value through other comprehensive income Investment in associates Property Investments Property, plant and equipment Total Fixed Assets Total assets Other credit balances Income Tax Provision Short term loans Total Current Liabilities Provision for employees'indemnity Long term loans Total non-current liabilities Total Liabilities Paid-in Capital Treasury shares Statutory reserve voluntary reserve Special Reserve Retained earnings Foreign currency translation differences Fairvalue reserve through other comprehensive income Non-controlling interests Total Owners' Equity Total Liabilities & Owners Equity 5023746 1500000 B.S 24636307 12358740 2019 7358593 137913 51015299 985139 21832382 502332 4511611 19281429 47112893 98128192 5615217 0 1166664 6781881 9441209 3201392 12642601 19424482 19002401 -136848 4750600 5158810 20000000 28443690 261881 611529 611647 78703710 98128192 Cash and cash equivalents long term bank deposit Accounts Receivable Inventory Investment in heldfor trading assets heldfor trading Other accounts receivable Total Current Assets Deferred Tax Financial assets at fair value through other comprehensive income Investment in associates Property Investments Property, plant and equipment Total Fixed Assets Total assets Other credit balances Income Tax Provision Short term loans Total Current Liabilities Provision for employees'indemnity Long term loans Total non-current liabilities Total Liabilities Paid-in Capital Treasury shares Statutory reserve voluntary reserve Special Reserve Retained earnings Foreign currency translation differences Fair value reserve through other comprehensive income Nor-controlling interests Total Owners' Equity Total Liabilities & Owners Equity 2553639 1500000 B.S 24036074 2020 12190134 8637123 1209458 50126428 1033989 19698876 0 6143519 22070380 48946764 99073192 6174962 0 1166664 7341626 9972995 2034728 12007723 19349349 19002401 -138900 4750600 5158810 20000000 31501925 587659 -1993002 854350 79723843 99073192 income statement USD Sales Cost of sales gross Profit Selling and Distribution Expenses Advertising Expenses General and administrative expenses Finance Expenses Allowance of doubtful accounts Net Income from operations Gain(loss) from sale and revaluation of heldfor trading financial assets Gain From Property Investments loss in Evaluate investmentsin allied companies Gains from investment properties Financing Income (Losses) Other revenues (expenses) Net Income beforetax Income tax expense Accrued income tax expense DifferedTaxes Benefits Net Income after tax Basic and diluted earnings (lossi per share 2020 35854785 -22402214 13452571 -2093619 -1159711 -3054924 -238725 -271054 | 6634538 1084421 227525 70000 8016484 -822246 48850 7243088 0.3812Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started