Answered step by step

Verified Expert Solution

Question

1 Approved Answer

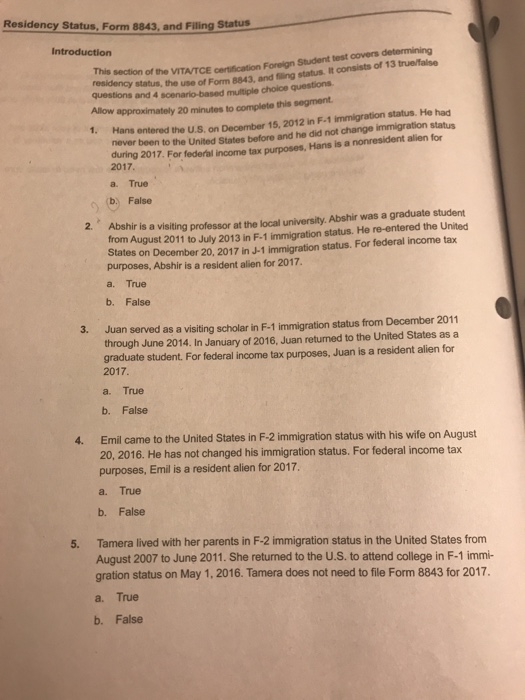

Find a solution Residency Status, Form 8843, and Filing Status This section of the VITA/TCE certification Foreign Student test covers determining consists of 13 true/taise

Find a solution

Residency Status, Form 8843, and Filing Status This section of the VITA/TCE certification Foreign Student test covers determining consists of 13 true/taise residency status, questions and 4 scenario-based multiple choice questions Allow approximately 20 minutes to complete this the use of Form 8043, and iling status segment status. He had 1. Hans entered the U.S. on December 15, 2012 in F-1 immigration never been to the United States before and he did not change immigration status during 2017. For 2017 a. True b. False 2. Abshir is a visiting professor at the local university. Abshir was a graduate student from August 2011 to July 2013 in F-1 immigration status. He re-entered the United States on December 20, 2017 in J-1 immigration status. For federal income tax purposes, Abshir is a resident alien for 2017 a. True b. False 3. Juan served as a visiting scholar in F-1 immigration status from December 2011 through June 2014. In January of 2016, Juan retumed to the United States as a graduate student. For federal income tax purposes, Juan is a resident alien for 2017 a. True b. False 4. Emil came to the United States in F-2 immigration status with his wife on August 20, 2016. He has not changed his immigration status. For federal income tax purposes, Emil is a resident alien for 2017. a. True b. False Tamera lived with her parents in F-2 immigration status in the United States from August 2007 to June 2011. She returned to the U.S. to attend college in F-1 immi- gration status on May 1, 2016. Tamera does not need to file Form 8843 for 2017. 5. a. True b. False

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started