Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Find a solution Tax Law U pdate Test for Circular 230 Professionals era Directions Read each question carefully and use your training and resource answer

Find a solution

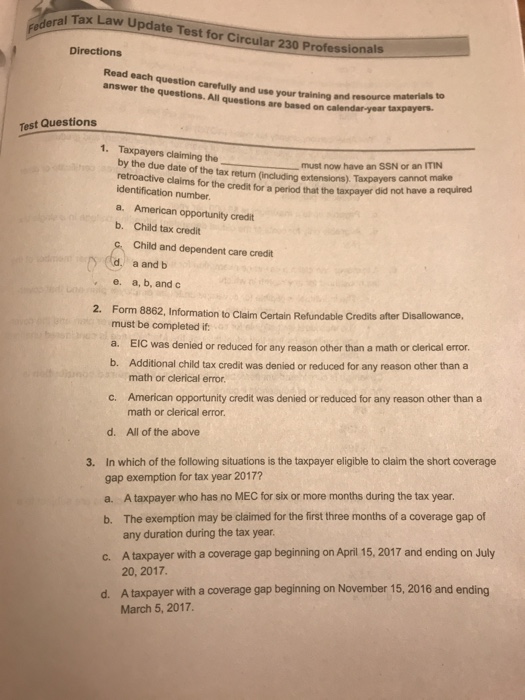

Tax Law U pdate Test for Circular 230 Professionals era Directions Read each question carefully and use your training and resource answer the questions. All questions are based on calendar-year materials to taxpayers. Test Questions 1. Taxpayers claiming the by the due date of the tax return (including extensions) i retroactive claims for the credit for a period that the taxpayer did not have a must now have an SSN or an ITIN Taxpayers cannot make required identification number a. American opportunity credit b. Child tax credit Child and dependent care credit d a and b e. a, b, and c 2. Form 8862, Information to Claim Certain Refundable Creditis after Disallowance, must be completed if: a. EIC was denied or reduced for any reason other than a math or clerical error b. Additional child tax credit was denied or reduced for any reason other than a math or clerical error c. American opportunity credit was denied or reduced for any reason other than a math or clerical error. d. All of the above In which of the following situations is the taxpayer eligible to claim the short coverage gap exemption for tax year 2017? a. A taxpayer who has no MEC for six or more months during the tax year b. The exemption may be claimed for the first three months of a coverage gap of 3. any duration during the tax year A taxpayer with a coverage gap beginning on April 15, 2017 and ending on July 20, 2017 c. A taxpayer with a coverage gap beginning on November 15, 2016 and ending March 5, 2017. d

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started