Answered step by step

Verified Expert Solution

Question

1 Approved Answer

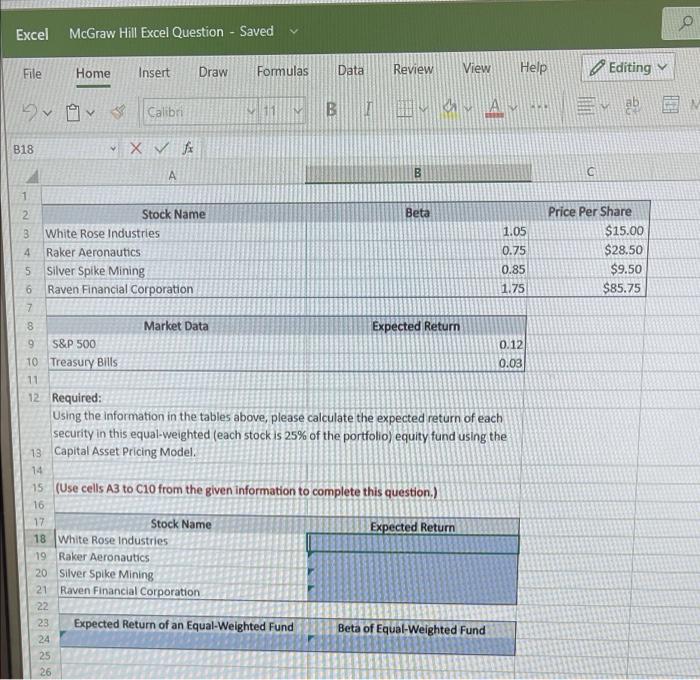

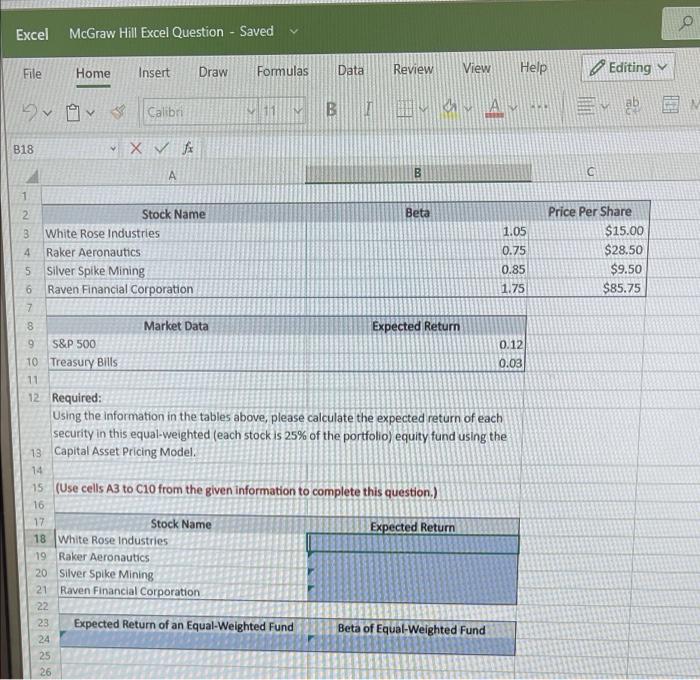

Find all the answers and include thr formulas and cells used to find answers. o Excel McGraw Hill Excel Question - Saved File Home Insert

Find all the answers and include thr formulas and cells used to find answers.

o Excel McGraw Hill Excel Question - Saved File Home Insert Draw Formulas Data Review View Help Editing Dro Calibri V 11 B A. B18 XA A B c 2 3 4 Price Per Share $15.00 $28.50 $9.50 $85.75 @ 1 Stock Name Beta White Rose Industries 1.05 Raker Aeronautics 0.75 Silver Spike Mining 0.85 6 Raven Financial Corporation 1.75 7 8 Market Data Expected Return 9 S&P 500 0.12 10 Treasury Bills 0.03 11 12. Required: Using the information in the tables above, please calculate the expected return of each security in this equal-weighted (each stock is 25% of the portfolio) equity fund using the 13 Capital Asset Pricing Model. 14 15 (Use cells A3 to C10 from the given information to complete this question.) 16 17 Stock Name Expected Return 18 White Rose Industries 19 Raker Aeronautics 20 Silver Spike Mining 21 Raven Financial Corporation 22 Expected Return of an Equal-Weighted Fund Beta of Equal-Weighted Fund 24 25 3 23 26

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started