Answered step by step

Verified Expert Solution

Question

1 Approved Answer

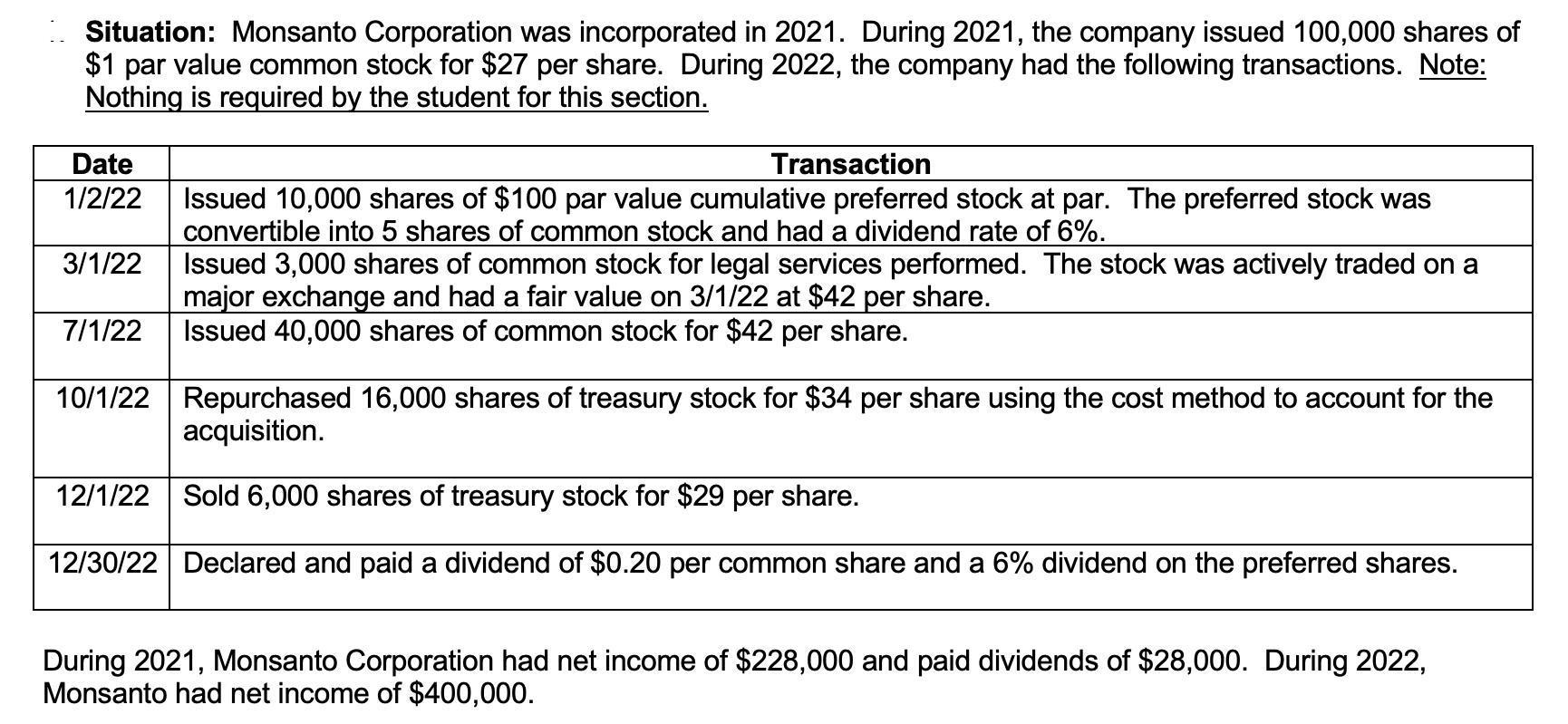

Situation: Monsanto Corporation was incorporated in 2021. During 2021, the company issued 100,000 shares of $1 par value common stock for $27 per share.

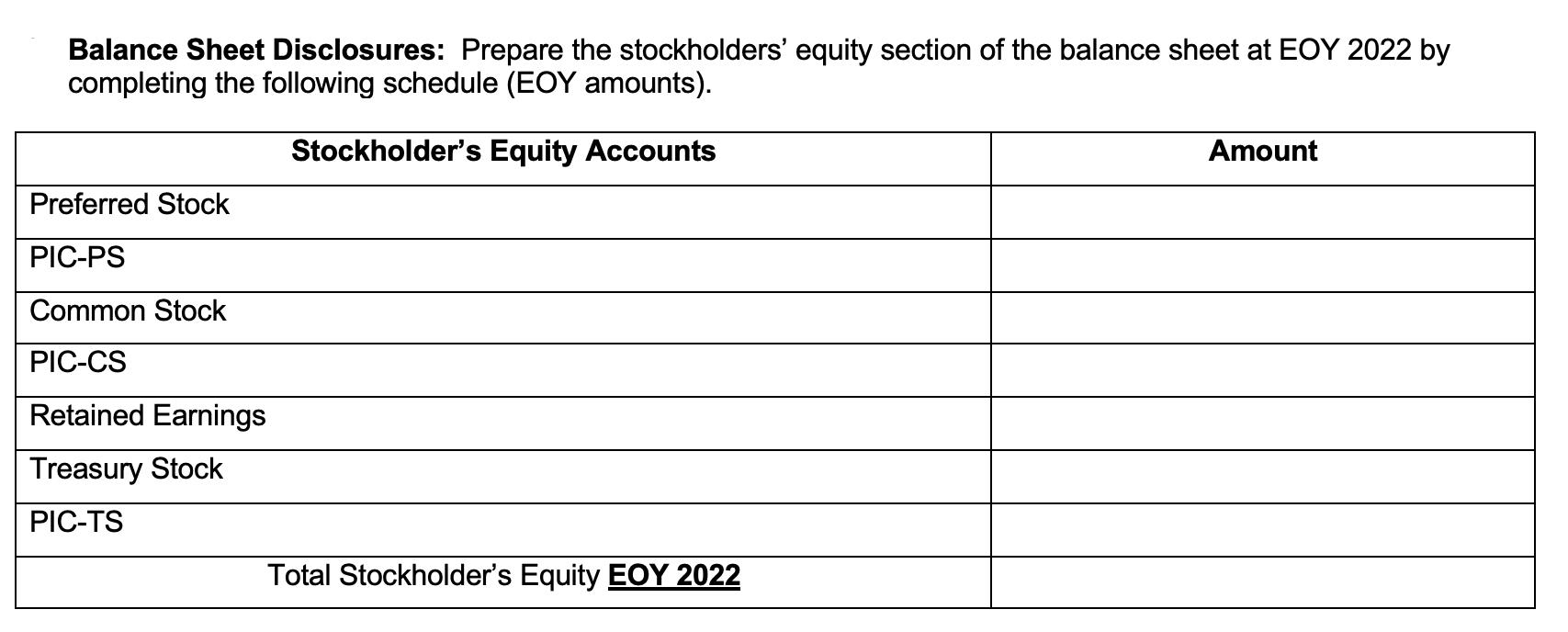

Situation: Monsanto Corporation was incorporated in 2021. During 2021, the company issued 100,000 shares of $1 par value common stock for $27 per share. During 2022, the company had the following transactions. Note: Nothing is required by the student for this section. Date 1/2/22 3/1/22 Transaction Issued 10,000 shares of $100 par value cumulative preferred stock at par. The preferred stock was convertible into 5 shares of common stock and had a dividend rate of 6%. Issued 3,000 shares of common stock for legal services performed. The stock was actively traded on a major exchange and had a fair value on 3/1/22 at $42 per share. 7/1/22 Issued 40,000 shares of common stock for $42 per share. 10/1/22 Repurchased 16,000 shares of treasury stock for $34 per share using the cost method to account for the acquisition. 12/1/22 Sold 6,000 shares of treasury stock for $29 per share. 12/30/22 Declared and paid a dividend of $0.20 per common share and a 6% dividend on the preferred shares. During 2021, Monsanto Corporation had net income of $228,000 and paid dividends of $28,000. During 2022, Monsanto had net income of $400,000. Balance Sheet Disclosures: Prepare the stockholders' equity section of the balance sheet at EOY 2022 by completing the following schedule (EOY amounts). Stockholder's Equity Accounts Preferred Stock PIC-PS Common Stock PIC-CS Retained Earnings Treasury Stock PIC-TS Total Stockholder's Equity EOY 2022 Amount

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Transaction Date 0101Y2 Beginning Balance 0102Y2 Issued Preferred stock at p...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started