Answered step by step

Verified Expert Solution

Question

1 Approved Answer

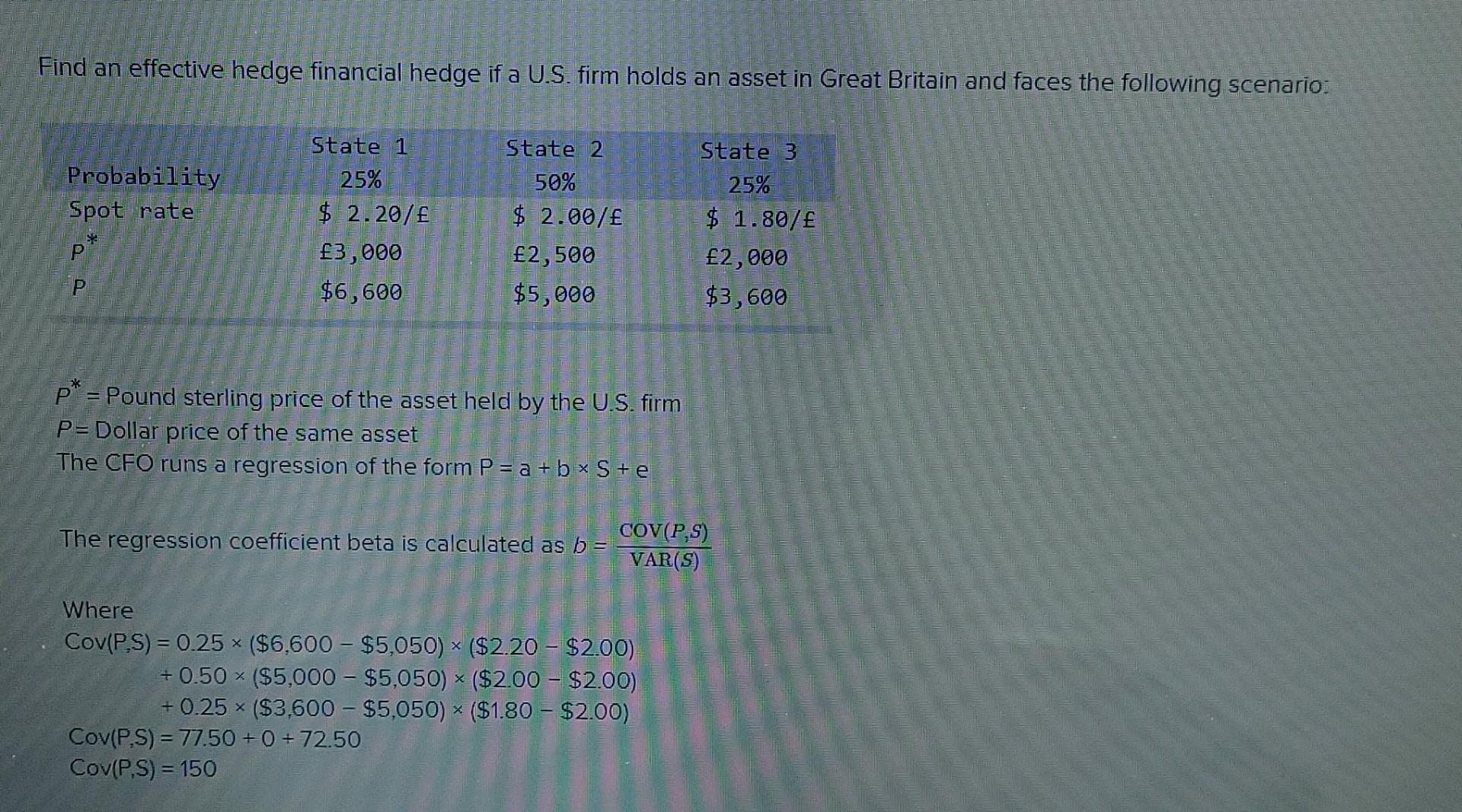

Find an effective hedge financial hedge if a U.S. firm holds an asset in Great Britain and faces the following scenario: Probability Spot rate State

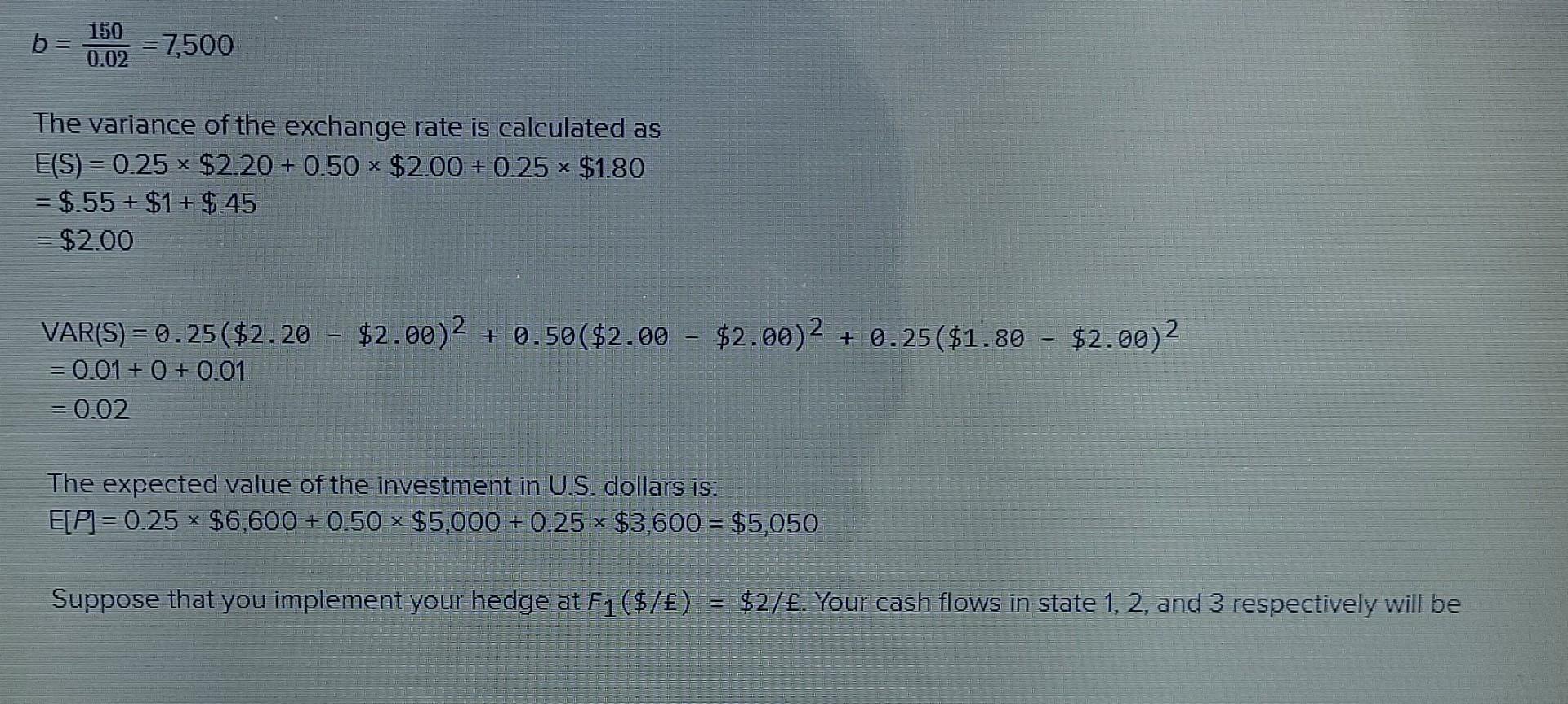

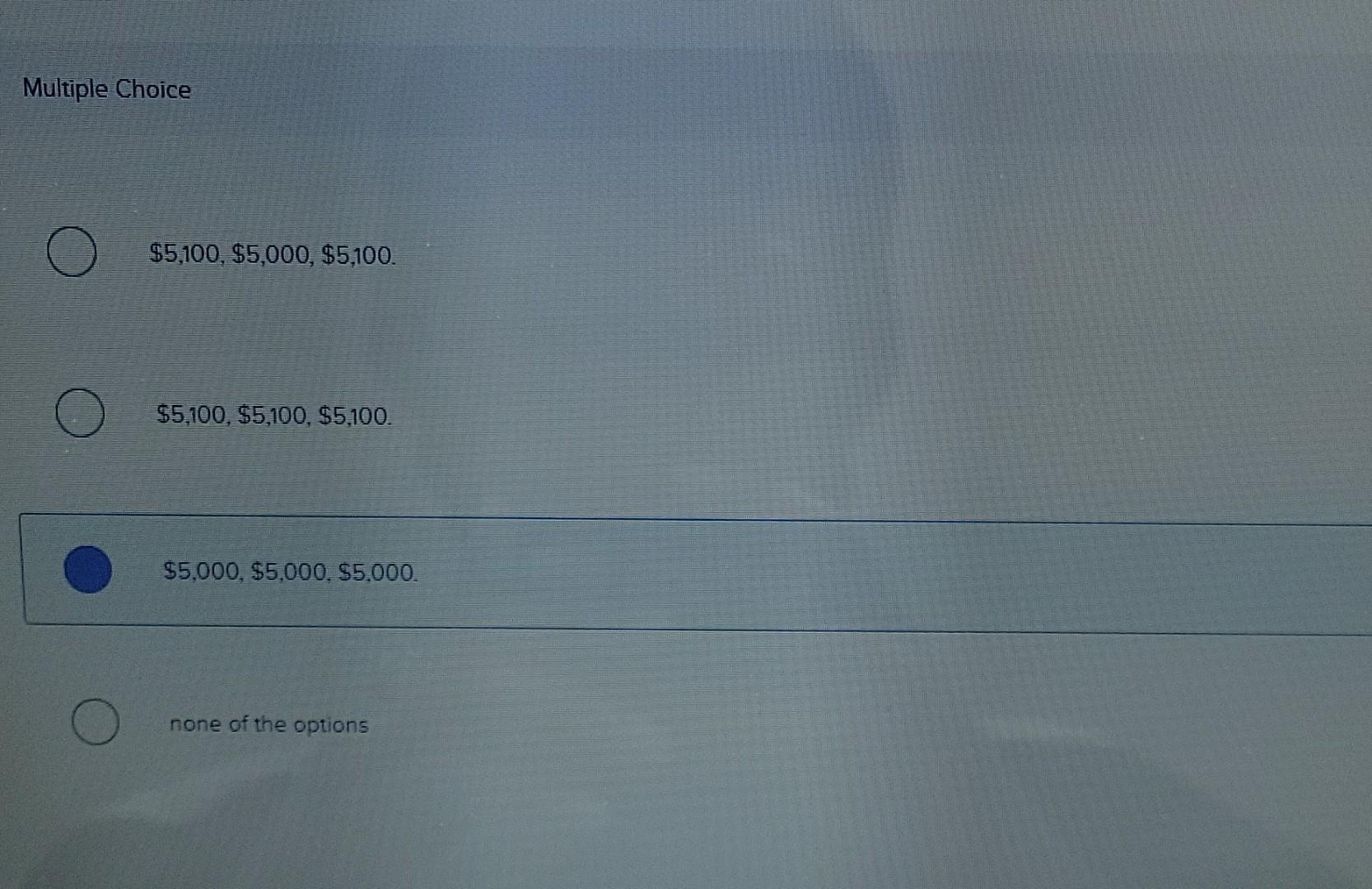

Find an effective hedge financial hedge if a U.S. firm holds an asset in Great Britain and faces the following scenario: Probability Spot rate State 1 25% $ 2.20/ 3,000 $6,600 State 2 50% $ 2.00/ 2,500 $5,000 State 3 25% $ 1.80/ 2,000 $3,600 P p* = Pound sterling price of the asset held by the U.S. firm P= Dollar price of the same asset The CFO runs a regression of the form P= a + b x S + e COV(P,9) The regression coefficient beta is calculated as b = VAR(S) X Where Cov(P.S) = 0.25 % ($6,600 - $5,050) x ($2.20 - $2.00) +0.50 ($5,000 - $5,050) ($2.00 - $2.00) +0.25 % ($3,600 - $5,050) * ($1.80 - $2.00) Cov(P.S) = 77.50 + 0 + 72.50 CovP.S) = 150 X x b = 150 0.02 =7,500 The variance of the exchange rate is calculated as E(S) = 0.25 * $2.20 + 0.50 $2.00 +0.25 $1.80 = $.55 + $1 + $.45 = $2.00 - VAR(S) = 0.25($2.20 - $2.00)2 + 0.50($2.00 - $2.00)2 + 0.25($1.80 - $2.00) (2 = 0.01 + 0 + 0.01 = 0.02 The expected value of the investment in U.S. dollars is: E[P] = 0.25 * $6,600 + 0.50 * $5,000 + 0.25 * $3,600 = $5,050 X Suppose that you implement your hedge at F1($/) = $2/. Your cash flows in state 1, 2, and 3 respectively will be Multiple Choice $5,100, $5,000, $5,100. $5,100, $5,100, $5,100. $5,000, $5,000. $5.000. none of the options Find an effective hedge financial hedge if a U.S. firm holds an asset in Great Britain and faces the following scenario: Probability Spot rate State 1 25% $ 2.20/ 3,000 $6,600 State 2 50% $ 2.00/ 2,500 $5,000 State 3 25% $ 1.80/ 2,000 $3,600 P p* = Pound sterling price of the asset held by the U.S. firm P= Dollar price of the same asset The CFO runs a regression of the form P= a + b x S + e COV(P,9) The regression coefficient beta is calculated as b = VAR(S) X Where Cov(P.S) = 0.25 % ($6,600 - $5,050) x ($2.20 - $2.00) +0.50 ($5,000 - $5,050) ($2.00 - $2.00) +0.25 % ($3,600 - $5,050) * ($1.80 - $2.00) Cov(P.S) = 77.50 + 0 + 72.50 CovP.S) = 150 X x b = 150 0.02 =7,500 The variance of the exchange rate is calculated as E(S) = 0.25 * $2.20 + 0.50 $2.00 +0.25 $1.80 = $.55 + $1 + $.45 = $2.00 - VAR(S) = 0.25($2.20 - $2.00)2 + 0.50($2.00 - $2.00)2 + 0.25($1.80 - $2.00) (2 = 0.01 + 0 + 0.01 = 0.02 The expected value of the investment in U.S. dollars is: E[P] = 0.25 * $6,600 + 0.50 * $5,000 + 0.25 * $3,600 = $5,050 X Suppose that you implement your hedge at F1($/) = $2/. Your cash flows in state 1, 2, and 3 respectively will be Multiple Choice $5,100, $5,000, $5,100. $5,100, $5,100, $5,100. $5,000, $5,000. $5.000. none of the options

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started