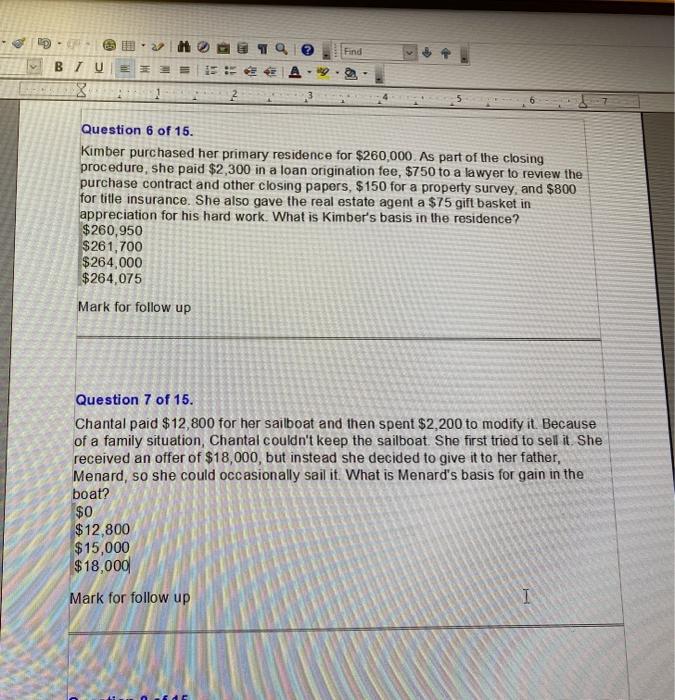

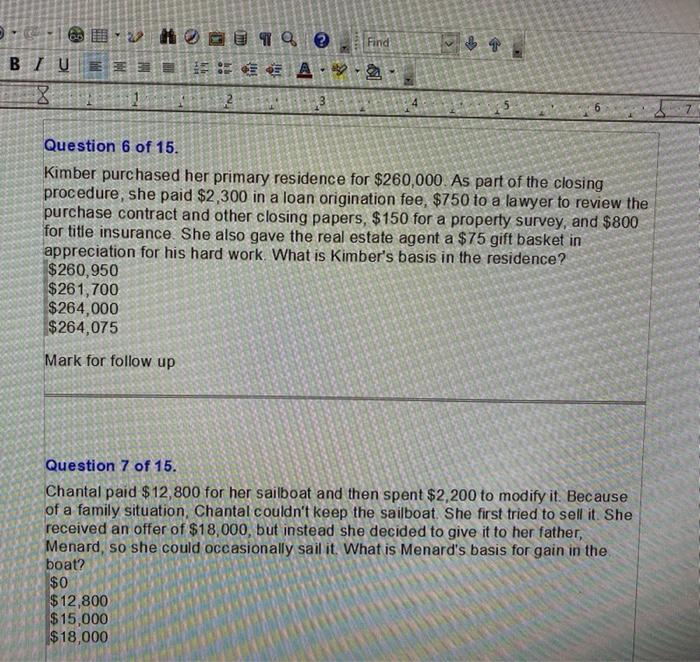

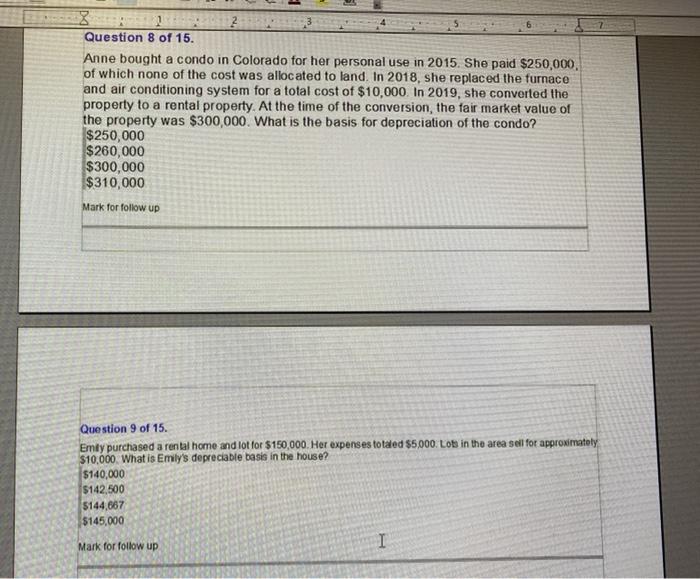

- Find BTU MSC E ** 2. 8 Question 6 of 15. Kimber purchased her primary residence for $260,000. As part of the closing procedure, she paid $2,300 in a loan origination fee, $750 to a lawyer to review the purchase contract and other closing papers, $150 for a property survey, and $800 for title insurance. She also gave the real estate agent a $75 gift basket in appreciation for his hard work. What is Kimber's basis in the residence? $260,950 $261,700 $264,000 $264,075 Mark for follow up Question 7 of 15. Chantal paid $12,800 for her sailboat and then spent $2,200 to modify it. Because of a family situation, Chantal couldn't keep the sailboat. She first tried to sell it She received an offer of $18,000, but instead she decided to give it to her father, Menard, so she could occasionally sail it. What is Menard's basis for gain in the boat? $0 $12,800 $15,000 $18,000 Mark for follow up I Find BB~ H @ @ @ BIU FEA.. X 1 2 3 Question 6 of 15. Kimber purchased her primary residence for $260,000. As part of the closing procedure, she paid $2,300 in a loan origination fee, $750 to a lawyer to review the purchase contract and other closing papers, $150 for a property survey, and $800 for title insurance. She also gave the real estate agent a $75 gift basket in appreciation for his hard work. What is Kimber's basis in the residence? $260,950 $261,700 $264,000 $264,075 Mark for follow up Question 7 of 15. Chantal paid $12,800 for her sailboat and then spent $2,200 to modify it. Because of a family situation, Chantal couldn't keep the sailboat She first tried to sell it. She received an offer of $18,000, but instead she decided to give it to her father, Menard, so she could occasionally sail it. What is Menard's basis for gain in the boat? $0 $12,800 $15,000 $18,000 X Question 8 of 15. Anne bought a condo in Colorado for her personal use in 2015. She paid $250,000, of which none of the cost was allocated to land. In 2018, she replaced the furnace and air conditioning system for a total cost of $10,000. In 2019, she converted the property to a rental property. At the time of the conversion, the fair market value of the property was $300,000. What is the basis for depreciation of the condo? $250,000 $260,000 $300,000 $310,000 Mark for follow up Question 9 of 15. Emly purchased a rental home and lot for $150,000. Her expenses totaled $5,000. Los in the area sell for approximately $10,000. What is Emily's depreciable basis in the house? $140,000 $142,500 $144,667 $145,000 Mark for follow up