Answered step by step

Verified Expert Solution

Question

1 Approved Answer

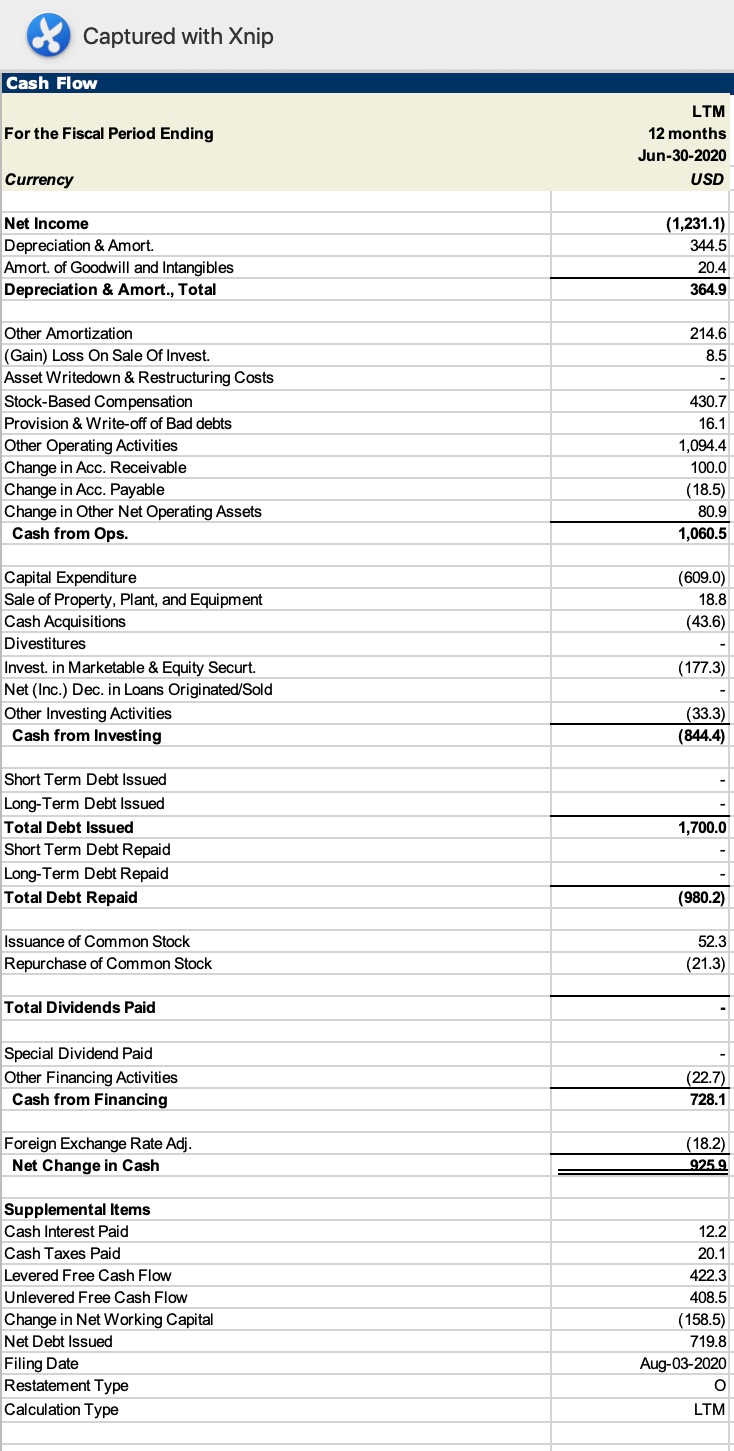

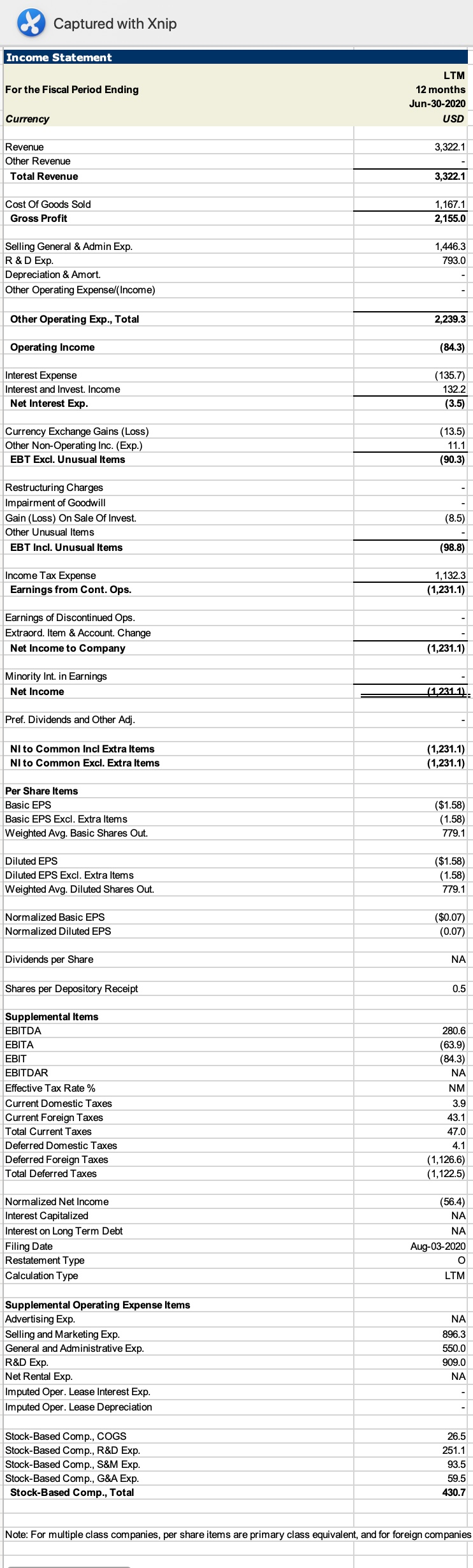

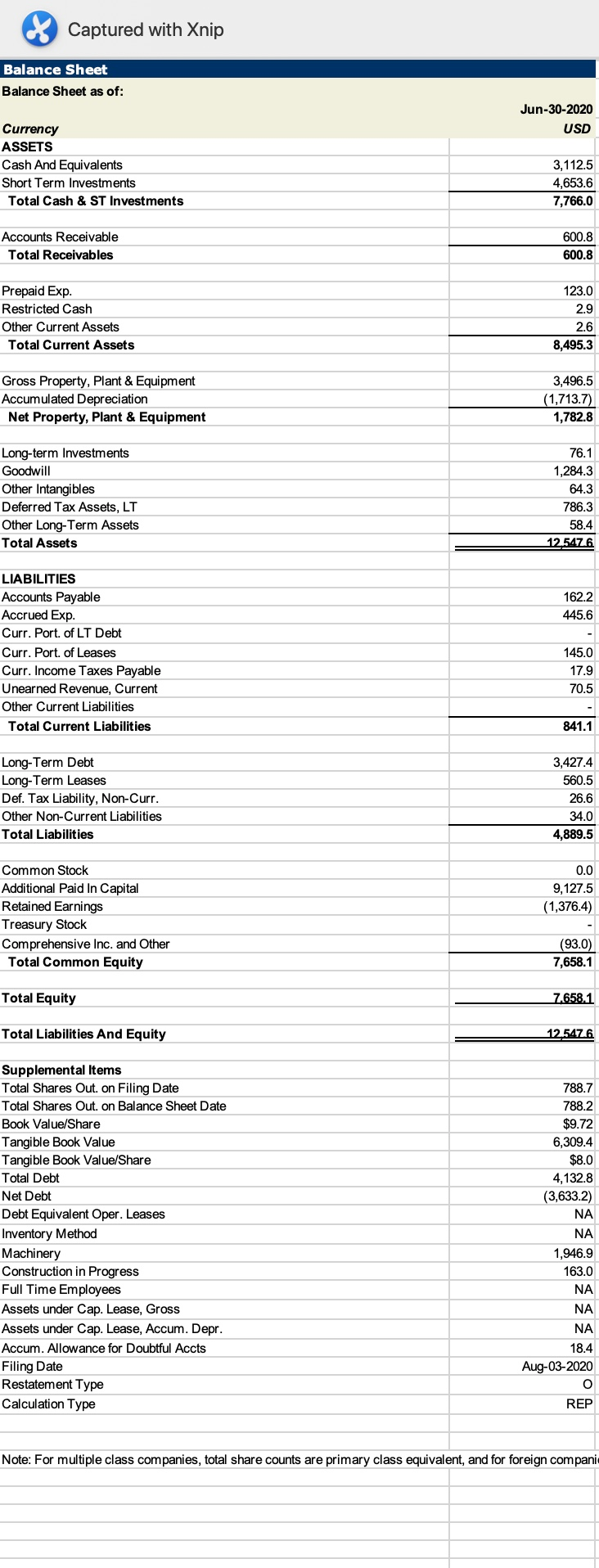

Find Cash Debt Coverage, Current Ratio, Quick Ratio, PE Ratio, Free Cash Flows, Working Capital . Show all calculations. Captured with Xnip Cash Flow For

Find Cash Debt Coverage, Current Ratio, Quick Ratio, PE Ratio, Free Cash Flows, Working Capital . Show all calculations.

Captured with Xnip Cash Flow For the Fiscal Period Ending LTM 12 months Jun-30-2020 USD Currency Net Income Depreciation & Amort. Amort. of Goodwill and Intangibles Depreciation & Amort., Total (1,231.1) 344.5 20.4 364.9 214.6 8.5 Other Amortization (Gain) Loss On Sale Of Invest. Asset Writedown & Restructuring Costs Stock-Based Compensation Provision & Write-off of Bad debts Other Operating Activities Change in Acc. Receivable Change in Acc. Payable Change in Other Net Operating Assets Cash from Ops. 430.7 16.1 1,094.4 100.0 (18.5) 80.9 1,060.5 (609.0) 18.8 (43.6) Capital Expenditure Sale of Property, plant, and Equipment Cash Acquisitions Divestitures Invest. in Marketable & Equity Securt. Net (Inc.) Dec. in Loans Originated/Sold Other Investing Activities Cash from Investing (177.3) (33.3) (844.4) 1,700.0 Short Term Debt Issued Long-Term Debt Issued Total Debt Issued Short Term Debt Repaid Long-Term Debt Repaid Total Debt Repaid (980.2) Issuance of Common Stock Repurchase of Common Stock 52.3 (21.3) Total Dividends Paid Special Dividend Paid Other Financing Activities Cash from Financing (22.7) 728.1 Foreign Exchange Rate Adj. Net Change in Cash (18.2) 925.9 Supplemental Items Cash Interest Paid Cash Taxes Paid Levered Free Cash Flow Unlevered Free Cash Flow Change in Net Working Capital Net Debt Issued Filing Date Restatement Type Calculation Type 12.2 20.1 422.3 408.5 (158.5) 719.8 Aug-03-2020 O LTM & Captured with Xnip Income Statement For the Fiscal Period Ending LTM 12 months Jun-30-2020 USD Currency 3,322.1 Revenue Other Revenue Total Revenue 3,322.1 Cost Of Goods Sold Gross Profit 1,167.1 2,155.0 1,446.3 793.0 Selling General & Admin Exp. R & D Exp. Depreciation & Amort. Other Operating Expense/Income) Other Operating Exp., Total 2,239.3 Operating Income (84.3) Interest Expense Interest and Invest. Income Net Interest Exp. (135.7) 132.2 (3.5) Currency Exchange Gains (Loss) Other Non-Operating Inc. (Exp.) EBT Excl. Unusual Items (13.5) 11.1 (90.3) Restructuring Charges Impairment of Goodwill Gain (Loss) On Sale Of Invest. Other Unusual Items EBT Incl. Unusual Items (8.5) (98.8) Income Tax Expense Earnings from Cont. Ops. 1,132.3 (1,231.1) Earnings of Discontinued Ops. Extraord. Item & Account Change Net Income to Company (1,231.1) Minority Int. in Earnings Net Income (1.231.1). Pref. Dividends and Other Adj. NI to Common Incl Extra Items NI to Common Excl. Extra Items (1,231.1) (1,231.1) Per Share Items Basic EPS Basic EPS Excl. Extra Items Weighted Avg. Basic Shares Out. ($1.58) (1.58) 779.1 Diluted EPS Diluted EPS Excl. Extra Items Weighted Avg. Diluted Shares Out. ($1.58) (1.58) 779.1 Normalized Basic EPS Normalized Diluted EPS ($0.07) (0.07) Dividends per Share NA Shares per Depository Receipt 0.5 Supplemental Items EBITDA EBITA EBIT EBITDAR Effective Tax Rate % Current Domestic Taxes Current Foreign Taxes Total Current Taxes Deferred Domestic Taxes Deferred Foreign Taxes Total Deferred Taxes 280.6 (63.9) (84.3) NA NM 3.9 43.1 47.0 4.1 (1,126.6) (1,122.5) Normalized Net Income Interest Capitalized Interest on Long Term Debt Filing Date Restatement Type Calculation Type (56.4) NA NA Aug-03-2020 O LTM Supplemental Operating Expense Items Advertising Exp. Selling and Marketing Exp. General and Administrative Exp. R&D Exp. Net Rental Exp. Imputed Oper. Lease Interest Exp. Imputed Oper. Lease Depreciation NA 896.3 550.0 909.0 NA Stock-Based Comp., COGS Stock-Based Comp., R&D Exp. Stock-Based Comp., S&M Exp. Stock-Based Comp., G&A Exp. Stock-Based Comp., Total 26.5 251.1 93.5 59.5 430.7 Note: For multiple class companies, per share items are primary class equivalent, and for foreign companies Captured with Xnip Balance Sheet Balance Sheet as of: Jun-30-2020 USD Currency ASSETS Cash And Equivalents Short Term Investments Total Cash & ST Investments 3,112.5 4,653.6 7,766.0 Accounts Receivable Total Receivables 600.8 600.8 Prepaid Exp. Restricted Cash Other Current Assets Total Current Assets 123.0 2.9 2.6 8,495.3 Gross Property, Plant & Equipment Accumulated Depreciation Net Property, Plant & Equipment 3,496.5 (1,713.7) 1,782.8 Long-term Investments Goodwill Other Intangibles Deferred Tax Assets, LT Other Long-Term Assets Total Assets 76.1 1,284.3 64.3 786.3 58.4 12.5476 162.2 445.6 LIABILITIES Accounts Payable Accrued Exp. Curr. Port of LT Debt Curr. Port. of Leases Curr. Income Taxes Payable Unearned Revenue, Current Other Current Liabilities Total Current Liabilities 145.0 17.9 70.5 841.1 Long-Term Debt Long-Term Leases Def. Tax Liability, Non-Curr. Other Non-Current Liabilities Total Liabilities 3,427.4 560.5 26.6 34.0 4,889.5 0.0 9,127.5 (1,376.4) Common Stock Additional Paid In Capital Retained Earnings Treasury Stock Comprehensive Inc. and Other Total Common Equity (93.0) 7,658.1 Total Equity 7.658.1 Total Liabilities And Equity 12.5476 Supplemental Items Total Shares Out. on Filing Date Total Shares Out. on Balance Sheet Date Book Value/Share Tangible Book Value Tangible Book Value/Share Total Debt Net Debt Debt Equivalent Oper. Leases Inventory Method Machinery Construction in Progress Full Time Employees Assets under Cap. Lease, Gross Assets under Cap. Lease, Accum. Depr. Accum. Allowance for Doubtful Accts Filing Date Restatement Type Calculation Type 788.7 788.2 $9.72 6,309.4 $8.0 4,132.8 (3,633.2) NA NA 1,946.9 163.0 NA NA NA 18.4 Aug-03-2020 O REP Note: For multiple class companies, total share counts are primary class equivalent, and for foreign companiStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started