Answered step by step

Verified Expert Solution

Question

1 Approved Answer

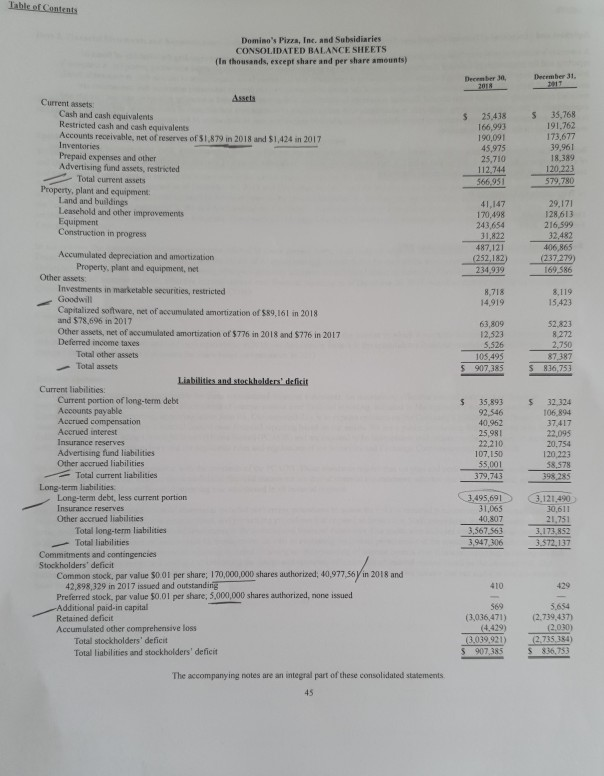

find current ratio EBIT EPS Turnover inventory and received debt equity profit margins Table of Contents Domino's Pizza, Inc. and Subsidiaries CONSOLIDATED BALANCE SHEETS (in

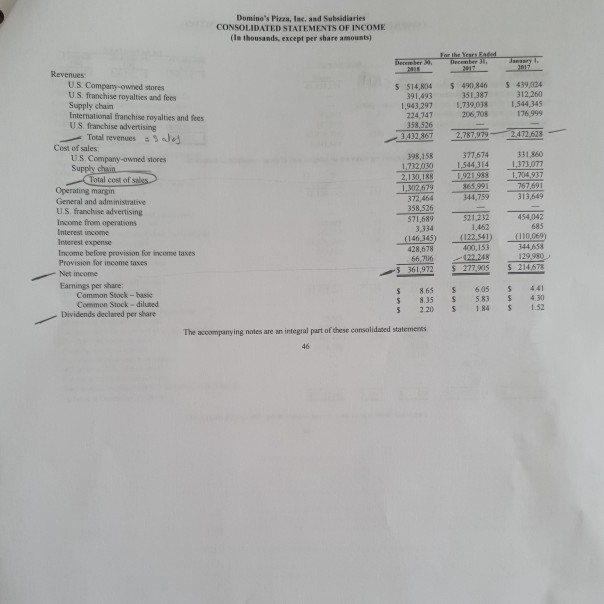

find current ratio EBIT EPS Turnover inventory and received debt equity profit margins

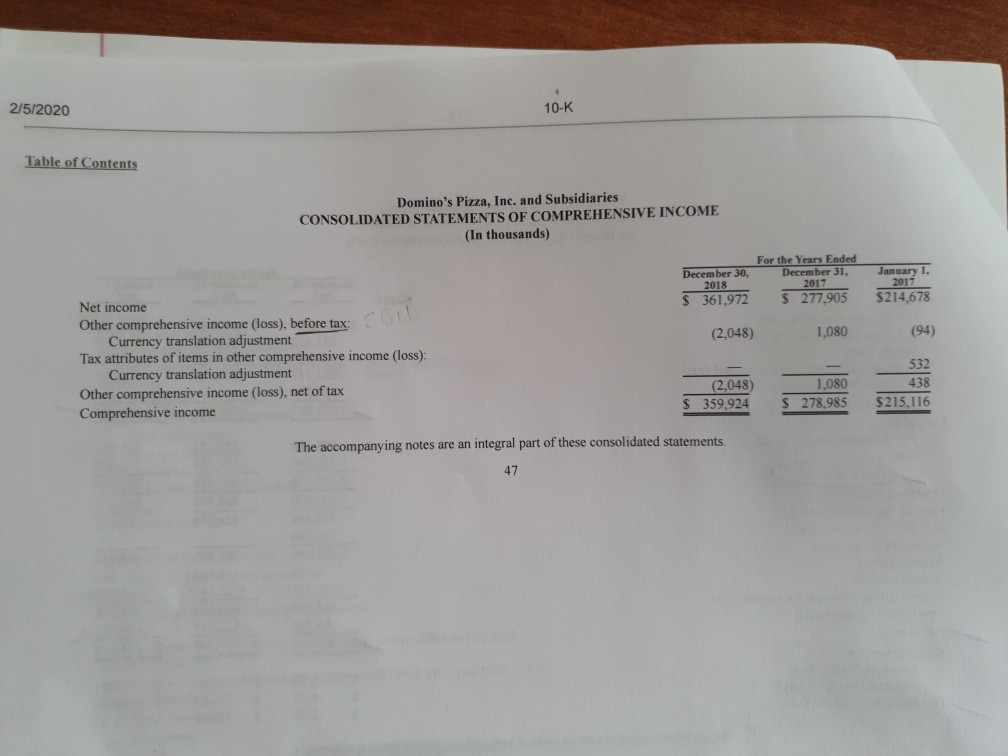

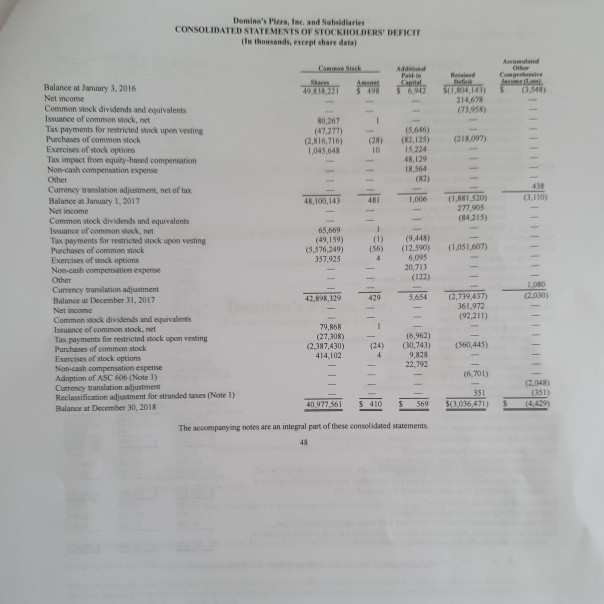

Table of Contents Domino's Pizza, Inc. and Subsidiaries CONSOLIDATED BALANCE SHEETS (in thousands, except share and per share amounts) December 31 December 2018 $ $ Assets Current assets Cash and cash equivalents Restricted cash and cash equivalents Accounts receivable, net of reserves of $1,879 in 2018 and $1.424 in 2017 Inventories Prepaid expenses and other Advertising fund assets, restricted Total current assets Property, plant and equipment Land and buildings Leasehold and other improvements Equipment Construction in progress 25.438 166,993 190,091 45,975 25,710 112,744 566.951 35,768 191.762 173,677 39,961 18,389 120.223 579,780 41,147 170,498 243,654 31,822 487,121 (252,182) 234,939 29,171 128613 216,599 32,482 406,865 (237,279) 169.586 8,718 14,919 8,119 15,423 63,809 12,523 5.526 105,495 907,385 52.823 8.272 2,750 87,387 $ 16,753 S $ 5 Accumulated depreciation and amortization Property, plant and equipment, net Other assets: Investments in marketable securities, restricted Goodwill Capitalized software, net of accumulated amortization of $89,161 in 2018 and $78,696 in 2017 Other assets, net of accumulated amortization of $776 in 2018 and $776 in 2017 Deferred income taxes Total other assets Total assets Liabilities and stockholders' deficit Current liabilities: Current portion of long-term debt Accounts payable Accrued compensation Accrued interest Insurance reserves Advertising fund liabilities Other accrued liabilities Total current liabilities Long-term liabilities Long-term debt, less current portion Insurance reserves Other accrued liabilities Total long-term liabilities Total liabilities Commitments and contingencies Stockholders' deficit Common stock, par value $0.01 per share; 170,000,000 shares authorized; 40,977,56y in 2018 and 42,898,329 in 2017 issued and outstanding Preferred stock, par value $0.01 per share; 5,000,000 shares authorized, none issued Additional paid-in capital Retained deficit Accumulated other comprehensive loss Total stockholders' deficit Total liabilities and stockholders' deficit 35,893 92 546 40.962 25,981 22,210 107,150 55,001 379,743 32.324 106,894 37,417 22.095 20.754 120.223 58,578 398,285 3.495,691 31,065 40,807 3,567 563 3,947.306 3.121,490 10,611 21,751 3,173,852 3.572,137 m.seyim 2018 and 410 429 569 (3,036,471) (4,429) (3.039.921) $ 907,385 5.654 (2.739,437) (2.030) (2.735, 384 $ 836,753 The accompanying notes are an integral part of these consolidated statements 45 Domino's Pizza, Inc. and Subsidiaries CONSOLIDATED STATEMENTS OF INCOME (In thousands, except per share amounts) For the Years Faded December 2017 $ 490,846 351 387 1.739,038 206,708 $439,034 312,260 1,544,345 176 999 2,787979 2.472.628 377,674 1,544 314 1,921,988 865991 344,759 331.850 1,373,077 1,704,937 767,691 313,649 Berber Revenues U.S. Company-owned stores $ $14,804 US franchise royalties and fees 391,493 Supply chain 1,943,297 International franchise royalties and fees 224,747 US franchise advertising 358526 Total revenues : 3.432.867 Cost of sales US Company-owned stores 398,158 Supply chain 1,732,030 Total cost of sales 2.1.2018 Operating margin 1,302,679 General and administrative 372 464 U.S. franchise advertising 358,526 Income from operations 571,689 Interest income 3,334 Interest expense (146,345) Income before provision for income taxes 421,678 Provision for income taxes 66,706 Net income 361.972 Earnings per share Common Stock-hasie $ 8.65 Common Stock-diluted $ 8.35 5 Dividends declared per share 2.20 The accompanying notes are an integral part of these consolidated statements 46 521.232 1.462 (122.541) 400.153 122.248 $ 277,905 454,042 685 (110.069 344,658 129,90 $ 214.678 $ $ S 605 5.83 1.84 5 $ $ 4.41 4.30 1.52 2/5/2020 10-K Table of Contents Domino's Pizza, Inc. and Subsidiaries CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (In thousands) December 30, 2018 $361,972 For the Years Ended December 31, 2017 $ 277,905 January 1, 2011 $214,678 (2,048) 1,080 (94) Net income Other comprehensive income (loss), before tax: Currency translation adjustment Tax attributes of items in other comprehensive income (loss): Currency translation adjustment Other comprehensive income (loss), net of tax Comprehensive income (2,048 1,080 $ 278,985 532 438 $215,116 $ 359,924 The accompanying notes are an integral part of these consolidated statements 47 Domino's Pizza, Inc. and Solsidiaries CONSOLIDATED STATEMENTS OF STOCKHOLDERS DEFICIT (In thousands, except share data) Che Hard $ (38) ST7.04.1431 214,67% (73.958) IIIIIIII (218.007) 1 438 (3,110) (1,881,520) 277,905 (84,215) (1,031,607) Pad Balance at January 3, 2016 498 Net income Common stock dividends and equivalents Issuance of common stock. It Tax payments for restricted stock upon vesting 80,267 (47,277) (5.646) Purchases of common stock (2,816,716) (28) (82,125) Exercises of stock options 1,045,648 10 15.224 Tax impact from equity-based compensation 48,129 Non-cash compensation expense 18,564 Other Currency translation adjustment, net of tax Balance at January 1, 2017 48.100.143 1,006 Net income Common stock dividends and equivalents Issuance of con stock.net 65,669 1 Tax payments for restricted stock upon vesting (49,159) (1) (9,448) Purchases of common stock (5,576,249) (56) (12,590) Exercises of stock options 357,925 4 6,095 Non-cash compensation expense 20,713 Other (122) Currency translation adjustment Balance at December 31, 2017 42,898,329 429 5.654 Net income Common stock dividends and equivalents Issuance of common stock, net 79,868 Tax payments for restricted stock upon vesting (27,308) (6,962) Purchases of common stock (2,387,430) (30,743) 4 Exercises of stock options 414.102 9,828 Non-cash compensation expense 22.792 Adoption of ASC 606 (Note 1) Currency translation adjustment Reclassification adjustment for stranded taxes (Note 1) Balance at December 30, 2018 40,977,561 410 569 The accompanying notes are an integral part of these consolidated statements 48 IIIIIIII - 100 62.030) (2.739,437) 361.972 (92.211) IIIIIII (24) (560,445) (6,701) 02.048) (351) 18,973 351 ${3,036,471)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started