Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Find el Replace Dictate Heading 1 1 Normal Strong Subtitle Title I No Space Select Styles Editing Voice 4. Suppose the Navy is considering two

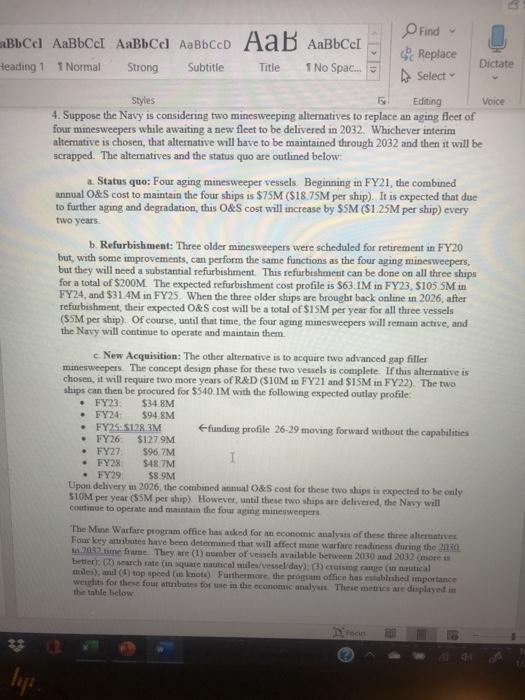

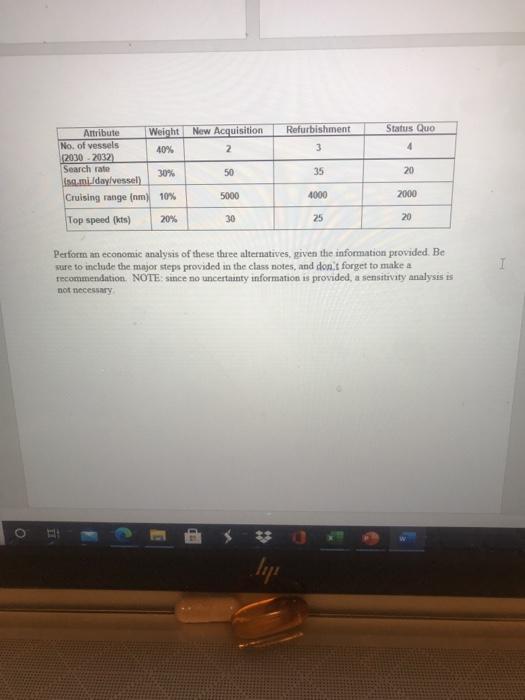

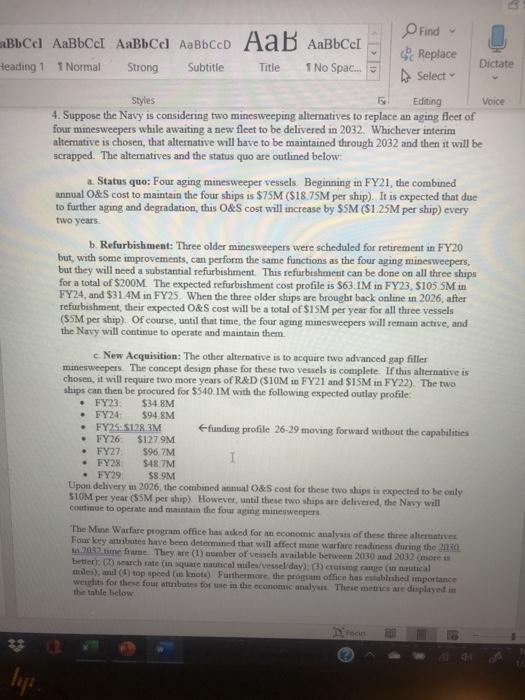

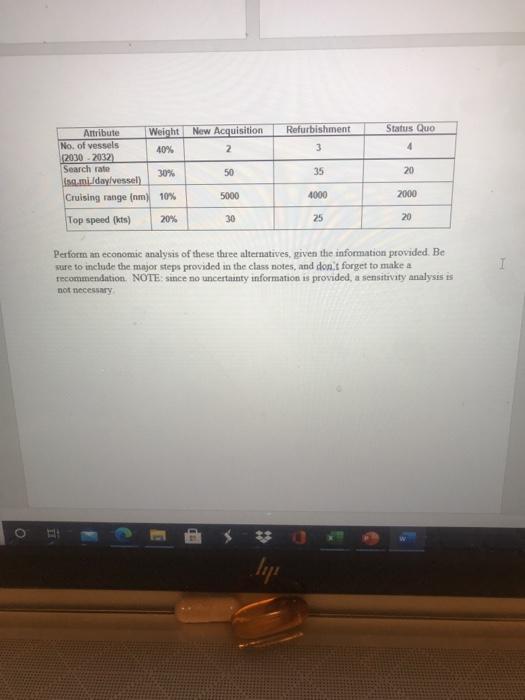

Find el Replace Dictate Heading 1 1 Normal Strong Subtitle Title I No Space Select Styles Editing Voice 4. Suppose the Navy is considering two minesweeping alternatives to replace an aging fleet of four minesweepers while awaiting a new fleet to be delivered in 2032. Whichever interim alternative is chosen, that alternative will bave to be maintained through 2032 and then it will be scrapped. The alternatives and the status quo are outlined below: Status quo: Four aging minesweeper vessels. Beginning in FY21, the combined annual O&S cost to maintain the four ships is $75M ($18.75M per ship). It is expected that due to further aging and degradation, this O&S cost will increase by SSM ($1.25M per ship) every two years. b. Refurbishment: Three older minesweepers were scheduled for retirement in FY20 but with some improvements, can perform the same functions as the four aging minesweepers, but they will need a substantial refurbishment. This refurbishment can be done on all three ships for a total of $200M. The expected refurbishment cost profile is 563.1M in FY23, S105 SM 1 FY24, and $31.4M in FY25. When the three older ships are brought back online in 2026, after refurbishment, their expected O&S cost will be a total of $1SM per year for all three vessels (SSM per ship). Of course, until that time, the four aging minesweepers will remain active, and the Navy will continue to operate and maintain them. e New Acquisition: The other alternative is to acquire two advanced gap filler minesweepers. The concept design phase for these two vessels is complete. If this alternative is chosen, it will require two more years of R&D (510M in FY21 and SISM in FY22). The two ships can then be procured for $540 IM with the following expected outlay profile FY23 $34 8M FY24 $948M FY25:51283M +funding profile 26-29 moving forward without the capabilities FY26 $127.9M FY27 596.7M FY28 $48.7M I FY29 $8.9M Upon delivery in 2026, the combined smal O&S cost for these two sups is expected to be only S10M per year (SSM per ship). However, until these two ships are delivered the Navy will continue to operate and maintain the four aging minesweepers . . . The Munn Warfare program office has asked for an economic analysis of these three alatives Four key tuributes have been determined that will affect mine warfare readiness during the 2030 1 2032 tunerme They are (1) number of vessels available between 2030 und 2032 mois better search rate (in que nautical miles/vessel/day), cruising range (utical miles), and () top speed (knots) Furthermore, the program office has established importance weight for these four attributes for me in the economic analysis. These metrics are displayed in the table below Refurbishment 3 Status Quo 4 Attribute Weight New Acquisition No. of vessels 40% 2 12030-2032) Search rate 30% 50 sumilday/vessel) Cruising range (m) 10% 5000 35 20 4000 2000 20% Top speed (kts) 30 25 20 Perform an economic analysis of these three alternatives, given the information provided. Be sure to include the major steps provided in the class notes, and dont forget to make a commendation. NOTE since no uncertainty information is provided, a sensitivity analysis is not necessary Juge Find el Replace Dictate Heading 1 1 Normal Strong Subtitle Title I No Space Select Styles Editing Voice 4. Suppose the Navy is considering two minesweeping alternatives to replace an aging fleet of four minesweepers while awaiting a new fleet to be delivered in 2032. Whichever interim alternative is chosen, that alternative will bave to be maintained through 2032 and then it will be scrapped. The alternatives and the status quo are outlined below: Status quo: Four aging minesweeper vessels. Beginning in FY21, the combined annual O&S cost to maintain the four ships is $75M ($18.75M per ship). It is expected that due to further aging and degradation, this O&S cost will increase by SSM ($1.25M per ship) every two years. b. Refurbishment: Three older minesweepers were scheduled for retirement in FY20 but with some improvements, can perform the same functions as the four aging minesweepers, but they will need a substantial refurbishment. This refurbishment can be done on all three ships for a total of $200M. The expected refurbishment cost profile is 563.1M in FY23, S105 SM 1 FY24, and $31.4M in FY25. When the three older ships are brought back online in 2026, after refurbishment, their expected O&S cost will be a total of $1SM per year for all three vessels (SSM per ship). Of course, until that time, the four aging minesweepers will remain active, and the Navy will continue to operate and maintain them. e New Acquisition: The other alternative is to acquire two advanced gap filler minesweepers. The concept design phase for these two vessels is complete. If this alternative is chosen, it will require two more years of R&D (510M in FY21 and SISM in FY22). The two ships can then be procured for $540 IM with the following expected outlay profile FY23 $34 8M FY24 $948M FY25:51283M +funding profile 26-29 moving forward without the capabilities FY26 $127.9M FY27 596.7M FY28 $48.7M I FY29 $8.9M Upon delivery in 2026, the combined smal O&S cost for these two sups is expected to be only S10M per year (SSM per ship). However, until these two ships are delivered the Navy will continue to operate and maintain the four aging minesweepers . . . The Munn Warfare program office has asked for an economic analysis of these three alatives Four key tuributes have been determined that will affect mine warfare readiness during the 2030 1 2032 tunerme They are (1) number of vessels available between 2030 und 2032 mois better search rate (in que nautical miles/vessel/day), cruising range (utical miles), and () top speed (knots) Furthermore, the program office has established importance weight for these four attributes for me in the economic analysis. These metrics are displayed in the table below Refurbishment 3 Status Quo 4 Attribute Weight New Acquisition No. of vessels 40% 2 12030-2032) Search rate 30% 50 sumilday/vessel) Cruising range (m) 10% 5000 35 20 4000 2000 20% Top speed (kts) 30 25 20 Perform an economic analysis of these three alternatives, given the information provided. Be sure to include the major steps provided in the class notes, and dont forget to make a commendation. NOTE since no uncertainty information is provided, a sensitivity analysis is not necessary Juge

Find el Replace Dictate Heading 1 1 Normal Strong Subtitle Title I No Space Select Styles Editing Voice 4. Suppose the Navy is considering two minesweeping alternatives to replace an aging fleet of four minesweepers while awaiting a new fleet to be delivered in 2032. Whichever interim alternative is chosen, that alternative will bave to be maintained through 2032 and then it will be scrapped. The alternatives and the status quo are outlined below: Status quo: Four aging minesweeper vessels. Beginning in FY21, the combined annual O&S cost to maintain the four ships is $75M ($18.75M per ship). It is expected that due to further aging and degradation, this O&S cost will increase by SSM ($1.25M per ship) every two years. b. Refurbishment: Three older minesweepers were scheduled for retirement in FY20 but with some improvements, can perform the same functions as the four aging minesweepers, but they will need a substantial refurbishment. This refurbishment can be done on all three ships for a total of $200M. The expected refurbishment cost profile is 563.1M in FY23, S105 SM 1 FY24, and $31.4M in FY25. When the three older ships are brought back online in 2026, after refurbishment, their expected O&S cost will be a total of $1SM per year for all three vessels (SSM per ship). Of course, until that time, the four aging minesweepers will remain active, and the Navy will continue to operate and maintain them. e New Acquisition: The other alternative is to acquire two advanced gap filler minesweepers. The concept design phase for these two vessels is complete. If this alternative is chosen, it will require two more years of R&D (510M in FY21 and SISM in FY22). The two ships can then be procured for $540 IM with the following expected outlay profile FY23 $34 8M FY24 $948M FY25:51283M +funding profile 26-29 moving forward without the capabilities FY26 $127.9M FY27 596.7M FY28 $48.7M I FY29 $8.9M Upon delivery in 2026, the combined smal O&S cost for these two sups is expected to be only S10M per year (SSM per ship). However, until these two ships are delivered the Navy will continue to operate and maintain the four aging minesweepers . . . The Munn Warfare program office has asked for an economic analysis of these three alatives Four key tuributes have been determined that will affect mine warfare readiness during the 2030 1 2032 tunerme They are (1) number of vessels available between 2030 und 2032 mois better search rate (in que nautical miles/vessel/day), cruising range (utical miles), and () top speed (knots) Furthermore, the program office has established importance weight for these four attributes for me in the economic analysis. These metrics are displayed in the table below Refurbishment 3 Status Quo 4 Attribute Weight New Acquisition No. of vessels 40% 2 12030-2032) Search rate 30% 50 sumilday/vessel) Cruising range (m) 10% 5000 35 20 4000 2000 20% Top speed (kts) 30 25 20 Perform an economic analysis of these three alternatives, given the information provided. Be sure to include the major steps provided in the class notes, and dont forget to make a commendation. NOTE since no uncertainty information is provided, a sensitivity analysis is not necessary Juge Find el Replace Dictate Heading 1 1 Normal Strong Subtitle Title I No Space Select Styles Editing Voice 4. Suppose the Navy is considering two minesweeping alternatives to replace an aging fleet of four minesweepers while awaiting a new fleet to be delivered in 2032. Whichever interim alternative is chosen, that alternative will bave to be maintained through 2032 and then it will be scrapped. The alternatives and the status quo are outlined below: Status quo: Four aging minesweeper vessels. Beginning in FY21, the combined annual O&S cost to maintain the four ships is $75M ($18.75M per ship). It is expected that due to further aging and degradation, this O&S cost will increase by SSM ($1.25M per ship) every two years. b. Refurbishment: Three older minesweepers were scheduled for retirement in FY20 but with some improvements, can perform the same functions as the four aging minesweepers, but they will need a substantial refurbishment. This refurbishment can be done on all three ships for a total of $200M. The expected refurbishment cost profile is 563.1M in FY23, S105 SM 1 FY24, and $31.4M in FY25. When the three older ships are brought back online in 2026, after refurbishment, their expected O&S cost will be a total of $1SM per year for all three vessels (SSM per ship). Of course, until that time, the four aging minesweepers will remain active, and the Navy will continue to operate and maintain them. e New Acquisition: The other alternative is to acquire two advanced gap filler minesweepers. The concept design phase for these two vessels is complete. If this alternative is chosen, it will require two more years of R&D (510M in FY21 and SISM in FY22). The two ships can then be procured for $540 IM with the following expected outlay profile FY23 $34 8M FY24 $948M FY25:51283M +funding profile 26-29 moving forward without the capabilities FY26 $127.9M FY27 596.7M FY28 $48.7M I FY29 $8.9M Upon delivery in 2026, the combined smal O&S cost for these two sups is expected to be only S10M per year (SSM per ship). However, until these two ships are delivered the Navy will continue to operate and maintain the four aging minesweepers . . . The Munn Warfare program office has asked for an economic analysis of these three alatives Four key tuributes have been determined that will affect mine warfare readiness during the 2030 1 2032 tunerme They are (1) number of vessels available between 2030 und 2032 mois better search rate (in que nautical miles/vessel/day), cruising range (utical miles), and () top speed (knots) Furthermore, the program office has established importance weight for these four attributes for me in the economic analysis. These metrics are displayed in the table below Refurbishment 3 Status Quo 4 Attribute Weight New Acquisition No. of vessels 40% 2 12030-2032) Search rate 30% 50 sumilday/vessel) Cruising range (m) 10% 5000 35 20 4000 2000 20% Top speed (kts) 30 25 20 Perform an economic analysis of these three alternatives, given the information provided. Be sure to include the major steps provided in the class notes, and dont forget to make a commendation. NOTE since no uncertainty information is provided, a sensitivity analysis is not necessary Juge

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started