Answered step by step

Verified Expert Solution

Question

1 Approved Answer

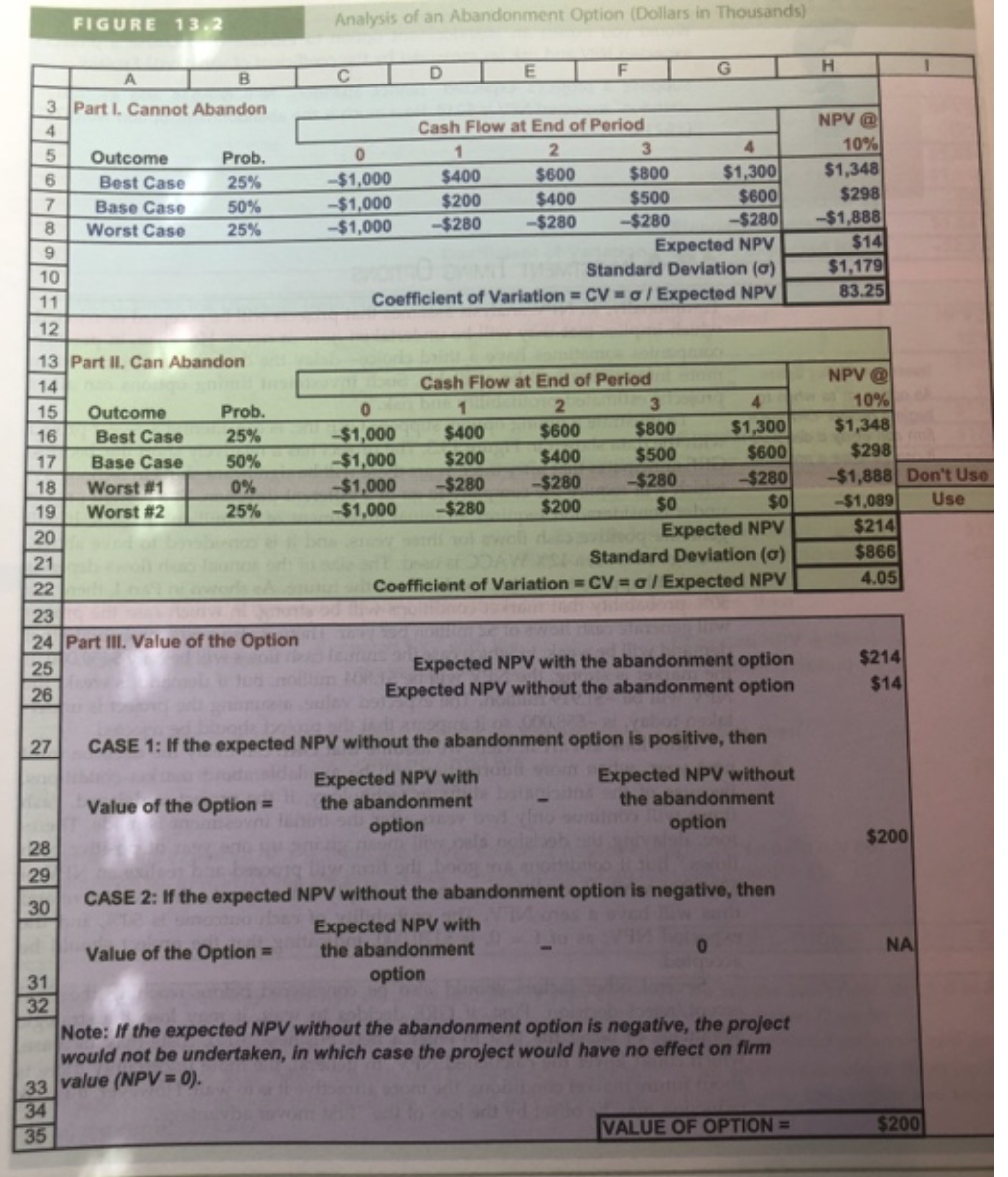

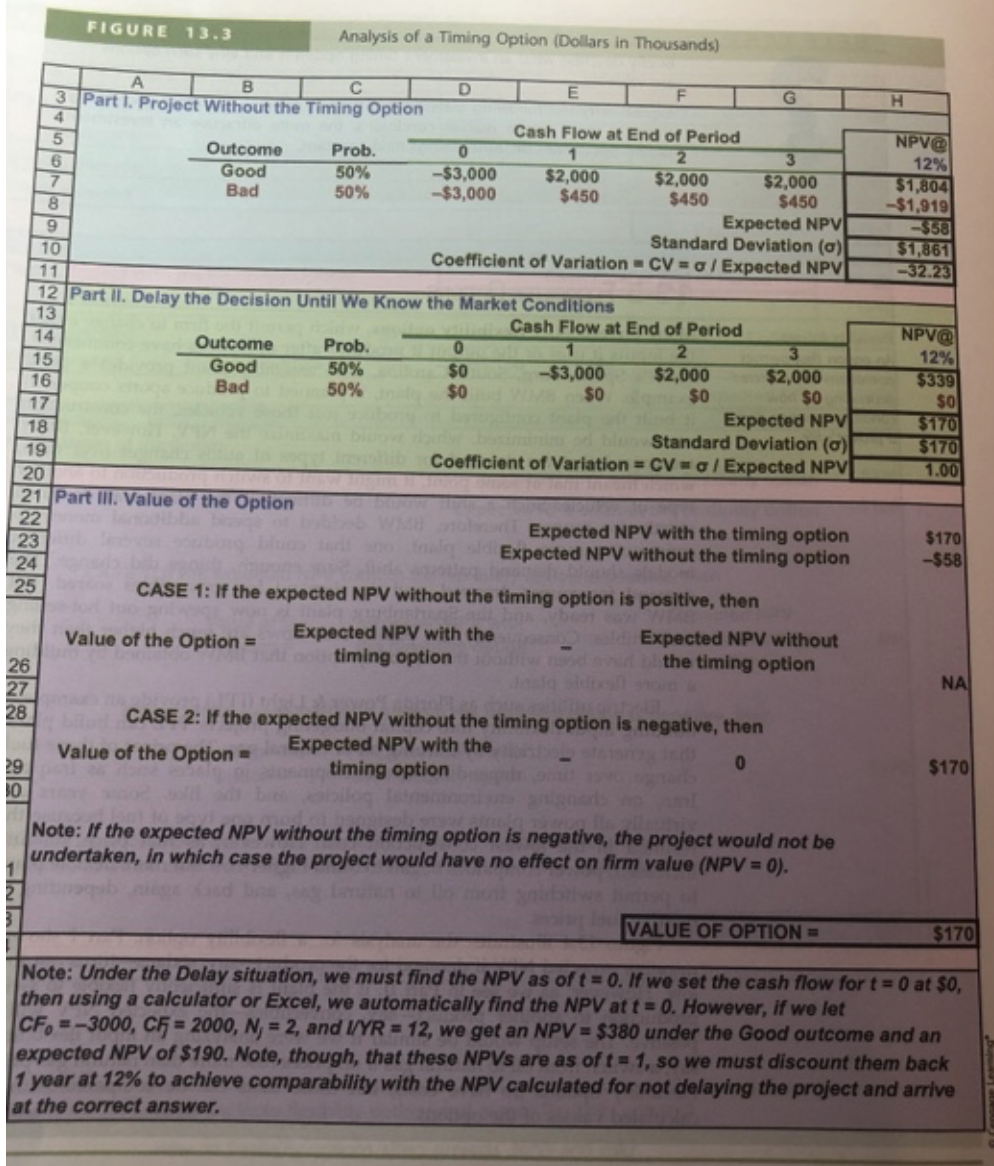

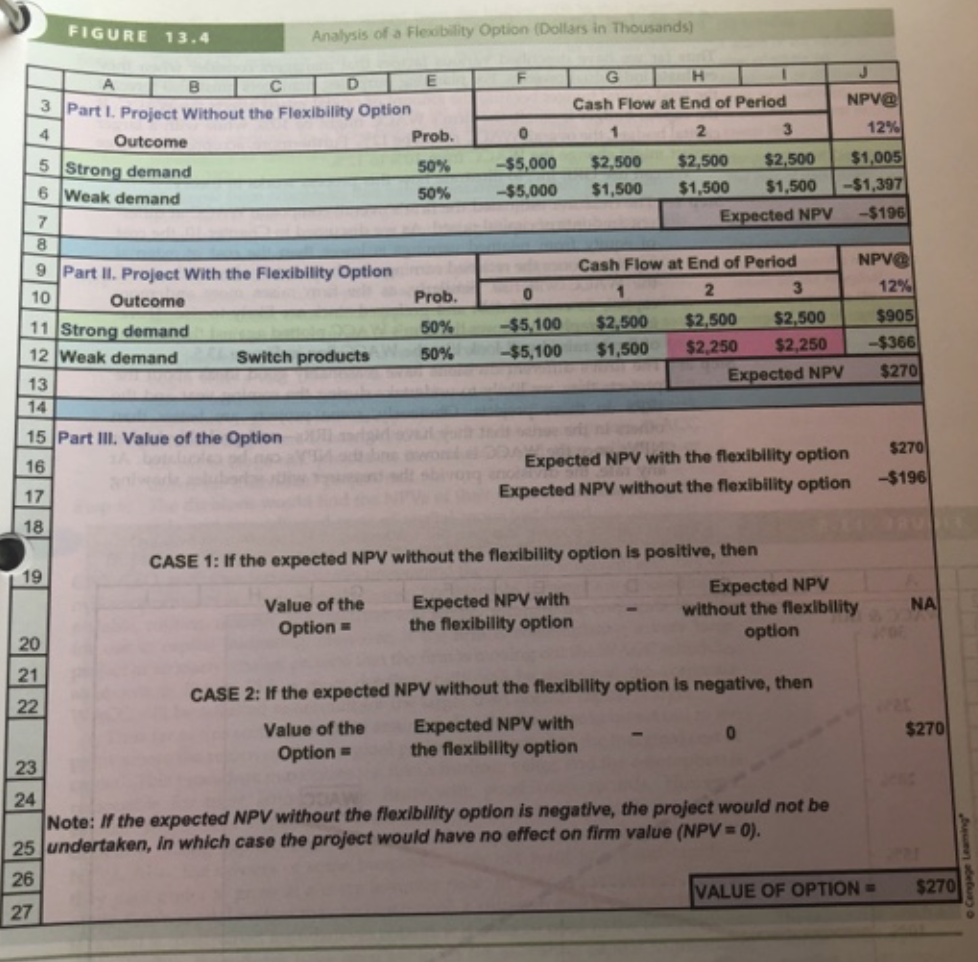

Find : expected NPV , standard deviation , CV, and value of the option for figures 13.2-13.4. (Please put what to input into the calculator.)

Find : expected NPV, standard deviation, CV, and value of the option for figures 13.2-13.4. (Please put what to input into the calculator.)

i just need to know the steps to input into the calculator.

FIGURE 13.2 Analysis of an Abandonment Option (Dollars in Thousands) D E F G A B H 3 Part I. Cannot Abandon 4 5 Outcome Prob. 6 Best Case 25% 7 Base Case 50% 8 Worst Case 25% 9 10 11 12 Cash Flow at End of Period 0 1 2 3 4 -$1,000 $400 $600 $800 $1,300 -$1,000 $200 $400 $500 $600 -$1,000 -$280 -$280 -$280 -$280 Expected NPV Standard Deviation (0) Coefficient of Variation = CV - o/Expected NPV NPV @ 10% $1,348 $298 -$1,888 $141 $1,179 83.25 NPV @ 10% 1 13 Part II. Can Abandon 14 15 Outcome Prob. 16 Best Case 25% 17 Base Case 50% 18 Worst #1 0% 19 Worst #2 25% 20 21 22 23 24 Part III. Value of the Option 25 26 Cash Flow at End of Period 0 2 3 4 $1,000 $400 $600 $800 $1,300 $1,000 $200 $400 $500 $600 $1,000 -$280 -$280 $280 $280 $1,000 $280 $200 $0 $0 Expected NPV Standard Deviation (0) Coefficient of Variation = CV= / Expected NPV $1,348 $298 -$1,888 Don't Use -$1,089 Use $214 $866 4.05 Expected NPV with the abandonment option Expected NPV without the abandonment option $214 $14 $200 27 CASE 1: If the expected NPV without the abandonment option is positive, then Expected NPV with Expected NPV without Value of the Option = the abandonment the abandonment option option 28 29 30 CASE 2: If the expected NPV without the abandonment option is negative, then Expected NPV with Value of the Option = the abandonment 0 31 option 32 Note: If the expected NPV without the abandonment option is negative, the project would not be undertaken, in which case the project would have no effect on firm 33 value (NPV = 0). 34 35 VALUE OF OPTION = NA $200 FIGURE 13.3 Analysis of a Timing Option (Dollars in Thousands) H NPV 12% $1,804 -$1,919 -$58 $1,861 32.23 1 NPV@ 12% $339 SO A B D E 3 G Part I. Project Without the timing Option 4 Cash Flow at End of Period 5 Outcome Prob. 0 1 2 6 Good 50% -$3,000 $2,000 7 $2,000 $2,000 Bad 50% -$3,000 $450 $450 $450 8 Expected NPV 9 Standard Deviation (a) 10 Coefficient of Variation - CV= / Expected NPV 11 12 Part II. Delay the Decision Until We Know the Market Conditions 13 Cash Flow at End of Period 14 Outcome Prob. 0 2 3 15 Good 50% $0 -$3,000 $2,000 $2,000 16 Bad 50% $0 $0 $0 SO 17 Expected NPV 18 Standard Deviation (0) 19 Coefficient of Variation = CVO / Expected NPV 20 21 Part III. Value of the Option 22 Expected NPV with the timing option 23 Expected NPV without the timing option 24 25 CASE 1: If the expected NPV without the timing option is positive, then Value of the Option = Expected NPV with the Expected NPV without timing option the timing option 26 27 28 CASE 2: If the expected NPV without the timing option is negative, then Value of the Option = Expected NPV with the 0 29 timing option 10 $170 $170 1.00 $170 -$58 $170 Note: If the expected NPV without the timing option is negative, the project would not be undertaken, in which case the project would have no effect on firm value (NPV = 0). VALUE OF OPTION = $170 Note: Under the Delay situation, we must find the NPV as of t = 0. If we set the cash flow for t = 0 at $0, then using a calculator or Excel, we automatically find the NPV at t = 0. However, if we let CF, = -3000, CF = 2000, N; = 2, and I/YR = 12, we get an NPV = $380 under the Good outcome and an expected NPV of $190. Note, though, that these NPVs are as of t= 1, so we must discount them back 1 year at 12% to achieve comparability with the NPV calculated for not delaying the project and arrive at the correct answer. FIGURE 13.4 Analysis of a Flexibility Option (Dollars in Thousands) A F G H Cash Flow at End of Period NPV@ 12% 0 1 2 3 -$5,000 -$5,000 $2,500 $1,500 $2,500 $2,500 $1,500 $1,500 Expected NPV $1,005 -$1,397 -$196 E D 3 Part I. Project Without the Flexibility Option 4 Outcome Prob. 5 Strong demand 50% 6 Weak demand 50% 7 8 9 Part II. Project with the Flexibility Option 10 Outcome Prob. 11 Strong demand 50% 12 Weak demand Switch products 13 14 15 Part III. Value of the Option 16 17 NPV 12% 0 -$5,100 -$5,100 Cash Flow at End of Period 1 2 3 $2,500 $2,500 $2,500 $1,500 $2,250 $2,250 Expected NPV 50% $905 -$366 $270 Expected NPV with the flexibility option Expected NPV without the flexibility option $270 $196 18 19 CASE 1: If the expected NPV without the flexibility option is positive, then Value of the Expected NPV with Expected NPV without the flexibility Option = the flexibility option option 20 21 22 CASE 2: If the expected NPV without the flexibility option is negative, then Value of the Expected NPV with Option the flexibility option 0 $270 23 24 Note: If the expected NPV without the flexibility option is negative, the project would not be 25 undertaken, in which case the project would have no effect on firm value (NPV = 0). 26 27 VALUE OF OPTION= $270 FIGURE 13.2 Analysis of an Abandonment Option (Dollars in Thousands) D E F G A B H 3 Part I. Cannot Abandon 4 5 Outcome Prob. 6 Best Case 25% 7 Base Case 50% 8 Worst Case 25% 9 10 11 12 Cash Flow at End of Period 0 1 2 3 4 -$1,000 $400 $600 $800 $1,300 -$1,000 $200 $400 $500 $600 -$1,000 -$280 -$280 -$280 -$280 Expected NPV Standard Deviation (0) Coefficient of Variation = CV - o/Expected NPV NPV @ 10% $1,348 $298 -$1,888 $141 $1,179 83.25 NPV @ 10% 1 13 Part II. Can Abandon 14 15 Outcome Prob. 16 Best Case 25% 17 Base Case 50% 18 Worst #1 0% 19 Worst #2 25% 20 21 22 23 24 Part III. Value of the Option 25 26 Cash Flow at End of Period 0 2 3 4 $1,000 $400 $600 $800 $1,300 $1,000 $200 $400 $500 $600 $1,000 -$280 -$280 $280 $280 $1,000 $280 $200 $0 $0 Expected NPV Standard Deviation (0) Coefficient of Variation = CV= / Expected NPV $1,348 $298 -$1,888 Don't Use -$1,089 Use $214 $866 4.05 Expected NPV with the abandonment option Expected NPV without the abandonment option $214 $14 $200 27 CASE 1: If the expected NPV without the abandonment option is positive, then Expected NPV with Expected NPV without Value of the Option = the abandonment the abandonment option option 28 29 30 CASE 2: If the expected NPV without the abandonment option is negative, then Expected NPV with Value of the Option = the abandonment 0 31 option 32 Note: If the expected NPV without the abandonment option is negative, the project would not be undertaken, in which case the project would have no effect on firm 33 value (NPV = 0). 34 35 VALUE OF OPTION = NA $200 FIGURE 13.3 Analysis of a Timing Option (Dollars in Thousands) H NPV 12% $1,804 -$1,919 -$58 $1,861 32.23 1 NPV@ 12% $339 SO A B D E 3 G Part I. Project Without the timing Option 4 Cash Flow at End of Period 5 Outcome Prob. 0 1 2 6 Good 50% -$3,000 $2,000 7 $2,000 $2,000 Bad 50% -$3,000 $450 $450 $450 8 Expected NPV 9 Standard Deviation (a) 10 Coefficient of Variation - CV= / Expected NPV 11 12 Part II. Delay the Decision Until We Know the Market Conditions 13 Cash Flow at End of Period 14 Outcome Prob. 0 2 3 15 Good 50% $0 -$3,000 $2,000 $2,000 16 Bad 50% $0 $0 $0 SO 17 Expected NPV 18 Standard Deviation (0) 19 Coefficient of Variation = CVO / Expected NPV 20 21 Part III. Value of the Option 22 Expected NPV with the timing option 23 Expected NPV without the timing option 24 25 CASE 1: If the expected NPV without the timing option is positive, then Value of the Option = Expected NPV with the Expected NPV without timing option the timing option 26 27 28 CASE 2: If the expected NPV without the timing option is negative, then Value of the Option = Expected NPV with the 0 29 timing option 10 $170 $170 1.00 $170 -$58 $170 Note: If the expected NPV without the timing option is negative, the project would not be undertaken, in which case the project would have no effect on firm value (NPV = 0). VALUE OF OPTION = $170 Note: Under the Delay situation, we must find the NPV as of t = 0. If we set the cash flow for t = 0 at $0, then using a calculator or Excel, we automatically find the NPV at t = 0. However, if we let CF, = -3000, CF = 2000, N; = 2, and I/YR = 12, we get an NPV = $380 under the Good outcome and an expected NPV of $190. Note, though, that these NPVs are as of t= 1, so we must discount them back 1 year at 12% to achieve comparability with the NPV calculated for not delaying the project and arrive at the correct answer. FIGURE 13.4 Analysis of a Flexibility Option (Dollars in Thousands) A F G H Cash Flow at End of Period NPV@ 12% 0 1 2 3 -$5,000 -$5,000 $2,500 $1,500 $2,500 $2,500 $1,500 $1,500 Expected NPV $1,005 -$1,397 -$196 E D 3 Part I. Project Without the Flexibility Option 4 Outcome Prob. 5 Strong demand 50% 6 Weak demand 50% 7 8 9 Part II. Project with the Flexibility Option 10 Outcome Prob. 11 Strong demand 50% 12 Weak demand Switch products 13 14 15 Part III. Value of the Option 16 17 NPV 12% 0 -$5,100 -$5,100 Cash Flow at End of Period 1 2 3 $2,500 $2,500 $2,500 $1,500 $2,250 $2,250 Expected NPV 50% $905 -$366 $270 Expected NPV with the flexibility option Expected NPV without the flexibility option $270 $196 18 19 CASE 1: If the expected NPV without the flexibility option is positive, then Value of the Expected NPV with Expected NPV without the flexibility Option = the flexibility option option 20 21 22 CASE 2: If the expected NPV without the flexibility option is negative, then Value of the Expected NPV with Option the flexibility option 0 $270 23 24 Note: If the expected NPV without the flexibility option is negative, the project would not be 25 undertaken, in which case the project would have no effect on firm value (NPV = 0). 26 27 VALUE OF OPTION= $270 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started