Answered step by step

Verified Expert Solution

Question

1 Approved Answer

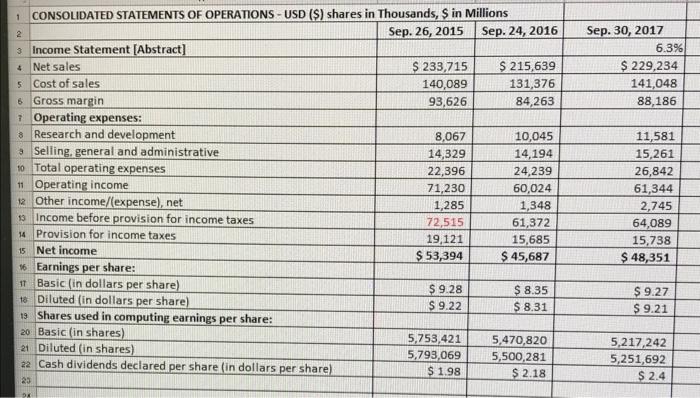

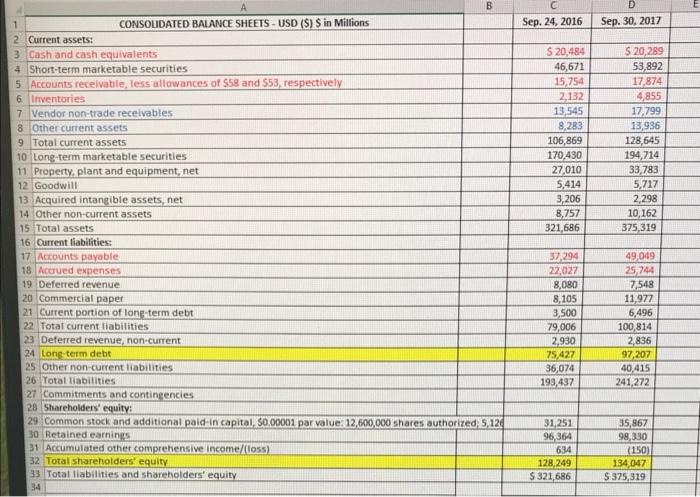

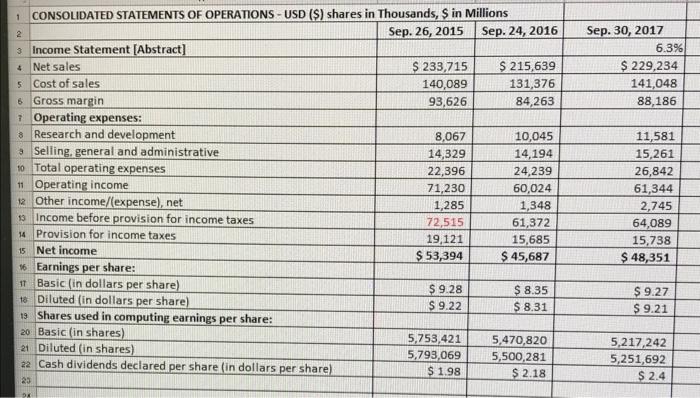

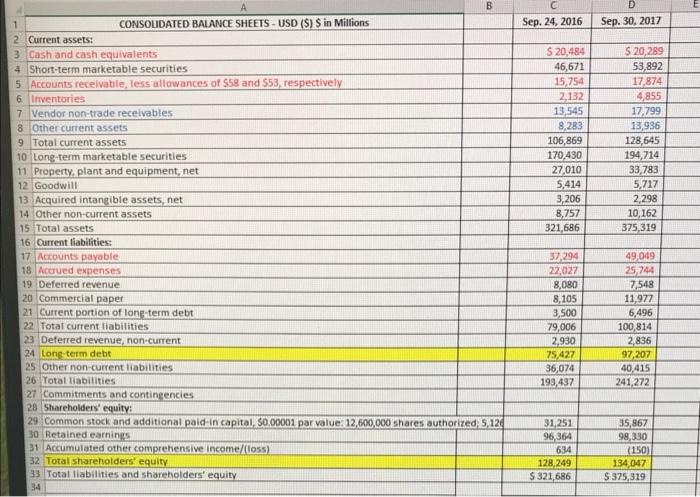

Find Fixed Assets Turn Over of 2016 and 2017 using data below 1 2 4 Sep. 30, 2017 6.3% $ 229,234 141,048 88,186 CONSOLIDATED STATEMENTS

Find Fixed Assets Turn Over of 2016 and 2017 using data below

1 2 4 Sep. 30, 2017 6.3% $ 229,234 141,048 88,186 CONSOLIDATED STATEMENTS OF OPERATIONS- USD ($) shares in Thousands, S in Millions Sep. 26, 2015 Sep. 24, 2016 Income Statement [Abstract] Net sales $ 233,715 $ 215,639 5 Cost of sales 140,089 131,376 6 Gross margin 93,626 84,263 + Operating expenses: 8 Research and development 8,067 10,045 Selling, general and administrative 14,329 14,194 10 Total operating expenses 22,396 24,239 + Operating income 71,230 60,024 12 Other income/expense), net 1,285 1,348 13 Income before provision for income taxes 72,515 61,372 14 Provision for income taxes 19,121 15,685 15 Net income $ 53,394 $ 45,687 16 Earnings per share: 11 Basic in dollars per share) $ 9.28 $ 8.35 18 Diluted (in dollars per share) S 9.22 $ 8.31 19 Shares used in computing earnings per share: 20 Basic (in shares) 5,753,421 5,470,820 21 Diluted in shares) 5,793,069 5,500,281 22 Cash dividends declared per share in dollars per share) $ 1.98 $ 2.18 11,581 15,261 26,842 61,344 2,745 64,089 15,738 $ 48,351 $ 9.27 $ 9.21 5,217,242 5,251,692 $ 2.4 23 B C Sep. 24, 2016 Sep. 30, 2017 S 20,484 46,671 15,754 2,132 13,545 8,283 106,869 170,430 27,010 5,414 3,206 8,757 321,686 $ 20,289 53,892 17,874 4,855 17,799 13,936 128,645 194,714 33,783 5,717 2,298 10,162 375,319 1 CONSOLIDATED BALANCE SHEETS - USD (S) Sin Millions 2 Current assets: 3 Cash and cash equivalents 4 Short-term marketable securities 5 Accounts receivable, less allowances of $58 and $53, respectively 6 Inventories 7 Vendor non-trade receivables 8 Other current assets 9 Total current assets 10 Long-term marketable securities 11 Property, plant and equipment, net 12 Goodwill 13 Acquired intangible assets, net 14 Other non-current assets 15 Total assets 16 Current liabilities: 17 Accounts payable 18 Accrued expenses 19 Deferred revenue 20 Commercial paper 21 Current portion of long-term debt 22 Total current liabilities 23 Deferred revenue, non-current 24 Long term debt 25 Other non-current liabilities 26 Total liabilities 27 Commitments and contingencies 28 Shareholders' equity 29 Common stock and additional paid in capital $0.00001 par value: 12,600,000 shares authorized: 5,124 30 Retained earnings 31 Accumulated other comprehensive income/(toss) 32 Total Shareholders' equity 33 Total liabilities and shareholders equity 34 37,294 22,027 8,080 8,105 3,500 79,006 2,930 75,427 36,074 193,437 49,049 25,744 7,548 11,977 6,496 100,814 2,836 97,207 40,415 241,272 31,251 96,364 634 128,249 S 321,686 35,867 98,330 (150) 134,047 S 375,319

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started