Question

Find Footnote 15 on Pensions from Coke's Annual Report. Answer the following questions. 1. What is the discount rate that Coke uses to calculate interest

Find Footnote 15 on Pensions from Coke's Annual Report. Answer the following questions.

1. What is the discount rate that Coke uses to calculate interest on its PBO?

2. How much was the actuarial loss or gain (which one) on the PBO, and what was its primary cause?

3. By how much was the actual $ROA higher or lower that the $EROA, and which one?

4. Assume that the EROA% was 1% higher than it actually is (i.e., if the actual rate is 5%,assume that it is 6%). What would be the end of year AOCI balance?

5. Assuming that the firm does not use the corridor, what is the average remaining service life over which AOCI- Actuarial account is being amortized (consider both actuarial and prior service as one account)?

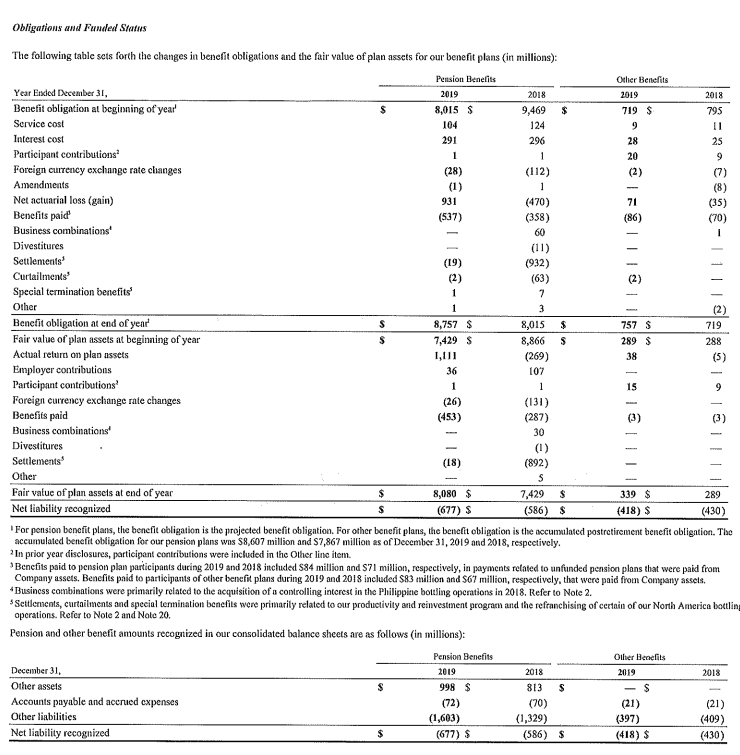

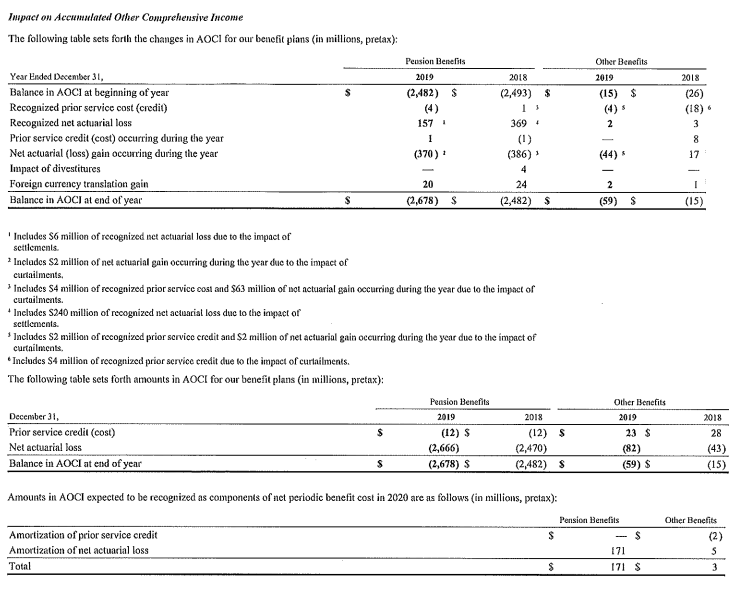

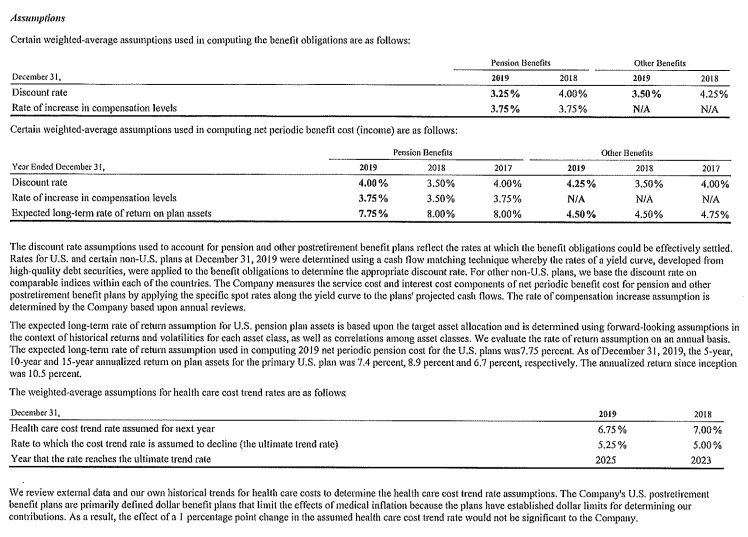

Obligations and Funded Status The following table sets forth the changes in benefit obligations and the fair value of plan assets for our benefit plans (in millions): Year Ended December 31, Benefit obligation at beginning of year' $ Pension Benefits 2019 8,015 $ 2018 9,469 $ Service cost 104 124 Participant contributions' Interest cost Foreign currency exchange rate changes Amendments Net actuarial loss (gain) Benefits paid' Business combinations' Divestitures Settlements 291 296 1 1 (28) (112) (1) 1 931 (470) (537) (358) 60 Benefits paid Business combinations' Divestitures Settlements' (932) Curtailments (2) (63) Special termination benefits' Other 1 7 1 3 Benefit obligation at end of year' S 8,757 $ 8,015 $ Fair value of plan assets at beginning of year 7,429 S 8,866 $ Actual return on plan assets 1,111 (269) Employer contributions Participant contributions' 36 107 1 1 Foreign currency exchange rate changes (26) (131) (453) (287) Other Fair value of plan assets at end of year Net liability recognized (18) - - 30 (1) (892) S $ $ 8,080 $ (677) $ 7,429 $ (586) $ 339 $ 289 (418) $ (430) (3) | | |S| | || | | | Other Benefits 2018 719 $ 795 (86) (2) 757 $ 719 289 $ 288 = Cg - | | | |g g@ | (7) (8) (35) (70) For pension benefit plans, the benefit obligation is the projected benefit obligation. For other benefit plans, the benefit obligation is the accumulated postretirement benefit obligation. The accumulated benefit obligation for our pension plans was $8,607 million and $7,867 million as of December 31, 2019 and 2018, respectively. 2 In prior year disclosures, participant contributions were included in the Other line item. Benefits paid to pension plan participants during 2019 and 2018 included $84 million and $71 million, respectively, in payments related to unfunded pension plans that were paid from Company assets. Benefits paid to participants of other benefit plans during 2019 and 2018 included $83 million and $67 million, respectively, that were paid from Company assets. *Business combinations were primarily related to the acquisition of a controlling interest in the Philippine bottling operations in 2018. Refer to Note 2. Settlements, curtailments and special termination benefits were primarily related to our productivity and reinvestment program and the refranchising of certain of our North America bottling operations. Refer to Note 2 and Note 20. Pension and other benefit amounts recognized in our consolidated balance sheets are as follows (in millions): December 31, Other assets Accounts payable and accrued expenses Other liabilities Net liability recognized Pension Benefits 2019 2018 Other Benefits 2019 2018 $ 998 $ 813 $ - $ - (72) (70) (21) (21) (1,603) (1,329) (397) (409) $ (677) $ (586) $ (418) $ (430)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started