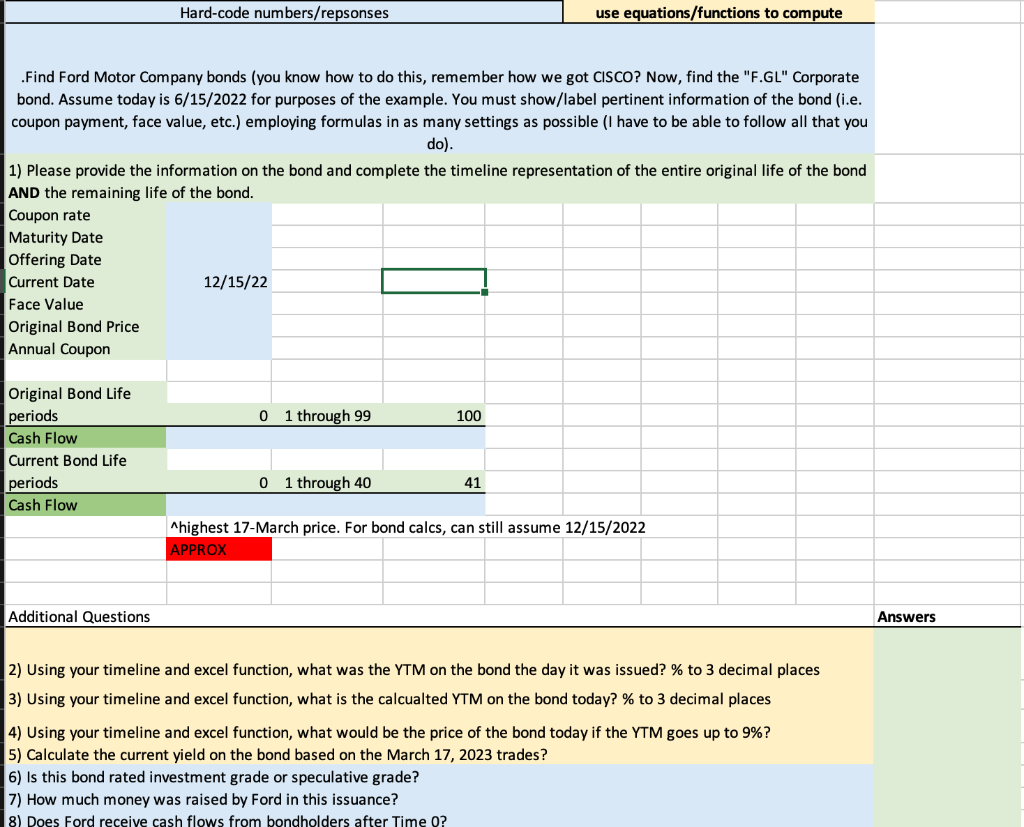

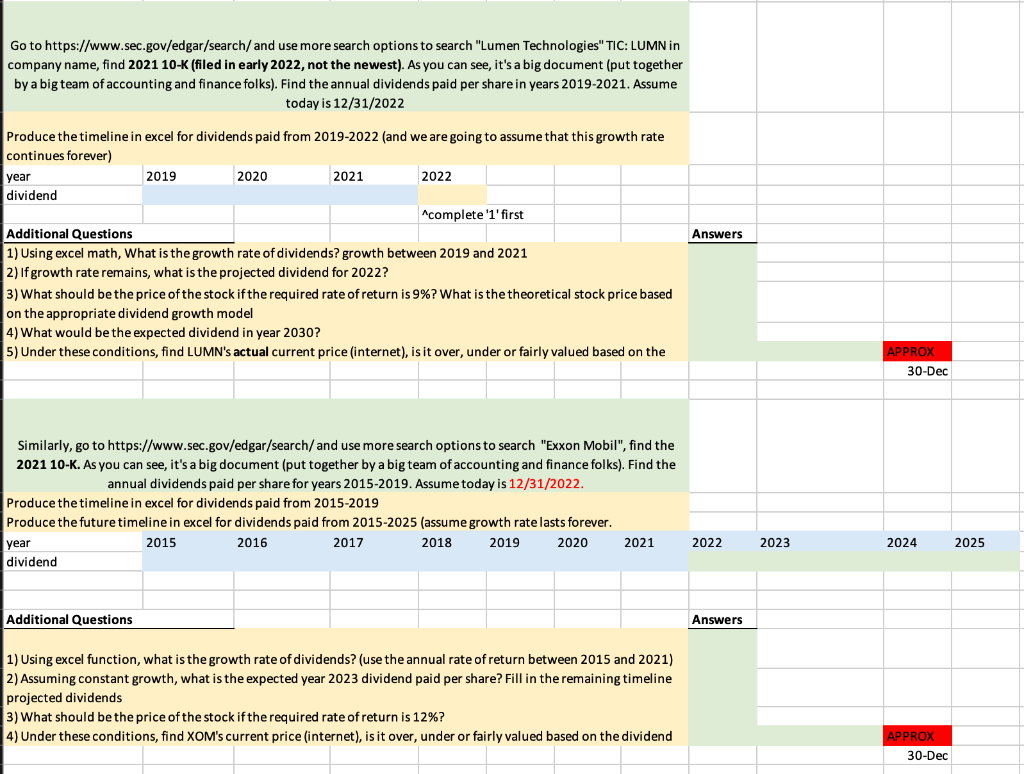

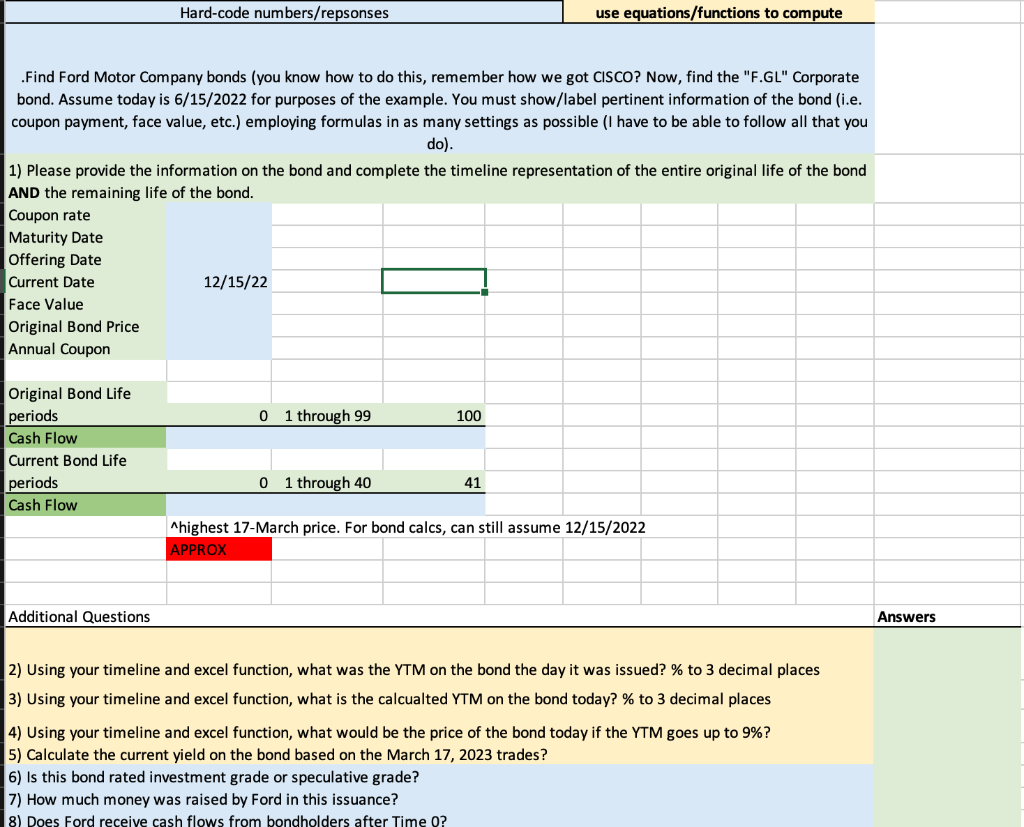

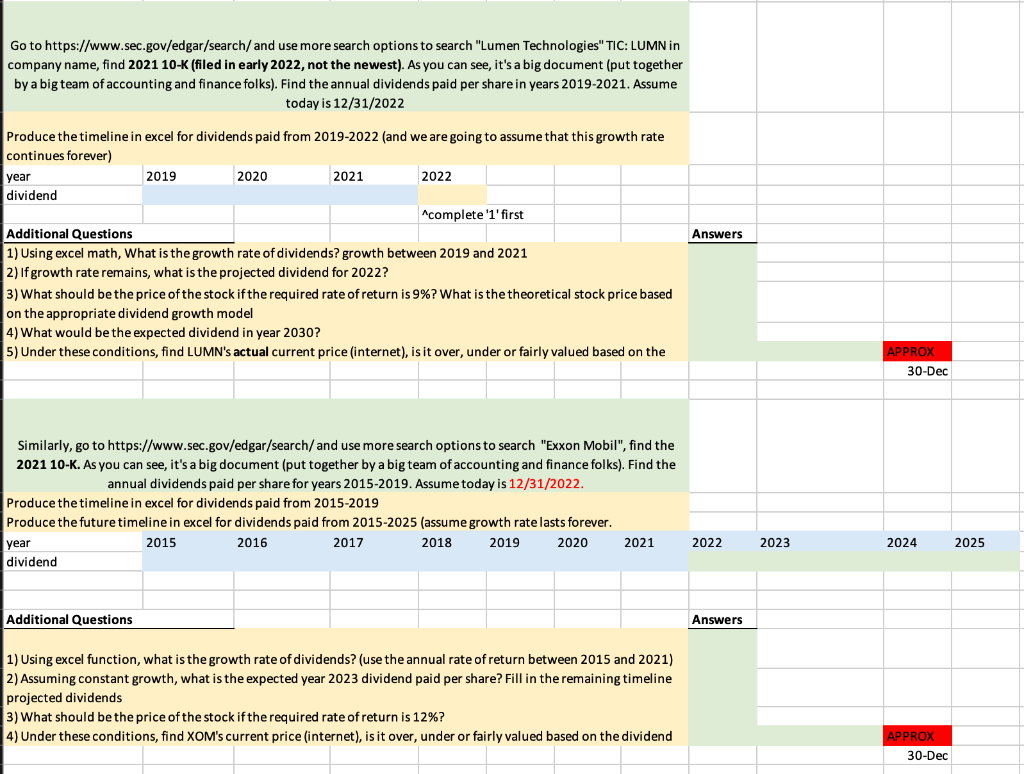

.Find Ford Motor Company bonds (you know how to do this, remember how we got CISCO? Now, find the "F.GL" Corporate bond. Assume today is 6/15/2022 for purposes of the example. You must show/label pertinent information of the bond (i.e. coupon payment, face value, etc.) employing formulas in as many settings as possible (I have to be able to follow all that you 3) Using your timeline and excel function, what is the calcualted YTM on the bond today? \% to 3 decimal places 4) Using your timeline and excel function, what would be the price of the bond today if the YTM goes up to 9% ? 5) Calculate the current yield on the bond based on the March 17, 2023 trades? 6) Is this bond rated investment grade or speculative grade? 7) How much money was raised by Ford in this issuance? Go to https://www.sec.gov/edgar/search/ and use more search options to search "Lumen Technologies" TIC: LUMN in company name, find 2021 10-K (filed in early 2022, not the newest). As you can see, it's a big document (put together by a big team of accounting and finance folks). Find the annual dividends paid per share in years 2019-2021. Assume today is 12/31/2022 Produce the timeline in excel for dividends paid from 2019-2022 (and we are going to assume that this growth rate continues forever) \begin{tabular}{l|l|l|l|l} year & 2019 & 2020 & 2021 & 2022 \end{tabular} dividend ^complete '1' first Additional Questions Answers 1) Using excel math, What is the growth rate of dividends? growth between 2019 and 2021 2) If growth rate remains, what is the projected dividend for 2022 ? 3) What should be the price of the stock if the required rate of return is 9% ? What is the theoretical stock price based on the appropriate dividend growth model 4) What would be the expected dividend in year 2030 ? 5) Under these conditions, find LUMN's actual current price (internet), is it over, under or fairly valued based on the Similarly, go to https://www.sec.gov/edgar/search/ and use more search options to search "Exxon Mobil", find the 2021 10-K. As you can see, it's a big document (put together by a big team of accounting and finance folks). Find the annual dividends paid per share for years 2015-2019. Assume today is 12/31/2022. Produce the timeline in excel for dividends paid from 2015-2019 Produce the future timeline in excel for dividends paid from 2015-2025 (assume growth rate lasts forever. dividend Additional Questions Answers 1) Using excel function, what is the growth rate of dividends? (use the annual rate of return between 2015 and 2021) 2) Assuming constant growth, what is the expected year 2023 dividend paid per share? Fill in the remaining timeline projected dividends 3) What should be the price of the stock if the required rate of return is 12% ? 4) Under these conditions, find XOM's current price (internet), is it over, under or fairly valued based on the dividend APPROX 30-Dec .Find Ford Motor Company bonds (you know how to do this, remember how we got CISCO? Now, find the "F.GL" Corporate bond. Assume today is 6/15/2022 for purposes of the example. You must show/label pertinent information of the bond (i.e. coupon payment, face value, etc.) employing formulas in as many settings as possible (I have to be able to follow all that you 3) Using your timeline and excel function, what is the calcualted YTM on the bond today? \% to 3 decimal places 4) Using your timeline and excel function, what would be the price of the bond today if the YTM goes up to 9% ? 5) Calculate the current yield on the bond based on the March 17, 2023 trades? 6) Is this bond rated investment grade or speculative grade? 7) How much money was raised by Ford in this issuance? Go to https://www.sec.gov/edgar/search/ and use more search options to search "Lumen Technologies" TIC: LUMN in company name, find 2021 10-K (filed in early 2022, not the newest). As you can see, it's a big document (put together by a big team of accounting and finance folks). Find the annual dividends paid per share in years 2019-2021. Assume today is 12/31/2022 Produce the timeline in excel for dividends paid from 2019-2022 (and we are going to assume that this growth rate continues forever) \begin{tabular}{l|l|l|l|l} year & 2019 & 2020 & 2021 & 2022 \end{tabular} dividend ^complete '1' first Additional Questions Answers 1) Using excel math, What is the growth rate of dividends? growth between 2019 and 2021 2) If growth rate remains, what is the projected dividend for 2022 ? 3) What should be the price of the stock if the required rate of return is 9% ? What is the theoretical stock price based on the appropriate dividend growth model 4) What would be the expected dividend in year 2030 ? 5) Under these conditions, find LUMN's actual current price (internet), is it over, under or fairly valued based on the Similarly, go to https://www.sec.gov/edgar/search/ and use more search options to search "Exxon Mobil", find the 2021 10-K. As you can see, it's a big document (put together by a big team of accounting and finance folks). Find the annual dividends paid per share for years 2015-2019. Assume today is 12/31/2022. Produce the timeline in excel for dividends paid from 2015-2019 Produce the future timeline in excel for dividends paid from 2015-2025 (assume growth rate lasts forever. dividend Additional Questions Answers 1) Using excel function, what is the growth rate of dividends? (use the annual rate of return between 2015 and 2021) 2) Assuming constant growth, what is the expected year 2023 dividend paid per share? Fill in the remaining timeline projected dividends 3) What should be the price of the stock if the required rate of return is 12% ? 4) Under these conditions, find XOM's current price (internet), is it over, under or fairly valued based on the dividend APPROX 30-Dec