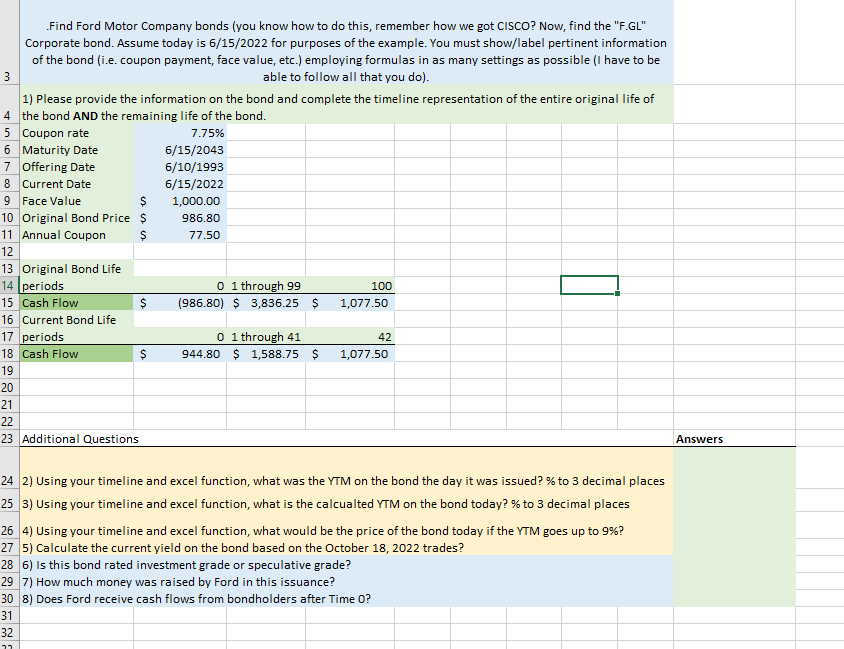

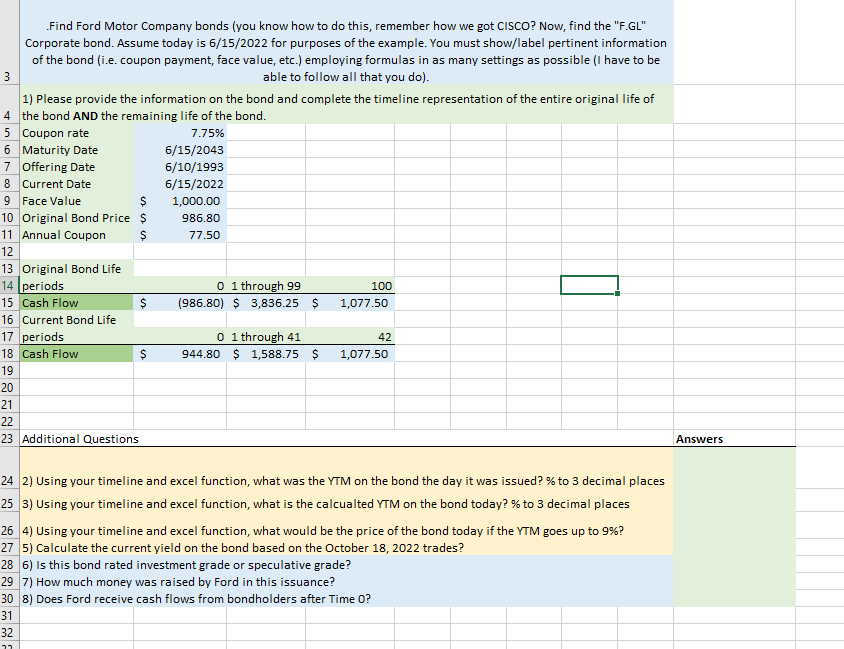

.Find Ford Motor Company bonds (you know how to do this, remember how we got CISCO? Now, find the "F.GL" Corporate bond. Assume today is 6/15/2022 for purposes of the example. You must show/label pertinent information of the bond (i.e. coupon payment, face value, etc.) employing formulas in as many settings as possible (I have to be able to follow all that you do). 1) Please provide the information on the bond and complete the timeline representation of the entire original life of the bond AND the remaining life of the bond. \begin{tabular}{c|l} 5 & Coupon rate \\ 6 & Maturity Date \\ 7 & Offering Date \\ 8 & Current Date \\ 9 & Face Value \\ 10 & Original Bond Price \\ 11 & Annual Coupon \\ 12 & \\ 13 & Original Bond Life \\ 14 & periods \\ \hline 15 & Cash Flow \\ 16 & Current Bond Life \\ 17 & periods \\ \hline 18 & Cash Flow \\ 19 & \\ \hline 20 & \\ \hline 21 & \\ \hline 22 & \\ \hline 23 & Additional Questions \\ \hline \end{tabular} Answers 24 2) Using your timeline and excel function, what was the YTM on the bond the day it was issued? \% to 3 decimal places 25 3) Using your timeline and excel function, what is the calcualted YM on the bond today? \% to 3 decimal places 26 4) Using your timeline and excel function, what would be the price of the bond today if the YTM goes up to 9% ? 27 5) Calculate the current yield on the bond based on the October 18,2022 trades? 28 6) Is this bond rated investment grade or speculative grade? 29 7) How much money was raised by Ford in this issuance? 30 8) Does Ford receive cash flows from bondholders after Time 0 ? .Find Ford Motor Company bonds (you know how to do this, remember how we got CISCO? Now, find the "F.GL" Corporate bond. Assume today is 6/15/2022 for purposes of the example. You must show/label pertinent information of the bond (i.e. coupon payment, face value, etc.) employing formulas in as many settings as possible (I have to be able to follow all that you do). 1) Please provide the information on the bond and complete the timeline representation of the entire original life of the bond AND the remaining life of the bond. \begin{tabular}{c|l} 5 & Coupon rate \\ 6 & Maturity Date \\ 7 & Offering Date \\ 8 & Current Date \\ 9 & Face Value \\ 10 & Original Bond Price \\ 11 & Annual Coupon \\ 12 & \\ 13 & Original Bond Life \\ 14 & periods \\ \hline 15 & Cash Flow \\ 16 & Current Bond Life \\ 17 & periods \\ \hline 18 & Cash Flow \\ 19 & \\ \hline 20 & \\ \hline 21 & \\ \hline 22 & \\ \hline 23 & Additional Questions \\ \hline \end{tabular} Answers 24 2) Using your timeline and excel function, what was the YTM on the bond the day it was issued? \% to 3 decimal places 25 3) Using your timeline and excel function, what is the calcualted YM on the bond today? \% to 3 decimal places 26 4) Using your timeline and excel function, what would be the price of the bond today if the YTM goes up to 9% ? 27 5) Calculate the current yield on the bond based on the October 18,2022 trades? 28 6) Is this bond rated investment grade or speculative grade? 29 7) How much money was raised by Ford in this issuance? 30 8) Does Ford receive cash flows from bondholders after Time 0