Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Find Marisols 2019 AGI, taxable income, and income tax liability. Marisol (age 60, single, no dependents, cash basis, calendar year taxpayer) works for Viva Corporation.

Find Marisols 2019 AGI, taxable income, and income tax liability.

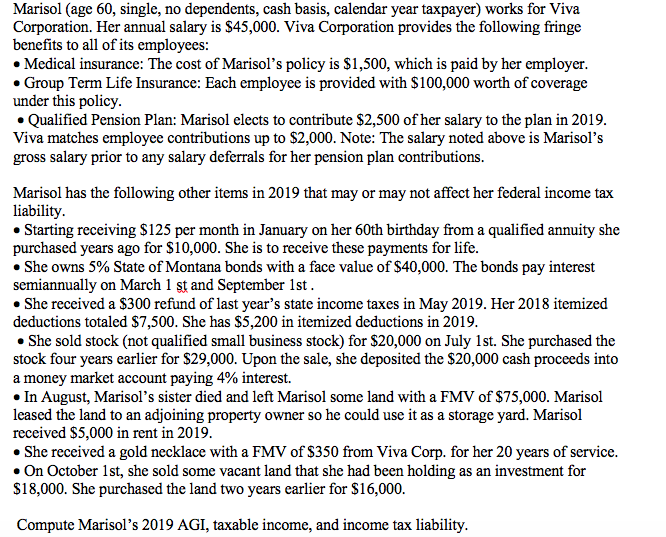

Marisol (age 60, single, no dependents, cash basis, calendar year taxpayer) works for Viva Corporation. Her annual salary is $45,000. Viva Corporation provides the following fringe benefits to all of its employees: Medical insurance: The cost of Marisol's policy is $1,500, which is paid by her employer. Group Term Life Insurance: Each employee is provided with $100,000 worth of coverage under this policy Qualified Pension Plan: Marisol elects to contribute $2,500 of her salary to the plan in 2019. Viva matches employee contributions up to $2,000. Note: The salary noted above is Marisol's gross salary prior to any salary deferrals for her pension plan contributions. Marisol has the following other items in 2019 that may or may not affect her federal income tax liability. . Starting receiving $125 per month in January on her 60th birthday from a qualified annuity she purchased years ago for $10,000. She is to receive these payments for life. She owns 5% State of Montana bonds with a face value of $40,000. The bonds pay interest semiannually on March 1 st and September 1st. She received a $300 refund of last year's state income taxes in May 2019. Her 2018 itemized deductions totaled $7,500. She has $5,200 in itemized deductions in 2019. She sold stock (not qualified small business stock) for $20,000 on July 1st. She purchased the stock four years earlier for $29,000. Upon the sale, she deposited the $20,000 cash proceeds into a money market account paying 4% interest. In August, Marisol's sister died and left Marisol some land with a FMV of $75,000. Marisol leased the land to an adjoining property owner so he could use it as a storage yard. Marisol received $5,000 in rent in 2019. She received a gold necklace with a FMV of $350 from Viva Corp. for her 20 years of service. On October 1st, she sold some vacant land that she had been holding as an investment for $18,000. She purchased the land two years earlier for $16,000. Compute Marisol's 2019 AGI, taxable income, and income tax liability. Marisol (age 60, single, no dependents, cash basis, calendar year taxpayer) works for Viva Corporation. Her annual salary is $45,000. Viva Corporation provides the following fringe benefits to all of its employees: Medical insurance: The cost of Marisol's policy is $1,500, which is paid by her employer. Group Term Life Insurance: Each employee is provided with $100,000 worth of coverage under this policy Qualified Pension Plan: Marisol elects to contribute $2,500 of her salary to the plan in 2019. Viva matches employee contributions up to $2,000. Note: The salary noted above is Marisol's gross salary prior to any salary deferrals for her pension plan contributions. Marisol has the following other items in 2019 that may or may not affect her federal income tax liability. . Starting receiving $125 per month in January on her 60th birthday from a qualified annuity she purchased years ago for $10,000. She is to receive these payments for life. She owns 5% State of Montana bonds with a face value of $40,000. The bonds pay interest semiannually on March 1 st and September 1st. She received a $300 refund of last year's state income taxes in May 2019. Her 2018 itemized deductions totaled $7,500. She has $5,200 in itemized deductions in 2019. She sold stock (not qualified small business stock) for $20,000 on July 1st. She purchased the stock four years earlier for $29,000. Upon the sale, she deposited the $20,000 cash proceeds into a money market account paying 4% interest. In August, Marisol's sister died and left Marisol some land with a FMV of $75,000. Marisol leased the land to an adjoining property owner so he could use it as a storage yard. Marisol received $5,000 in rent in 2019. She received a gold necklace with a FMV of $350 from Viva Corp. for her 20 years of service. On October 1st, she sold some vacant land that she had been holding as an investment for $18,000. She purchased the land two years earlier for $16,000. Compute Marisol's 2019 AGI, taxable income, and income tax liabilityStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started