Answered step by step

Verified Expert Solution

Question

1 Approved Answer

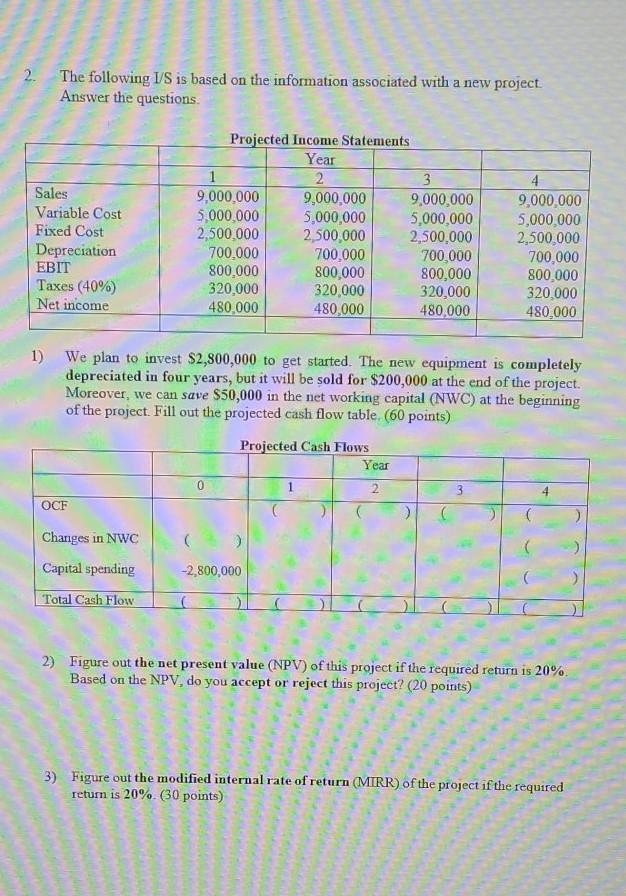

find MIRR 2. The following I/S is based on the information associated with a new project. Answer the questions. Sales Variable Cost Fixed Cost Depreciation

find MIRR

2. The following I/S is based on the information associated with a new project. Answer the questions. Sales Variable Cost Fixed Cost Depreciation EBIT Taxes (40%) Net income Projected Income Statements Year 1 2 3 9,000,000 9,000,000 9,000,000 5.000.000 5,000,000 5,000,000 2,500,000 2,500,000 2,500,000 700.000 700.000 700,000 800,000 800,000 800,000 320,000 320,000 320,000 480,000 480,000 480,000 4 9,000,000 5,000,000 2,500,000 700,000 800.000 320,000 480,000 1) We plan to invest $2,800,000 to get started. The new equipment is completely depreciated in four years, but it will be sold for $200,000 at the end of the project. Moreover, we can save $50,000 in the networking capital (NWC) at the beginning of the project. Fill out the projected cash flow table (60 points) Projected Cash Flows Year 1 2 0 OCF Changes in NWC Capital spending -2,800,000 Total Cash Flow 2) Figure out the net present value (NPV) of this project if the required return is 20% Based on the NPV, do you accept or reject this project? (20 points) 3) Figure out the modified internal rate of return (MIRR) of the project if the required return is 20% (30 points)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started