Answered step by step

Verified Expert Solution

Question

1 Approved Answer

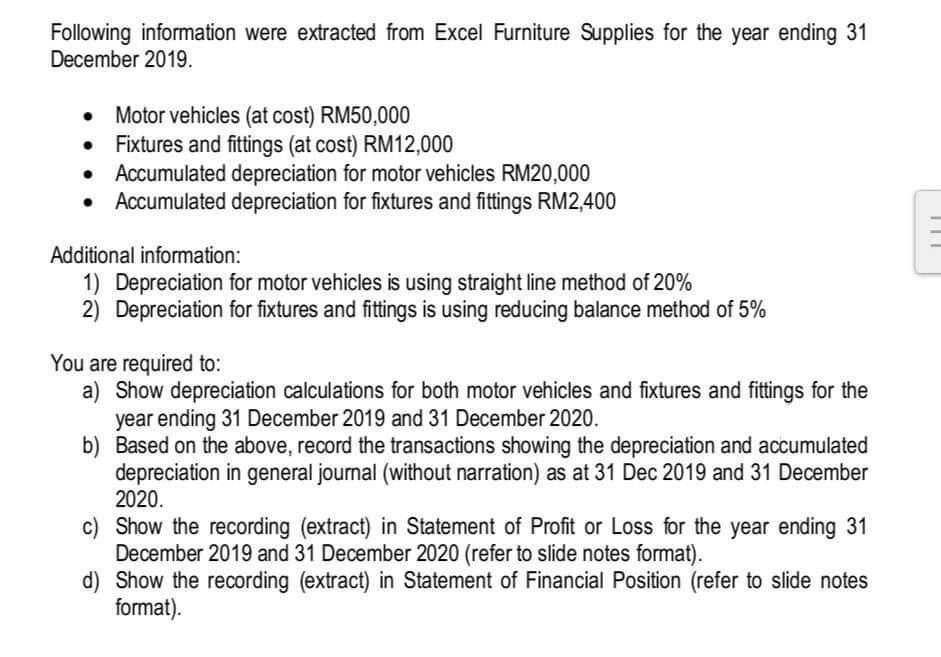

Following information were extracted from Excel Furniture Supplies for the year ending 31 December 2019. Motor vehicles (at cost) RM50,000 Fixtures and fittings (at

Following information were extracted from Excel Furniture Supplies for the year ending 31 December 2019. Motor vehicles (at cost) RM50,000 Fixtures and fittings (at cost) RM12,000 Accumulated depreciation for motor vehicles RM20,000 Accumulated depreciation for fixtures and fittings RM2,400 Additional information: 1) Depreciation for motor vehicles is using straight line method of 20% 2) Depreciation for fixtures and fittings is using reducing balance method of 5% You are required to: a) Show depreciation calculations for both motor vehicles and fixtures and fittings for the year ending 31 December 2019 and 31 December 2020. b) Based on the above, record the transactions showing the depreciation and accumulated depreciation in general journal (without narration) as at 31 Dec 2019 and 31 December 2020. c) Show the recording (extract) in Statement of Profit or Loss for the year ending 31 December 2019 and 31 December 2020 (refer to slide notes format). d) Show the recording (extract) in Statement of Financial Position (refer to slide notes format).

Step by Step Solution

★★★★★

3.45 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

a Depreciation for motor vehicles for 2019 Depreciation expense Cost of motor vehicle Accumulated de...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started