Answered step by step

Verified Expert Solution

Question

1 Approved Answer

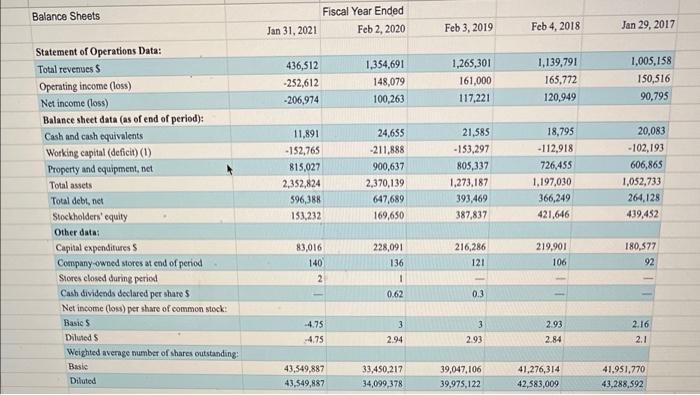

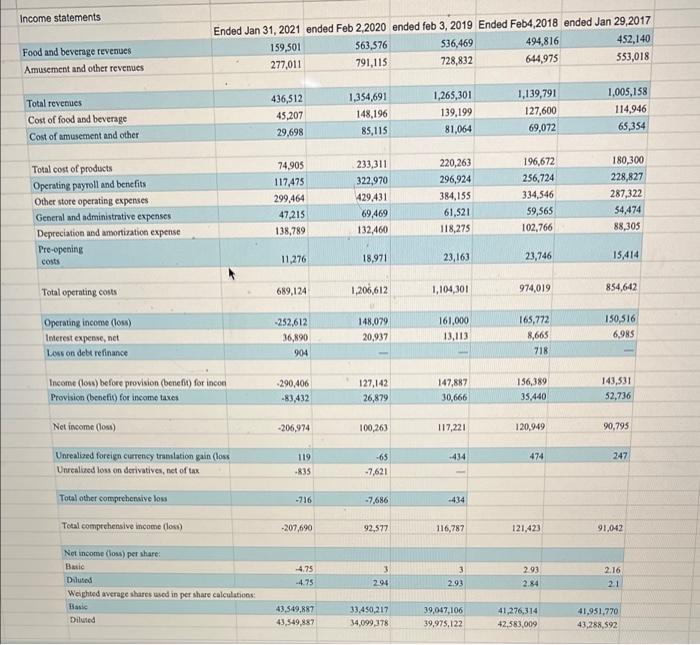

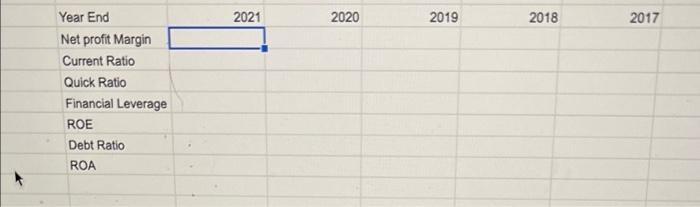

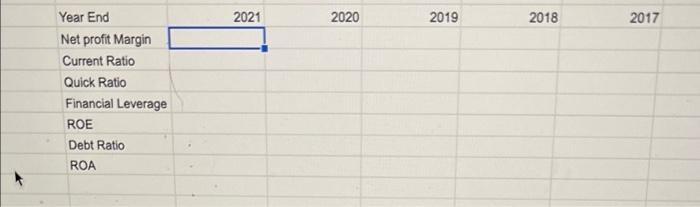

find net profit margin, current ratio, quick ratio, financial leverage, roe, debt ratio, and roa for 2021 (working capital is defined as current assets-current liability)

find net profit margin, current ratio, quick ratio, financial leverage, roe, debt ratio, and roa for 2021

(working capital is defined as current assets-current liability)

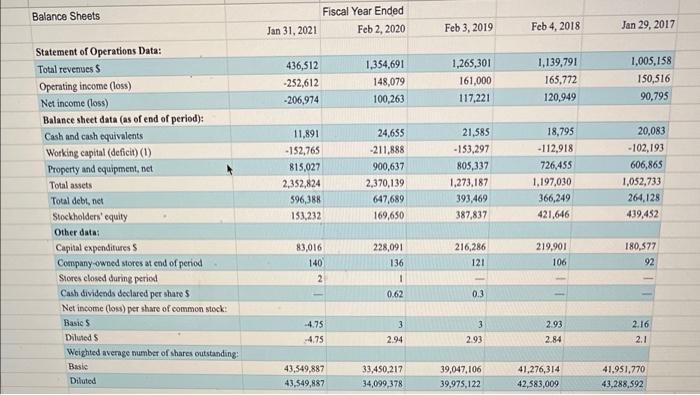

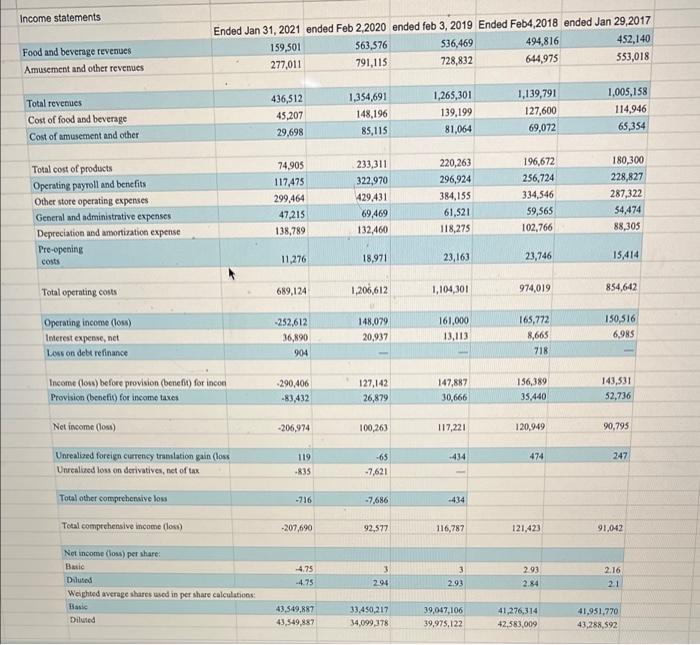

Balance Sheets Fiscal Year Ended Feb 2, 2020 Jan 31, 2021 Feb 3, 2019 Feb 4, 2018 Jan 29, 2017 436,512 -252,612 -206,974 1,354,691 148,079 100,263 1,265,301 161,000 117.221 1,139,791 165,772 120,949 1,005,158 150,516 90,795 Statement of Operations Data: Total revenues S Operating income (los) Net income (los) Balance sheet data (as of end of period): Cash and cash equivalents Working capital (deficit) (1) Property and equipment, net Total assets Total debt, net Stockholders' equity Other data: Capital expenditures Company-owned stores at end of period Stores closed during period Cash dividends declared per shares Net income (loss) per share of common stock Basics Diluted s Weighted average number of shares outstanding Basic Diluted 11,891 - 152,765 815,027 2,352,824 596,388 153.232 24,655 -211.888 900,637 2,370,139 647,689 169,650 21,585 -153,297 805,337 1,273,187 393,469 387,837 18,795 - 112,918 726,455 1,197,030 366,249 421,646 20,083 -102,193 606,865 1,052,733 264,128 439,452 83,016 219,901 216,286 121 180,577 92 140 106 228,091 136 1 0.62 2 0.3 4.75 -4.75 3 2.94 3 2.93 2.93 2.84 2.16 2.1 43,549,887 43,549,887 33,450,217 34,099,378 39,047,106 39,975,122 41,276,314 42,583,009 41,951,770 43,288,592 Income statements Food and beverage revenues Amusement and other revenues Ended Jan 31, 2021 ended Feb 2,2020 ended feb 3, 2019 Ended Feb4, 2018 ended Jan 29,2017 159,501 563,576 536,469 452,140 494,816 277,011 791,115 728,832 644,975 353,018 Total revenues Cost of food and beverage Cost of amusement and other 436,512 45,207 29,698 1,354,691 148,196 85,115 1,265,301 139,199 81,064 1,139,791 127,600 69,072 1,005,158 114,946 65,354 Total cost of products Operating payroll and benefits Other store operating expenses General and administrative expenses Depreciation and amortization expense Pre-opening costs 74,905 117,475 299,464 47,215 138,789 233,311 322,970 429,431 69.469 132,460 220,263 296,924 384,155 61,521 118,275 196,672 256,724 334,546 59,565 102,766 180,300 228,827 287,322 54,474 88,305 11,276 18,971 23,163 23,746 15,414 Total operating costs 689,124 1,206,612 1,104,101 974,019 854,642 Operating income (low) Interest expense, net Loss on debt refinance -252,612 36,890 904 148,079 20,937 161,000 13,113 165,772 8,665 150,516 6,985 718 156,389 -290,406 -83,432 127,142 26,879 147,887 30,666 143,531 52,736 Income (lom) before provision (benefi) for incon Provision (benefit) for income taxes Net income (om) 35,440 -206,974 100,263 117,221 120,949 90.795 -434 247 Unrealized foreign currency translation gain (lows Uncalized loss en derivatives, net of tax 119 .835 -65 -7,621 Total other comprehensive lo -716 -7.686 -434 Total comprehensive income (los) -207,690 92,577 116,787 121.423 91,042 3 2.16 Net income (low) per share Basic Diluted Weighted average shares used in per share calculations Basic Diluted 4.75 -4.75 3 294 2.93 2.84 2.93 21 43,549,887 43,549,887 33.450,217 34,099,178 39,047, 106 39,975,122 41,276,314 42,583,009 41,951.770 43,288,592 2021 2020 2019 2018 2017 Year End Net profit Margin Current Ratio Quick Ratio Financial Leverage ROE Debt Ratio ROA Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started