find now

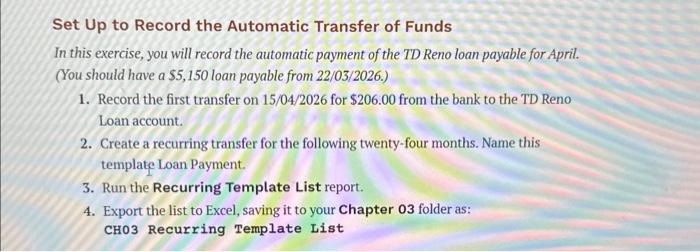

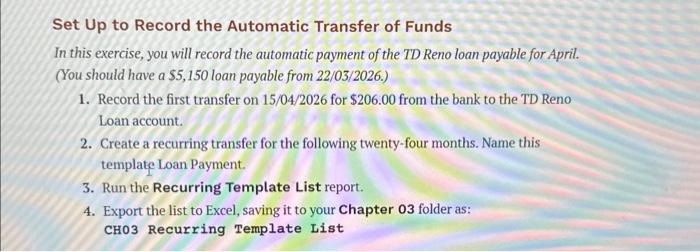

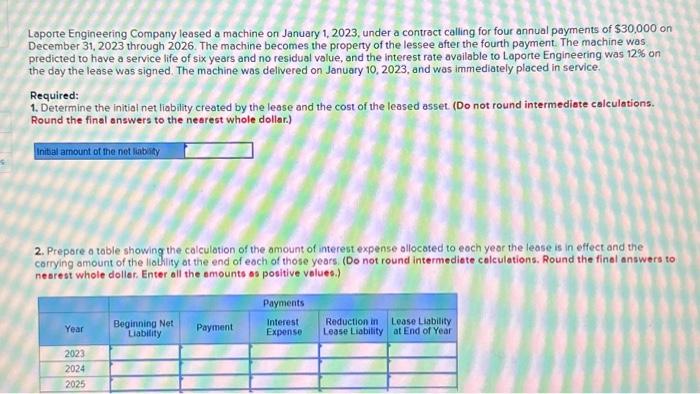

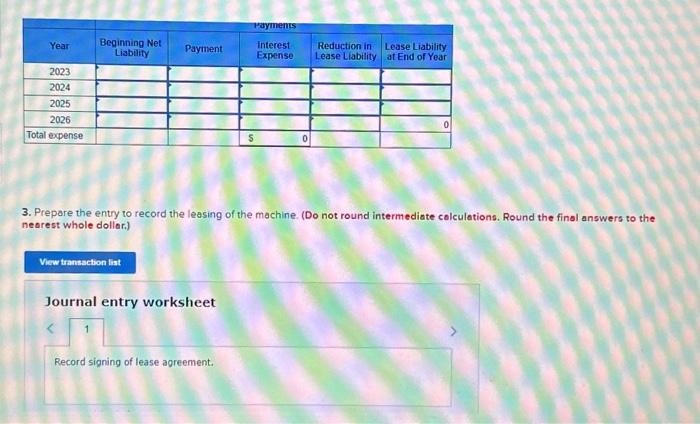

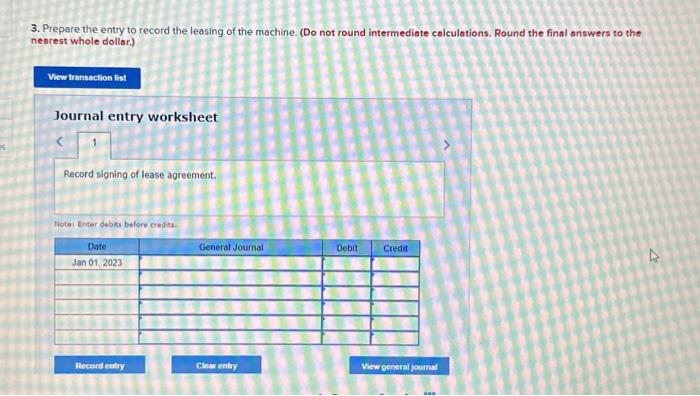

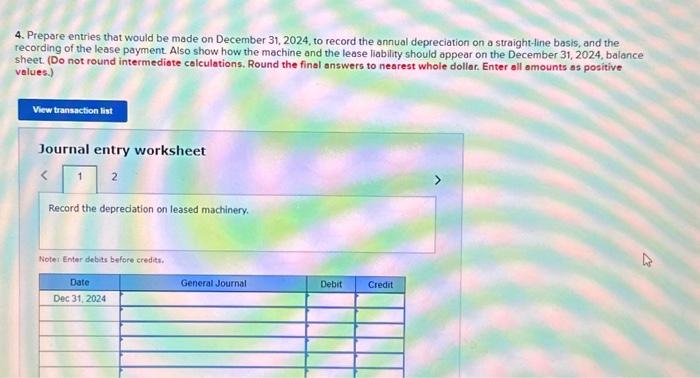

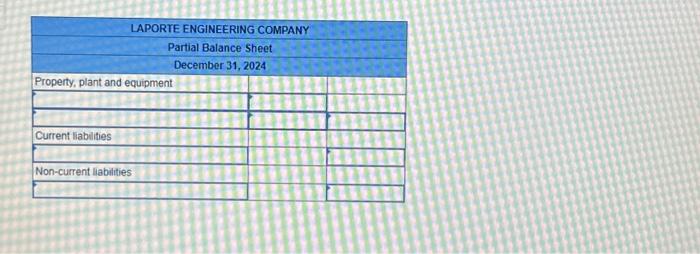

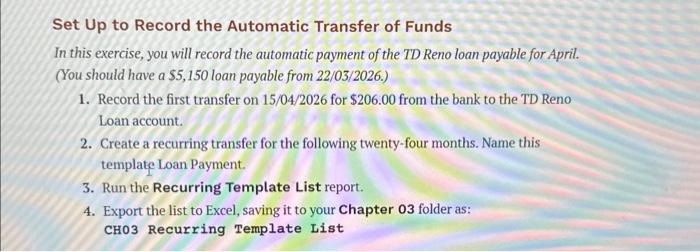

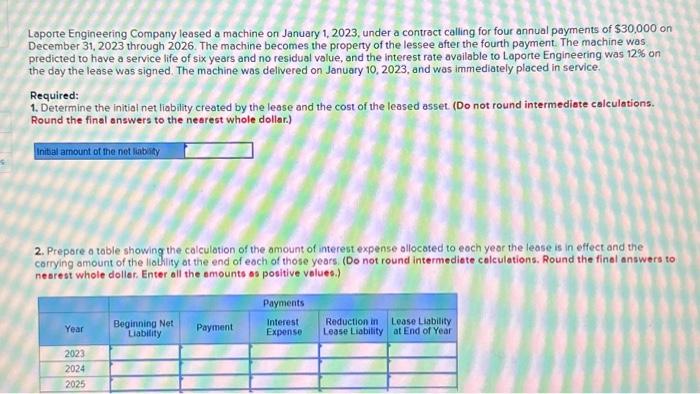

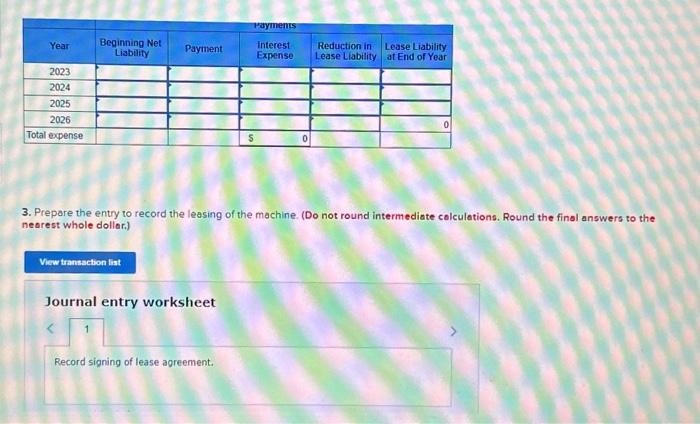

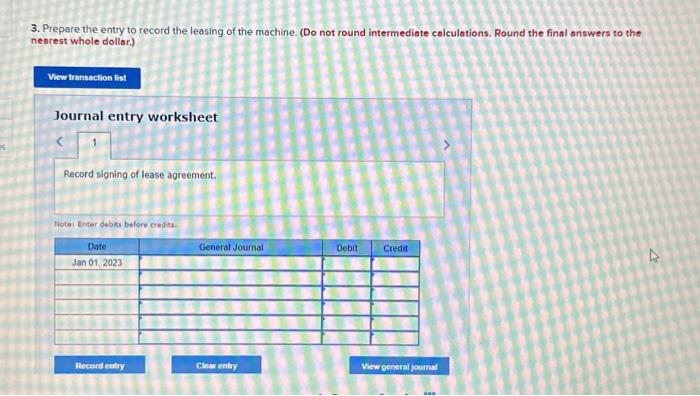

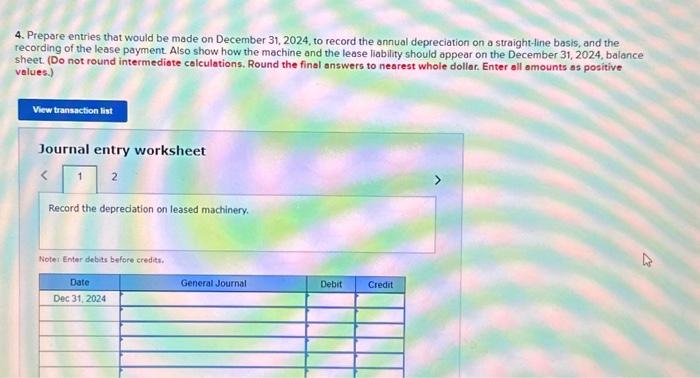

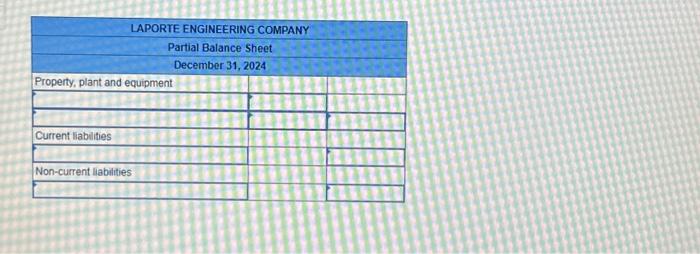

Set Up to Record the Automatic Transfer of Funds In this exercise, you will record the automatic payment of the TD Reno loan payable for April. (You should have a $5,150 loan payable from 22/03/2026.) 1. Record the first transfer on 15/04/2026 for $206.00 from the bank to the TD Reno Loan account. 2. Create a recurring transfer for the following twenty-four months. Name this template Loan Payment. 3. Run the Recurring Template List report. 4. Export the list to Excel, saving it to your Chapter 03 folder as: CHO3 Recurring Template List Laporte Engineering Company leased a machine on January 1, 2023, under a contract calling for four annual payments of $30,000 on December 31, 2023 through 2026 . The machine becomes the property of the lessee after the fourth payment. The machine was predicted to have a service life of six years and no residual value, and the interest rate available to Laporte Engineering was 12% on the day the lease was signed. The machine was delivered on January 10,2023 , and was immediately placed in service. Required: 1. Determine the initial net liability created by the lease and the cost of the leased asset. (Do not round intermediate calculations. Round the final answers to the nearest whole dollar.) 2. Prepore o table showing the calculation of the amount of interest expense allocated to eoch year the lease is in effect and the corrying amount of the liobility at the end of eoch of those years. (Do not round intermediote calculations. Round the final answers to nesrest whole doller. Enter all the emounts as positive velues.) 3. Prepare the entry to record the leasing of the mochine. (Do not round intermediate calculations. Round the final answers to the nearest whole doller.) 3. Prepare the entry to record the leasing of the machine. (Do not round intermediate calculations. Round the final answers to the neerest whole doller.) Journal entry worksheet 4. Prepare entries that would be made on December 31,2024 , to record the annual depreciation on a straight-ine basis, and the recording of the lease payment. Also show how the machine and the lease liability should appear on the December 31 , 2024, balance sheet. (Do not round intermediate calculations. Round the final answers to nearest whole dollar. Enter all amounts as positive values.) Journal entry worksheet