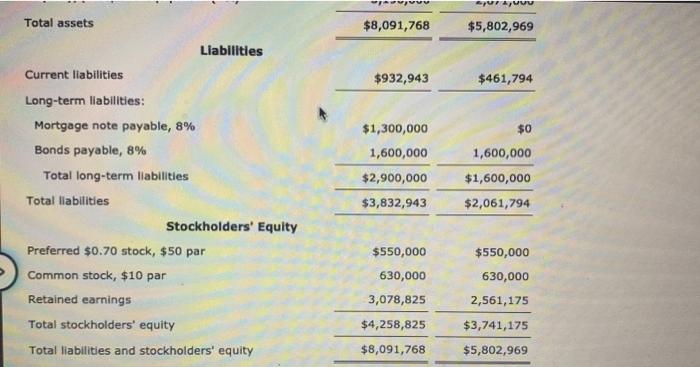

Find number 12, Return on total Assets %

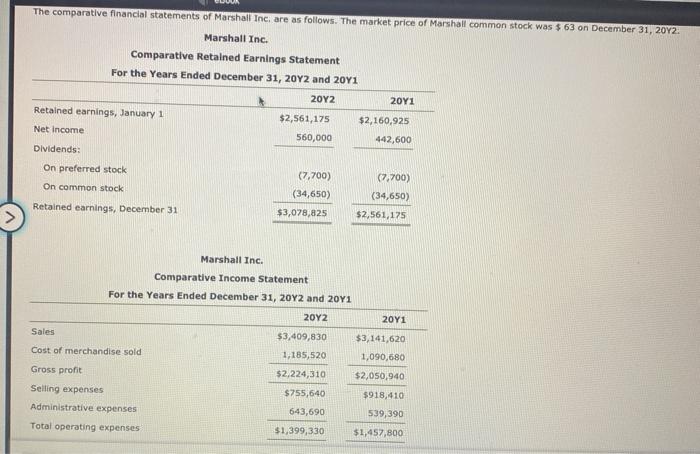

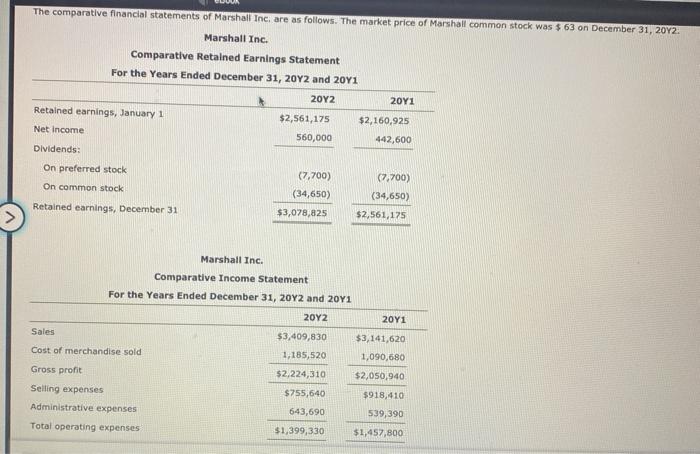

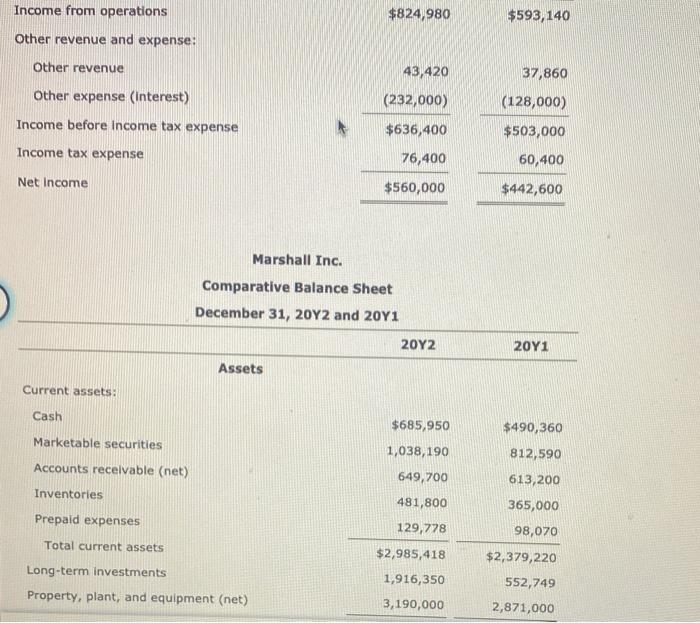

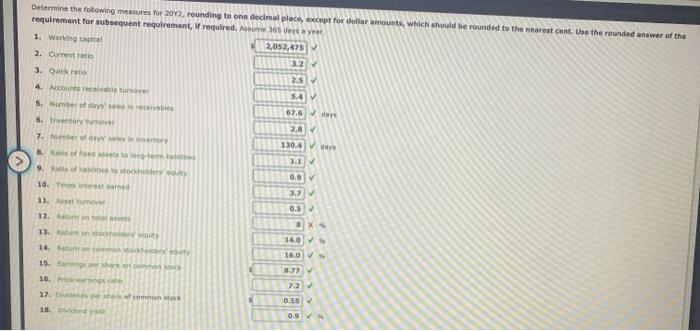

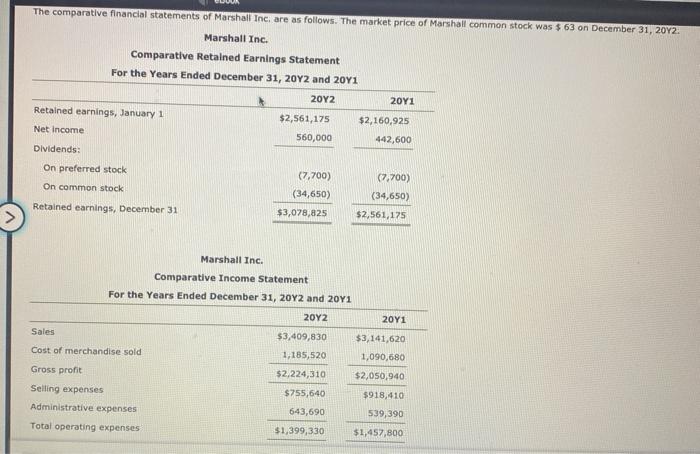

The comparative financial statements of Marshall Inc. are as follows. The market price of Marshall common stock was $ 63 on December 31, 2012 Marshall Inc. Comparative Retained Earnings Statement For the Years Ended December 31, 2012 and 2041 2012 2011 Retained earnings, January 1 $2,561,175 $2,160,925 Net Income 560,000 442,600 Dividends: On preferred stock (7,700) (7,700) On common stock (34,650) (34,650) Retained earnings, December 31 $3,078,825 $2,561,175 Marshall Inc. Comparative Income Statement For the Years Ended December 31, 2012 and 2011 2012 2011 Sales $3,409,830 $3,141,620 Cost of merchandise sold 1,185,520 1,090,680 $2,050,940 Gross profit Selling expenses Administrative expenses Total operating expenses $2,224,310 $755,640 $918.410 539,390 643,690 $1,399,330 $1,457,800 Income from operations $824,980 $593,140 Other revenue and expense: Other revenue 37,860 Other expense (Interest) (128,000) Income before Income tax expense 43,420 (232,000) $636,400 76,400 Income tax expense $503,000 60,400 Net Income $560,000 $442,600 Marshall Inc. Comparative Balance Sheet December 31, 2012 and 2011 20Y2 20Y1 Assets Current assets: Cash $490,360 Marketable securities 812,590 Accounts receivable (net) 613,200 Inventories 365,000 Prepaid expenses $685,950 1,038,190 649,700 481,800 129,778 $2,985,418 1,916,350 3,190,000 98,070 Total current assets Long-term investments Property, plant, and equipment (net) $2,379,220 552,749 2,871,000 SIA Total assets $8,091,768 $5,802,969 Liabilities Current liabilities $932,943 $461,794 $0 1,600,000 $1,300,000 1,600,000 $2,900,000 $3,832,943 $1,600,000 $2,061,794 Long-term liabilities: Mortgage note payable, 8% Bonds payable, 8% Total long-term liabilities Total liabilities Stockholders' Equity Preferred $0.70 stock, $50 par Common stock, $10 par Retained earnings Total stockholders' equity Total liabilities and stockholders' equity $550,000 $550,000 630,000 630,000 3,078,825 2,561,175 $4,258,825 $3,741,175 $5,802,969 $8,091,768 Determine the following measures for 2012, rounding to one decimal place, scept for dollar amounts, which should be rounded to the nearest cont. Use the rounded answer of the requirement for subsequent requirement required. As 1. Wong capital 2,052,475 2. Current ratio 3.2 3. Quick to 2.5 4. Accounts receivable turver 5. Numerosivable 62.5 days 6. Thvertory to 2.8 7 bers 130.4 Ver 3. of tot 1.1 9. of tot 0.9 10. Theret med 3.7 11. Au 0.5 12. Rota X 14.0 13. 14. 15. Tag er hann 16.0 8.77 16.Png 72 17. of common wack 01551 0.97