Answered step by step

Verified Expert Solution

Question

1 Approved Answer

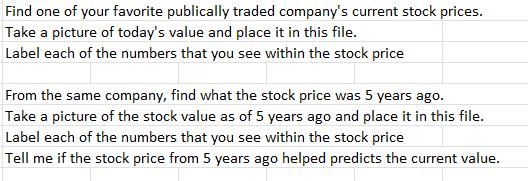

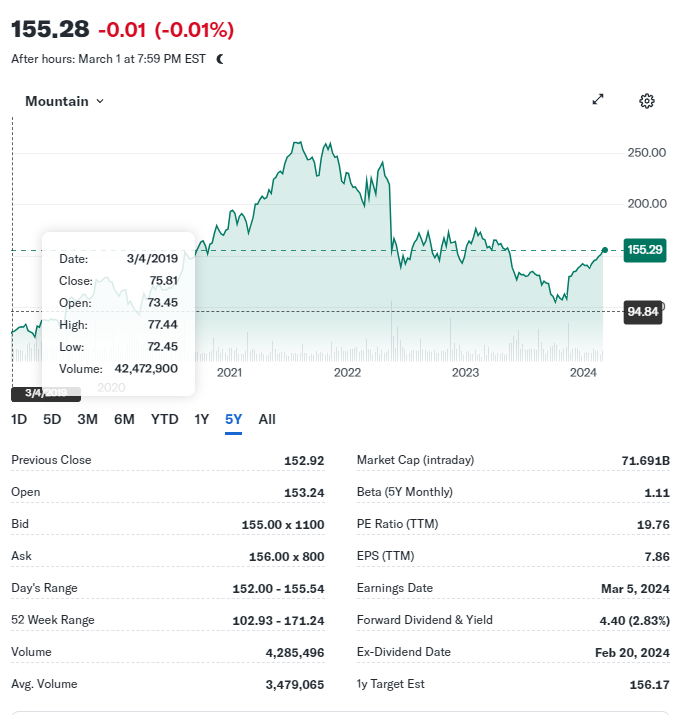

Find one of your favorite publically traded company's current stock prices. Take a picture of today's value and place it in this file. Label

Find one of your favorite publically traded company's current stock prices. Take a picture of today's value and place it in this file. Label each of the numbers that you see within the stock price From the same company, find what the stock price was 5 years ago. Take a picture of the stock value as of 5 years ago and place it in this file. Label each of the numbers that you see within the stock price Tell me if the stock price from 5 years ago helped predicts the current value. 155.28 -0.01 (-0.01%) After hours: March 1 at 7:59 PM EST Mountain Date: 3/4/2019 Close: 75.81 Open: 73.45 High: 77.44 Low: 72.45 2021 Volume: 42,472,900 3/4/2019 2020 1D 5D 3M 6M YTD 1Y 5Y All 2022 2023 2024 250.00 200.00 155.29 94.84 Previous Close Open Bid 152.92 Market Cap (intraday) 71.691B 153.24 Beta (5Y Monthly) 1.11 155.00 x 1100 PE Ratio (TTM) 19.76 Ask 156.00 x 800 EPS (TTM) 7.86 Day's Range 152.00 -155.54 Earnings Date Mar 5, 2024 52 Week Range 102.93 -171.24 Forward Dividend & Yield 4.40 (2.83%) Volume 4,285,496 Ex-Dividend Date Feb 20, 2024 Avg. Volume 3,479,065 1y Target Est 156.17 NYSE - Delayed Quote - USD Target Corporation (TGT) 155.29 +2.37 (+1.55%) At close: March 1 at 4:00 PM EST 155.28 -0.01 (-0.01%) After hours: March 1 at 7:59 PM EST Mountain 2021 2020 1D 5D 3M 6M YTD 1Y 5Y All - Follow 2022 2023 2024 250.00 200.00 155.29 100.00 Previous Close Open Bid 152.92 Market Cap (intraday) 71.691B 153.24 Beta (5Y Monthly) 1.11 155.00 x 1100 PE Ratio (TTM) 19.76 Ask 156.00 x 800 EPS (TTM) 7.86 Day's Range 152.00 -155.54 Earnings Date Mar 5, 2024 52 Week Range 102.93 -171.24 Forward Dividend & Yield 4.40 (2.83%) Volume 4,285,496 Ex-Dividend Date Feb 20, 2024 Avg. Volume 3,479,065 1y Target Est 156.17

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started