Find online the annual 10-K report for Costco Wholesale Corporation (COST) as of August 28, 2022 a. Compute Costco's net profit margin, total asset

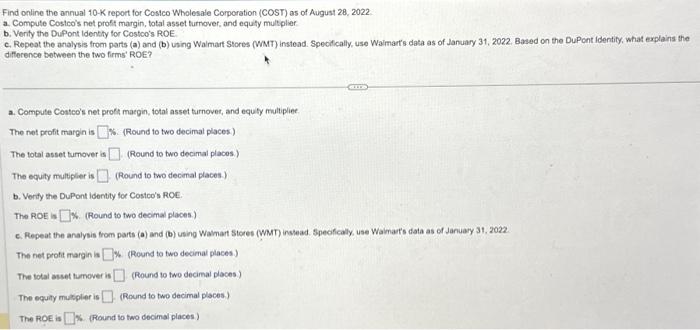

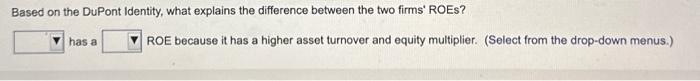

Find online the annual 10-K report for Costco Wholesale Corporation (COST) as of August 28, 2022 a. Compute Costco's net profit margin, total asset turnover, and equity multiplier b. Verity the DuPont Identity for Costco's ROE c. Repeat the analysis from parts (a) and (b) using Walmart Stores (WMT) instead. Specifically, use Walmart's data as of January 31, 2022. Based on the DuPont Identity, what explains the difference between the two firms' ROE? a. Compute Costco's net profit margin, total asset turnover, and equity multiplier The net profit margin is % (Round to two decimal places) (Round to two decimal places.) (Round to two decimal places.) The total asset tumover is The equity multiplier is b. Verify the DuPont Identity for Costoo's ROE. The ROE is % (Round to two decimal places) c. Repeat the analysis from parts (a) and (b) using Walmart Stores (WMT) instead. Specifically, use Waimart's data as of January 31, 2022. The net profit margin is% (Round to two decimal places) The total asset tumover is (Round to two decimal places) The equity multiplier is (Round to two decimal places) The ROE is% (Round to two decimal places) Based on the DuPont Identity, what explains the difference between the two firms' ROES? has a ROE because it has a higher asset turnover and equity multiplier. (Select from the drop-down menus.)

Step by Step Solution

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

a Compute Costcos net profit margin total asset turnover and equity multiplier Using Costcos 10K rep...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started