Answered step by step

Verified Expert Solution

Question

1 Approved Answer

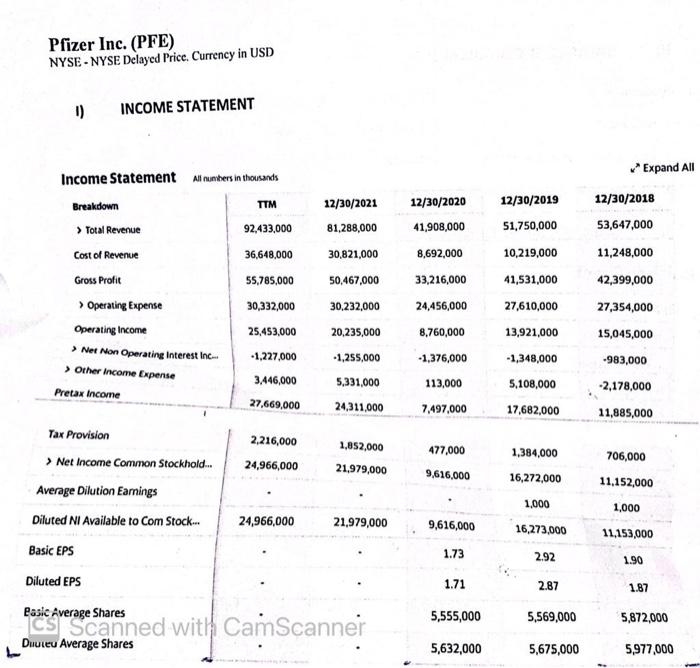

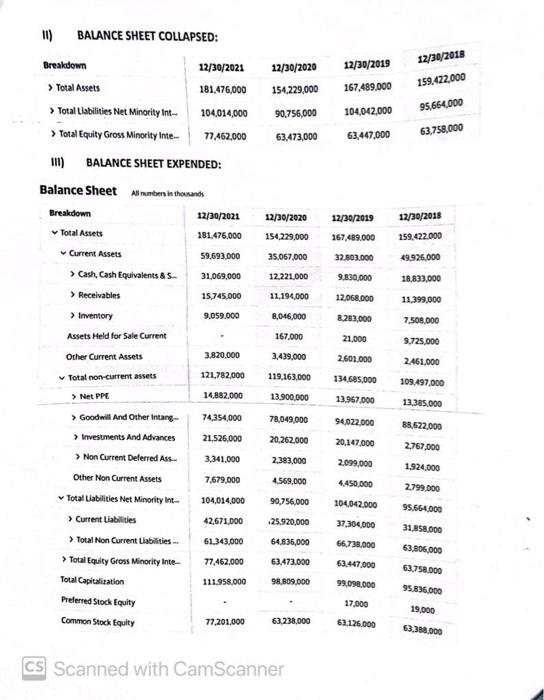

Find out the ratios of all of them for the pfizer company from Yahoo! Finance and we need the results of 2021 and how healthy

Find out the ratios of all of them for the pfizer company from Yahoo! Finance and we need the results of 2021 and how healthy the company was going and please make small notes on every ratios or comment of how did u get it

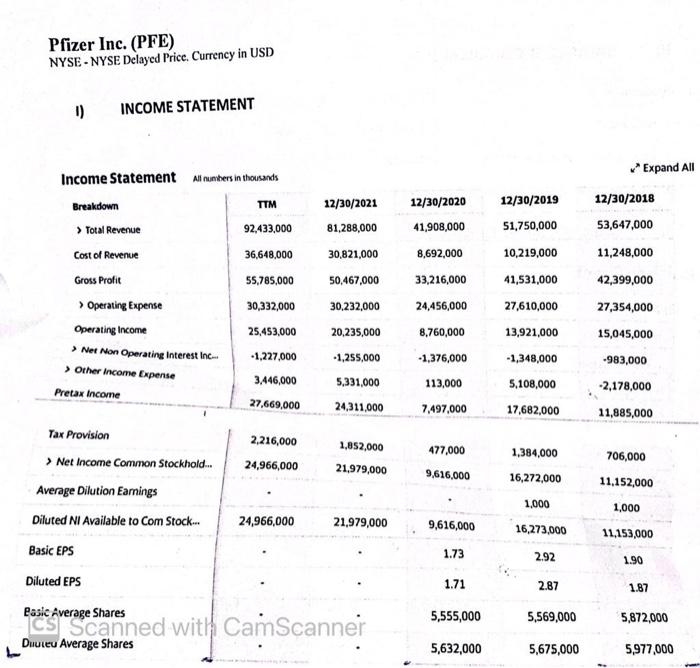

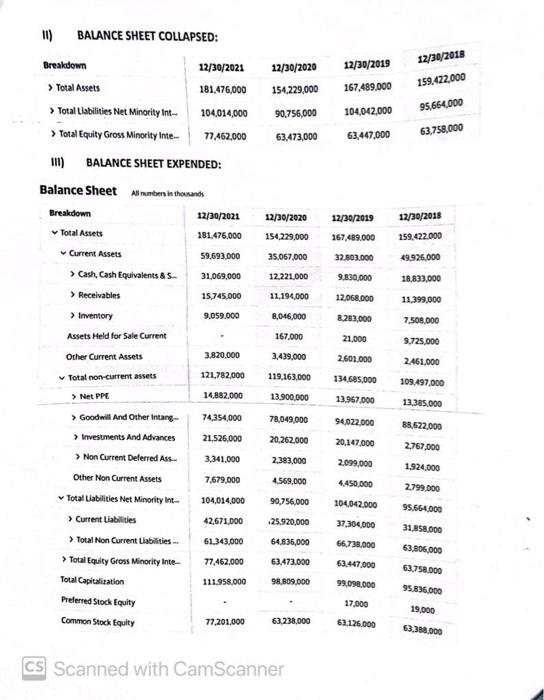

Financial Management Summer 2022 Liquidity Efficiency Profitability Leverage Market Value CS Scanned with CamScanner Pfizer Inc. (PFE) NYSE-NYSE Delayed Price. Currency in USD 1) INCOME STATEMENT Income Statement Breakdown > Total Revenue All numbers in thousands Cost of Revenue Gross Profit Operating Expense Operating Income > Net Non Operating Interest Inc. > Other Income Expense Pretax Income Tax Provision > Net Income Common Stockhold.... Average Dilution Earnings Diluted NI Available to Com Stock... Basic EPS TTM 92,433,000 36,648,000 55,785,000 30,332,000 25,453,000 -1,227,000 3,446,000 27,669,000 2,216,000 24,966,000 24,966,000 12/30/2021 81,288,000 30,821,000 50,467,000 30,232,000 20,235,000 -1,255,000 5,331,000 24,311,000 1,852,000 21,979,000 21,979,000 Diluted EPS Basic Average Shares CS Scanned with CamScanner Duuleu Average Shares 12/30/2020 41,908,000 8,692,000 33,216,000 24,456,000 8,760,000 -1,376,000 113,000 7,497,000 477,000 9,616,000 9,616,000 1.73 1.71 5,555,000 5,632,000 12/30/2019 51,750,000 10,219,000 41,531,000 27,610,000 13,921,000 -1,348,000 5,108,000 17,682,000 1,384,000 16,272,000 1,000 16,273,000 2.92 2.87 5,569,000 5,675,000 Expand All 12/30/2018 53,647,000 11,248,000 42,399,000 27,354,000 15,045,000 -983,000 -2,178,000 11,885,000 706,000 11,152,000 1,000 11,153,000 1.90 1.87 5,872,000 5,977,000 11) BALANCE SHEET COLLAPSED: Breakdown > Total Assets > Total Liabilities Net Minority Int... 104,014,000 > Total Equity Gross Minority Inte... 77,462,000 III) BALANCE SHEET EXPENDED: Balance Sheet All numbers in thousands Breakdown Total Assets Current Assets > Cash, Cash Equivalents & S... > Receivables > Inventory Assets Held for Sale Current Other Current Assets Total non-current assets > Net PPE > Goodwill And Other Intang- > Investments And Advances > Non Current Deferred Ass Other Non Current Assets Total Liabilities Net Minority Int.. > Current Liabilities >Total Non Current Liabilities... > Total Equity Gross Minority Inte Total Capitalization Preferred Stock Equity Common Stock Equity 12/30/2021 181,476,000 12/30/2021 181,476,000 59,693,000 31,069,000 15,745,000 9,059.000 3,820,000 121,782,000 14,882,000 74,354,000 21,526,000 3,341,000 7,679,000 104,014,000 42,671,000 61,343,000 77,462.000 111,958,000 77,201,000 12/30/2020 154,229,000 90,756,000 63,473,000 12/30/2020 154,229,000 35,067,000 12,221,000 11,194,000 8,046,000 167,000 3,439,000 119,163,000 13,900,000 78,049,000 20,262,000 2,383,000 4,569,000 90,756,000 25,920,000 64,836,000 63,473.000 98,809,000 63,238,000 CS Scanned with CamScanner 12/30/2019 167,489,000 104,042,000 63,447,000 12/30/2019 167,489.000 32,803,000 9.830,000 12,068,000 8,283,000 21,000 2,601,000 134,685,000 13.967,000 94,022,000 20,147,000 2,099,000 4,450,000 104,042,000 37,304,000 66,738,000 63,447,000 99,098,000 17,000 63.126.000 12/30/2018 159,422,000 95,664,000 63,758,000 12/30/2018 159,422.000 49,926,000 18,833,000 11,399,000 7,508,000 9,725,000 2,461,000 109,497,000 13.385.000 88,622,000 2,767,000 1,924,000 2,799,000 95,664,000 31,858,000 63,806,000 63,758.000 95,836,000 19,000 63,388,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started