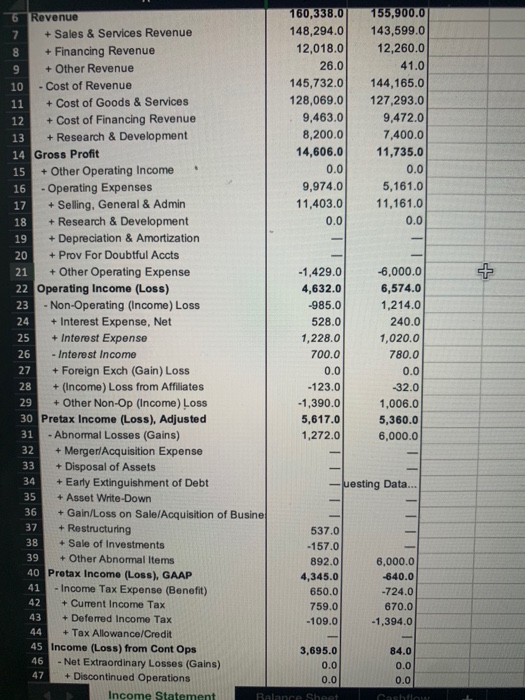

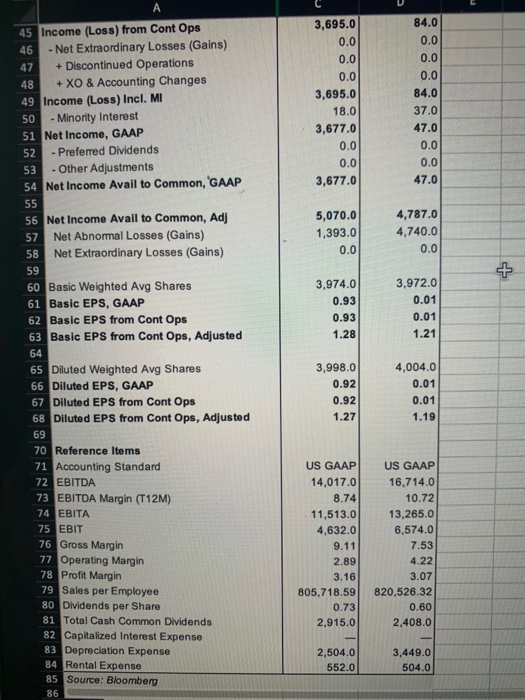

find profitability ratio:

ROA

ROE

profit margin

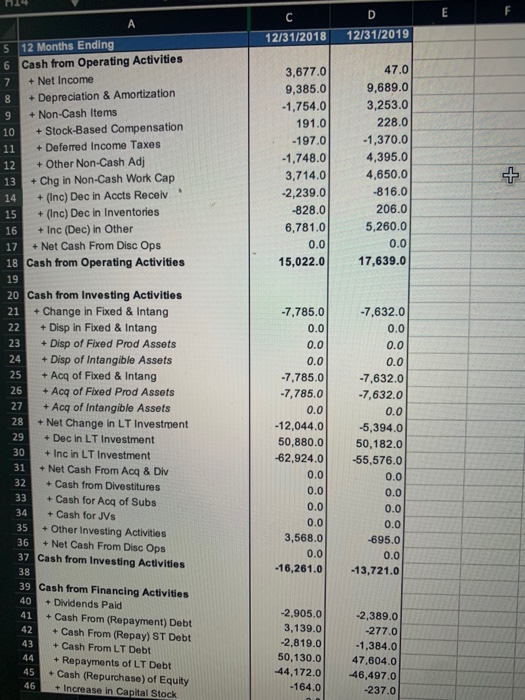

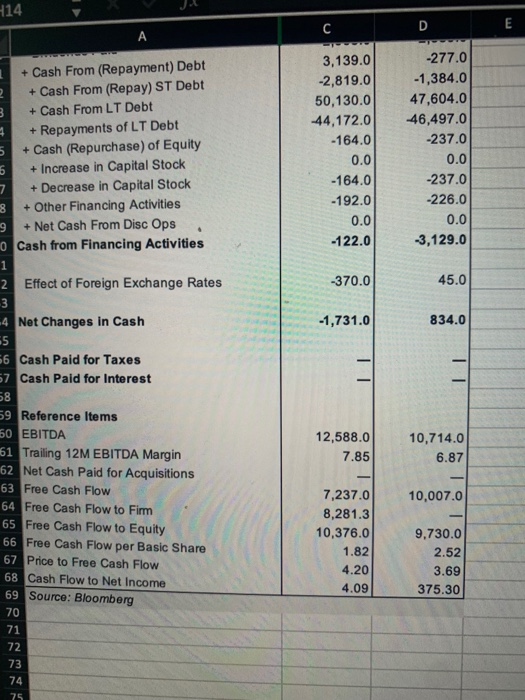

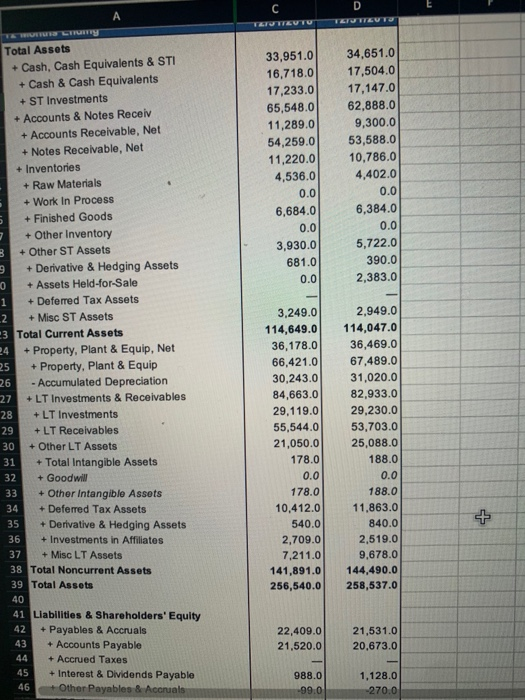

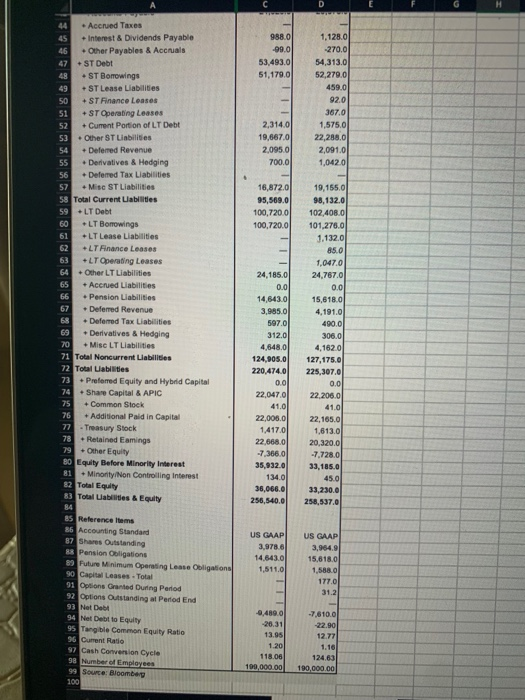

C D E 12/31/2018 12/31/2019 3,677.0 9,385.0 -1,754.0 191.0 -197.0 -1,748.0 3,714.0 -2,239.0 -828.0 6,781.0 0.0 15,022.0 47.0 9,689.0 3,253.0 228.0 -1,370.0 4,395.0 4,650.0 -816.0 206.0 5,260.0 0.0 17,639.0 5 12 Months Ending 6 Cash from Operating Activities 7 + Net Income 8 Depreciation & Amortization 9 + Non-Cash Items 10 + Stock-Based Compensation 11 + Deferred Income Taxes 12 + Other Non-Cash Adj 13 + Chg in Non-Cash Work Cap 14 + (Inc) Dec in Accts Receiv 15 + (Inc) Dec in Inventories 16 + Inc (Dec) in Other 17 + Net Cash From Disc Ops 18 Cash from Operating Activities 19 20 Cash from Investing Activities 21 + Change in Fixed & Intang 22 + Disp in Fixed & Intang 23 + Disp of Fixed Prod Assets 24 + Disp of Intangible Assets 25 + Acq of Fixed & Intang 26 + Acq of Fixed Prod Assets 27 + Ace of Intangible Assets 28 + Net Change in LT Investment 29 + Dec in LT Investment 30 + Inc in LT Investment 31 + Net Cash From Acq & Div 32 + Cash from Divestitures 33 + Cash for Acg of Subs 34 + Cash for JVs 35 + Other Investing Activities 36 + Net Cash From Disc Ops 37 Cash from Investing Activities 38 39 Cash from Financing Activities 40 + Dividends Pald 41 + Cash From (Repayment) Debt 42 + Cash From (Repay) ST Debt 43 + Cash From LT Debt 44 + Repayments of LT Debt 45 + Cash (Repurchase) of Equity 46 + Increase in Capital Stock -7,785.0 0.0 0.0 0.0 -7,785.0 -7,785.0 0.0 -12,044.0 50,880.0 -62,924.0 0.0 0.0 0.0 0.0 3,568.0 0.0 -16,261.0 -7,632.0 0.0 0.0 0.0 -7,632.0 -7,632.0 0.0 -5,394.0 50,182.0 -55,576.0 0.0 0.0 0.0 0.0 -695.0 0.0 -13,721.0 -2.905.0 3,139.0 -2.819.0 50,130.0 44,172.0 -164.0 -2,389.0 -277.0 -1,384.0 47,604.0 46,497.0 -237.0 414 C D E A TU + Cash From (Repayment) Debt 2 + Cash From (Repay) ST Debt 3 + Cash From LT Debt + Repayments of LT Debt 5 + Cash (Repurchase) of Equity 6 + Increase in Capital Stock 7 + Decrease in Capital Stock 8 + Other Financing Activities 9 + Net Cash From Disc Ops 0 Cash from Financing Activities 1 3,139.0 -2,819.0 50,130.0 44,172.0 -164.0 0.0 -164.0 -192.0 0.0 -122.0 -277.0 -1,384.0 47,604.0 46,497.0 -237.0 0.0 -237.0 -226.0 0.0 -3,129.0 6 -370.0 45.0 -1,731.0 834.0 12,588.0 7.85 10,714.0 6.87 2 Effect of Foreign Exchange Rates 3 -4 Net Changes in Cash 45 6 Cash Paid for Taxes 57 Cash Paid for Interest 58 59 Reference Items 50 EBITDA 161 Trailing 12M EBITDA Margin 62 Net Cash Paid for Acquisitions 63 Free Cash Flow 64 Free Cash Flow to Firm 65 Free Cash Flow to Equity 66 Free Cash Flow per Basic Share 67 Price to Free Cash Flow 68 Cash Flow to Net Income 69 Source: Bloomberg 70 71 72 73 74 75 10,007.0 7,237.0 8,281.3 10,376.0 1.82 4.20 4.09 9.730.0 2.52 3.69 375.30 C TAU TEV TU D TETUTTET 33,951.0 16,718.0 17,233.0 65,548.0 11,289.0 54,259.0 11,220.0 4,536.0 0.0 6,684.0 0.0 3,930.0 681.0 0.0 34,651.0 17,504.0 17,147.0 62,888.0 9,300.0 53,588.0 10,786.0 4,402.0 0.0 6,384.0 0.0 5,722.0 390.0 2,383.0 TW LUTY Total Assets + Cash, Cash Equivalents & STI + Cash & Cash Equivalents + ST Investments + Accounts & Notes Receiv + Accounts Receivable, Net + Notes Receivable, Net + Inventories + Raw Materials + Work In Process + Finished Goods + Other Inventory 3 + Other ST Assets + Derivative & Hedging Assets 0 + Assets Held-for-Sale 1 + Deferred Tax Assets .2 + Misc ST Assets 3 Total Current Assets 24 + Property, Plant & Equip, Net 25 + Property, Plant & Equip 26 - Accumulated Depreciation 27 +LT Investments & Receivables 28 + LT Investments 29 +LT Receivables 30 + Other LT Assets 31 + Total Intangible Assets 32 + Goodwill 33 + Other Intangible Assets 34 + Deferred Tax Assets 35 + Derivative & Hedging Assets 36 + Investments in Affiliates 37 + Misc LT Assets 38 Total Noncurrent Assets 39 Total Assets 40 41 Liabilities & Shareholders' Equity 42 + Payables & Accruals 43 + Accounts Payable 44 + Accrued Taxes 45 + Interest & Dividends Payable 46 + Other Payables & Accruals 3,249.0 114,649.0 36,178.0 66,421.0 30,243.0 84,663.0 29.119.0 55,544.0 21,050.0 178.0 0.0 178.0 10,412.0 540.0 2,709.0 7,211.0 141,891.0 256,540.0 2,949.0 114,047.0 36,469.0 67,489.0 31,020.0 82,933.0 29,230.0 53,703.0 25,088.0 188.0 0.0 188.0 11.863.0 840.0 2,519.0 9,678.0 144,490.0 258,537.0 22,409.0 21,520.0 21,531.0 20,673.0 988.0 -99.0 1,128.0 -270.0 D 988.0 -99.0 53,493.0 51,179.0 - 1,128.0 270.0 54,313.0 52,279.0 459.0 92.0 367.00 1,575.0 22,288.0 2,091,0 1,0420 2,314.01 19,667.0 2,0950 700.00 16,872.0 95,569.0 100,720.01 100,720.0 44 Accrued Taxes 45 Interest & Dividends Payable 46 Other Payables & Accruals 47 + ST Debt 49 +ST Borrowings 49 +ST Lease Liabilities 50 +ST Finance Losses 51 +ST Operating Leases 52 + Current Portion of LT Debt S3 - Other ST Liabilities 54 +Deferred Revenue 55 + Derivatives & Hedging 56 +Deferred Tax Liabilities 57 Mise ST Liabilities 58 Total Current Liabilities 59 +LT Debt 60 +LT Borowings 61 +LT Lease Liabilities 62 +LT Finance Leases 63 +LT Operating Leases 64 + Other LT Liabilities 65 + Accrued Liabilities 66 - Pension Llabilities 67 Deferred Revenue 68 + Deferred Tax Liabilities 69 + Derivatives & Hedging 70 + Mise LT Liabilities 71 Total Noncurrent Liabilities 72 Total Liabilities 73 Preferred Equity and Hybrid Capital 74 + Share Capital & APIC 75 + Common Stock 76 + Additional Paid in Capital - Treasury Stock 78 Retained Eamingo 79 - Other Equity 80 Equity Before Minority Interest 81 + Minority/ Non Controlling Interest 82 Total Equity 83 Total abilities & Equity 84 85 Reference Items 86 Accounting Standard 87 Shares Outstanding 8 Pension Obligations 89 Future Minimum Operating Lease Obligations 90 Capital Leases - Total 91 Options Granted During Period 92 Options Outstanding at Period End 93 Net Det 94 Net Debt to Equity 95 Tangible Common Equity Ratio 96 Current Ratio 97 Cash Conversion Cycle 98 Nurnber of Employees 99 Source: Bloomberg 100 24,185.0 0.0 14,643.0 3,985.0 597.0 312.0 4,648.0 124,905.0 220,474.0 0.0 22,047.0 41.0 22,000.00 1.417.01 22,668.0 -7.366.0 35,932.0 134.0 36,066.0 256,540.0 19,155.0 98,132.0 102,408.0 101.276.0 1.132.0 85.0 1,047.0 24,767.0 0.0 15,618.0 4,191.0 490.0 306.0 4,1620 127,175.0 225,307.0 0.0 22.206.0 41.0 22,165.0 1,613.0 20,320.0 -7.728.0 33,185.0 45.0 33,230.0 258,537.0 US GAAP 3,9786 14.643.0 1,511.0 US GAAP 3,964.9 15,818,0 1,588.0 177.0 31.2 9.489.0 -26.31 13.95 1.20 118.06 100,000.00 -7.610.0 -22.90 12.77 1.16 124.63 190,000.00 + 160,338.0 148,294.0 12,018.0 26.0 145,732.0 128,069.0 9,463.0 8,200.0 14,606.0 0.0 9,974.0 11,403.0 0.0 155,900.0 143,599.0 12,260.0 41.0 144,165.0 127,293.0 9,472.0 7,400.0 11,735.0 0.0 5,161.0 11.161.0 0.0 + 6 Revenue 7 + Sales & Services Revenue 8 Financing Revenue 9 + Other Revenue 10 - Cost of Revenue 11 + Cost of Goods & Services 12 + Cost of Financing Revenue 13 + Research & Development 14 Gross Profit 15 + Other Operating Income 16 - Operating Expenses 17 + Selling, General & Admin 18 + Research & Development 19 + Depreciation & Amortization 20 + Prov For Doubtful Accts 21 + Other Operating Expense 22 Operating Income (Loss) 23 - Non-Operating (Income) Loss 24 + Interest Expense, Net 25 + Interest Expense 26 - Interest Income 27 + Foreign Exch (Gain) Loss 28 + (Income) Loss from Affiliates 29 + Other Non-Op (Income) Loss 30 Pretax Income (Loss), Adjusted 31 - Abnormal Losses (Gains) 32 + Merger Acquisition Expense 33 + Disposal of Assets 34 + Early Extinguishment of Debt 35 + Asset Write-Down 36 + Gain/Loss on Sale/Acquisition of Busine 37 + Restructuring 38 + Sale of Investments 39 + Other Abnormal Items 40 Pretax Income (Loss), GAAP 41 - Income Tax Expense (Benefit) 42 + Current Income Tax 43 + Deferred Income Tax 44 + Tax Allowance/Credit 45 Income (Loss) from Cont Ops 46 - Net Extraordinary Losses (Gains) 47 + Discontinued Operations Income Statement -1,429.0 4,632.0 -985.0 528.0 1,228.0 700.0 0.0 -123.0 -1,390.0 5,617.0 1,272.0 -6,000.0 6,574.0 1,214.0 240.0 1,020.0 780.0 0.0 -32.0 1,006.0 5,360.0 6,000.0 uesting Data... 537.0 -157.0 892.0 4,345.0 650.0 759.0 -109.0 6,000.0 -640.0 -724.0 670.0 -1,394.0 3,695.0 0.0 0.0 84.0 0.0 0.0 Balance Sheet Cashflow 3,695.0 0.0 0.0 0.0 3,695.0 18.0 3,677.0 0.0 0.0 3,677.0 84.0 0.0 0.0 0.0 84.0 37.0 47.0 0.0 0.0 47.0 5,070.0 1,393.0 0.0 4,787.0 4,740.0 0.0 3,974.0 0.93 0.93 1.28 3,972.0 0.01 0.01 1.21 A 45 Income (Loss) from Cont Ops 46 - Net Extraordinary Losses (Gains) 47 + Discontinued Operations 48 + XO & Accounting Changes 49 Income (Loss) Incl. MI 50 - Minority Interest 51 Net Income, GAAP 52 - Preferred Dividends 53 - Other Adjustments 54 Net Income Avail to Common, 'GAAP 55 56 Net Income Avail to Common, Adj 57 Net Abnormal Losses (Gains) 58 Net Extraordinary Losses (Gains) 59 60 Basic Weighted Avg Shares 61 Basic EPS, GAAP 62 Basic EPS from Cont Ops 63 Basic EPS from Cont Ops, Adjusted 64 65 Diluted Weighted Avg Shares 66 Diluted EPS, GAAP 67 Diluted EPS from Cont Ops 68 Diluted EPS from Cont Ops, Adjusted 69 70 Reference Items 71 Accounting Standard 72 EBITDA 73 EBITDA Margin (T12M) 74 EBITA 75 EBIT 76 Gross Margin 77 Operating Margin 78 Profit Margin 79 Sales per Employee 80 Dividends per Share 81 Total Cash Common Dividends 82 Capitalized Interest Expense 83 Depreciation Expense 84 Rental Expense 85 Source: Bloomberg 86 3,998.0 0.92 0.92 1.27 4,004.0 0.01 0.01 1.19 US GAAP 14,017.0 8.74 11,513.0 4,632.0 9.11 2.89 3.16 805.718.59 0.73 2.915.0 US GAAP 16.714.0 10.72 13,265.0 6,574.0 7.53 4.22 3.07 820,526.32 0.60 2,408.0 - 2,504.0 552.0 3,449.0 504.0