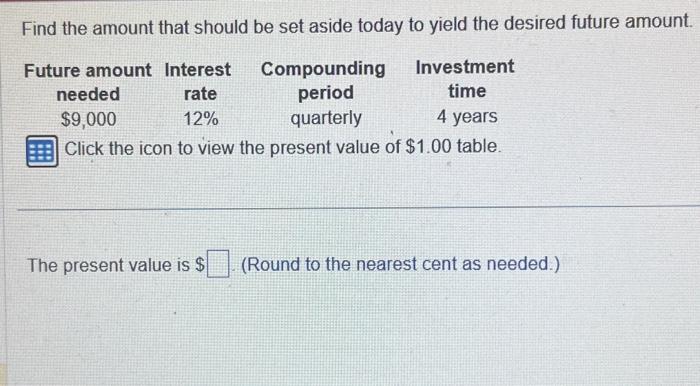

Find the amount that should be set aside today to yield the desired future amount. Future amount Interest Compounding rate period 12% quarterly needed $9,000 Investment time 4 years Click the icon to view the present value of $1.00 table. The present value is $ (Round to the nearest cent as needed.)

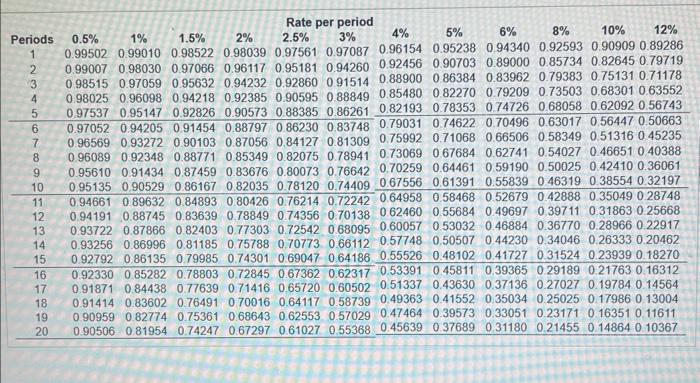

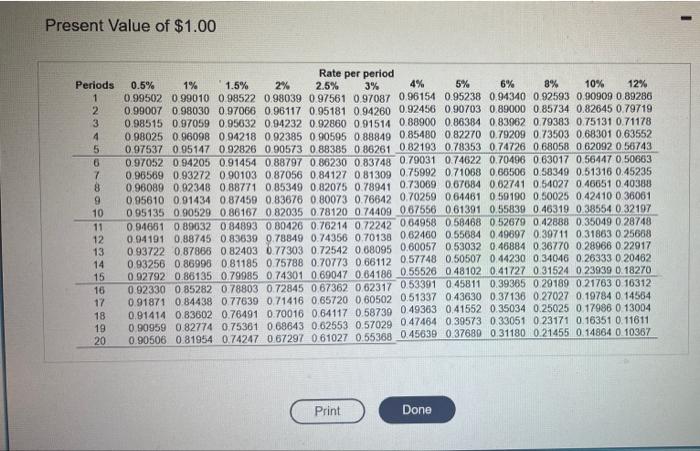

Find the amount that should be set aside today to yield the desired future amount. Click the icon to view the present value of $1.00 table. The present value is $ (Round to the nearest cent as needed.) \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|c|c|} \hline & & & & & & & & & & & & \\ \hline Periods & 0.5% & 1% & 1.5% & 2% & 2.5% & 3% & 4% & 5% & 6% & 8% & 10% & 12% \\ \hline 1 & 0.99502 & 0.99010 & 0.98522 & 0.98039 & 0.97561 & 0.97087 & 0.96154 & 0.95238 & 0.94340 & 0.92593 & 0.90909 & 0.89286 \\ \hline 2 & 0.99007 & 0.98030 & 0.97066 & 0.96117 & 0.95181 & 0.94260 & 0.92456 & 0.90703 & 0.89000 & 0.85734 & 0.82645 & 0.79719 \\ \hline 3 & 0.98515 & 0.97059 & 0.95632 & 0.94232 & 0.92860 & 0.91514 & 0.88900 & 0.86384 & 0.83962 & 0.79383 & 0.75131 & 0.71178 \\ \hline 4 & 0.98025 & 0.96098 & 0.94218 & 0.92385 & 0.90595 & 0.88849 & 0.85480 & 0.82270 & 0.79209 & 0.73503 & 0.68301 & 0.63552 \\ \hline 5 & 0.97537 & 0.95147 & 0.92826 & 0.90573 & 0.88385 & 0.86261 & 0.82193 & 0.78353 & 0.74726 & 0.68058 & 0.62092 & 0.56743 \\ \hline 6 & 0.97052 & 0.94205 & 0.91454 & 0.88797 & 0.86230 & 0.83748 & 0.79031 & 0.74622 & 0.70496 & 0.63017 & 0.56447 & 0.50663 \\ \hline 7 & 0.96569 & 0.93272 & 0.90103 & 0.87056 & 0.84127 & 09 & 0.75992 & 0.71068 & 0.66506 & 0.58349 & 0.51316 & 0.45235 \\ \hline 8 & 0.96089 & 0.92348 & 0.88771 & 0.85349 & 0.82075 & 0.78941 & 0.73069 & 0.67684 & 0.62741 & 0.54027 & 0.46651 & 0.40388 \\ \hline 9 & 0.95610 & 0.91434 & 0.87459 & 0.83676 & 0.80073 & 0.76642 & 0.70259 & 0.64461 & 0.59190 & 0.50025 & 0.42410 & 36061 \\ \hline 10 & 0.95135 & 0.90529 & 0.86167 & 0.82035 & 0.78120 & 0.74409 & 0.67556 & 0.61391 & 0.55839 & 0.46319 & 0.38554 & 32197 \\ \hline 11 & 0.94661 & 0.89632 & 0.84893 & 0.80426 & 0.76214 & 0.72242 & 0.64958 & 0.58468 & 0.52679 & 0.42888 & 0.35049 & 0.28748 \\ \hline 12 & 0.94191 & 0.88745 & 0.83639 & 0.78849 & 0.74356 & 0.70 & 0.62460 & 0.55684 & 0.49697 & 0.39711 & 0.31863 & 668 \\ \hline 13 & 0.93722 & 0.87866 & 0.82403 & 0.77303 & 0.72542 & 0.68095 & 0.60057 & 0.53032 & 0.46884 & 0.36770 & 0.28966 & 0.22917 \\ \hline 14 & 0.93256 & 0.86996 & 0.81185 & 0.75788 & 0.70773 & 0.66112 & 0.57748 & 0.50507 & 0.44230 & 0.34046 & 0.26333 & 0.20462 \\ \hline 15 & 0.92792 & 0.86135 & 0.79985 & 0.74301 & 0.69047 & 0.64186 & 0.55526 & 0.48102 & 0.41727 & 0.31524 & 0.23939 & 0.18270 \\ \hline 16 & 0.92330 & 0.85282 & 0.78803 & 0.72845 & 0.67362 & 0.62317 & 0.53391 & 0.45811 & 0,39365 & 0.29189 & 0.217630 & 0.16312 \\ \hline 17 & 0.91871 & 0.84438 & 0.77639 & 0.71416 & 0.65720 & 0.60502 & 0.51337 & 0.43630 & 0.37136 & 0.27027 & 0.1978 & 0.14564 \\ \hline 18 & 0.91414 & 0.83602 & 0.76491 & 0.70016 & 0.64117 & 0.58739 & 0.49363 & 0.41552 & 0.35034 & 0.25025 & 0.1798 & 0.13004 \\ \hline 19 & 0.90959 & 0.82774 & 0.75361 & 0.68643 & 0.62553 & 0.57029 & 0.47464 & 0.39573 & 0.33051 & 0.23171 & 0.163 & 0.11611 \\ \hline 20 & 0.90506 & 0.81954 & 0.74247 & 0.67297 & 0.61027 & 0.55368 & 0.45639 & 0.37689 & 0.31180 & 0.21455 & 0.1486 & 0.10367 \\ \hline \end{tabular} Present Value of $1.00