Answered step by step

Verified Expert Solution

Question

1 Approved Answer

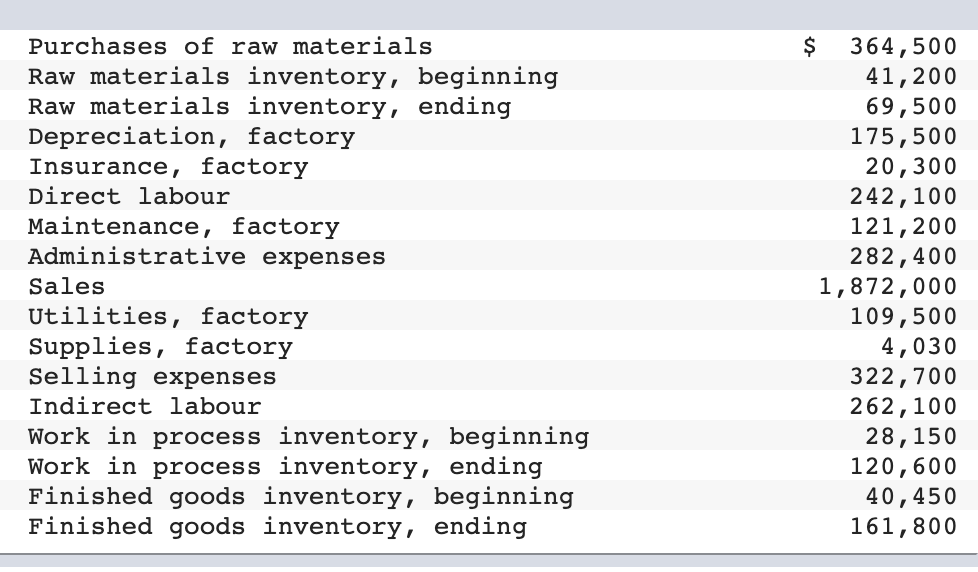

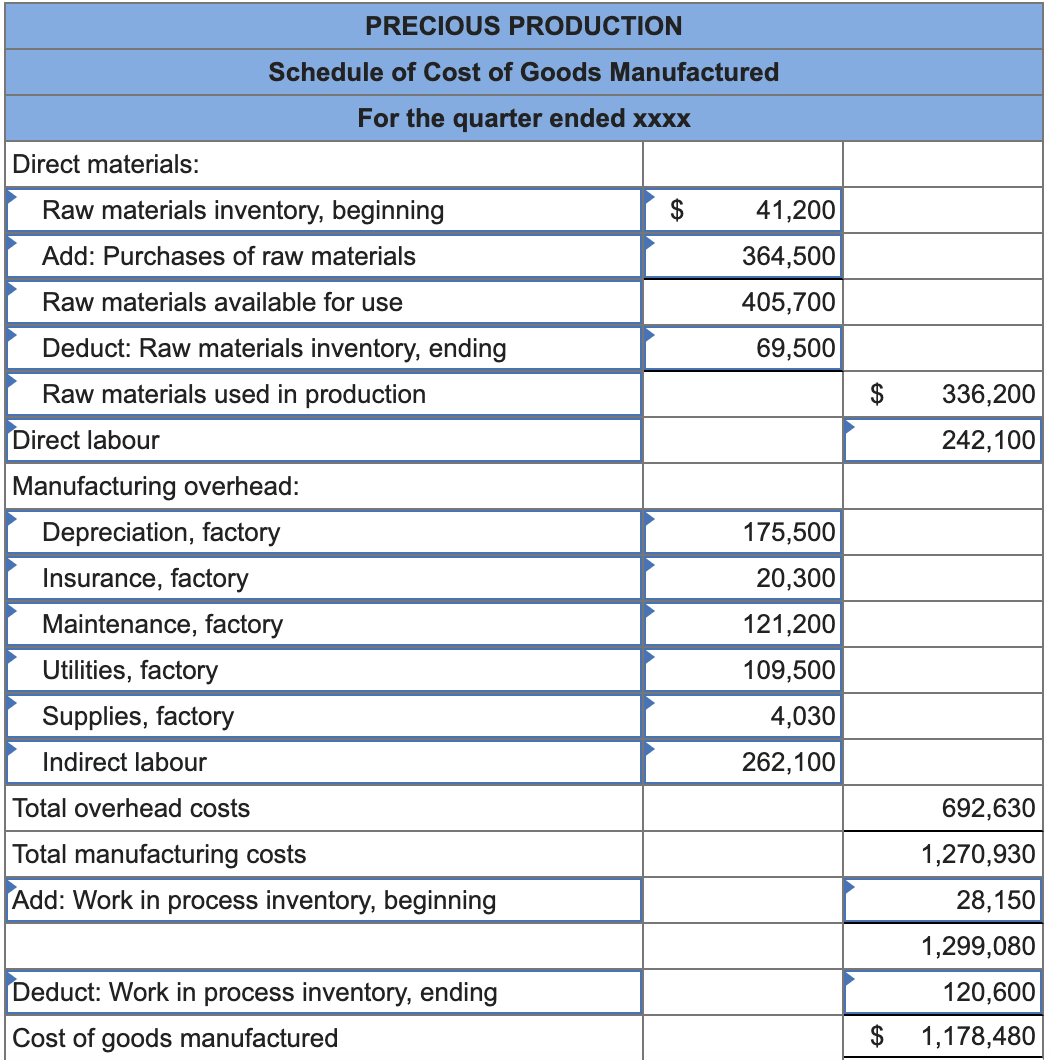

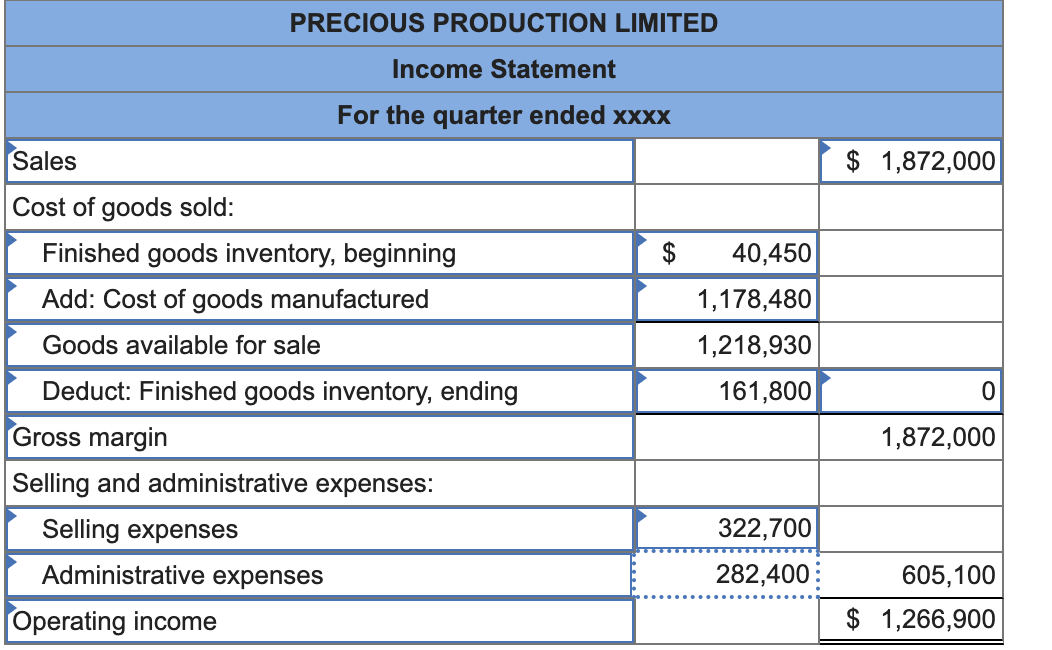

find the aswer for question 5 and 6 question 4&6, not 5* complete questions 4 and 6 not number 5! PurchasesofrawmaterialsRawmaterialsinventory,beginningRawmaterialsinventory,endingDepreciation,factoryInsurance,factoryDirectlabourMaintenance,factoryAdministrativeexpensesSalesUtilities,factorySupplies,factorySellingexpensesIndirectlabourWorkinprocessinventory,beginningWorkinprocessinventory,endingFinishedgoodsinventory,beginningFinishedgoodsinventory,ending$364,50041,20069,500175,50020,300242,100121,200282,4001,872,000109,5004,030322,700262,10028,150120,60040,450161,800 PRECIOUS PRODUCTION LIMITED Income

find the aswer for question 5 and 6

question 4&6, not 5*

complete questions 4 and 6 not number 5!

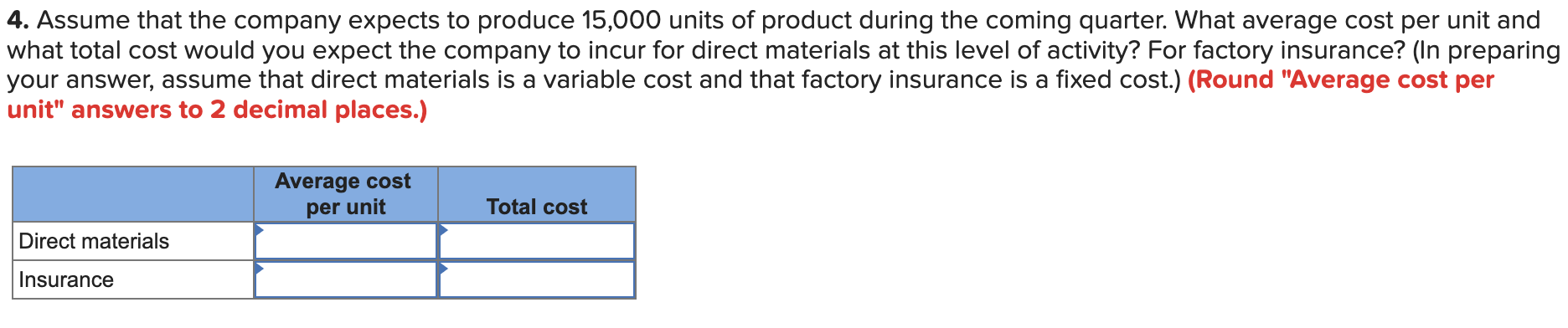

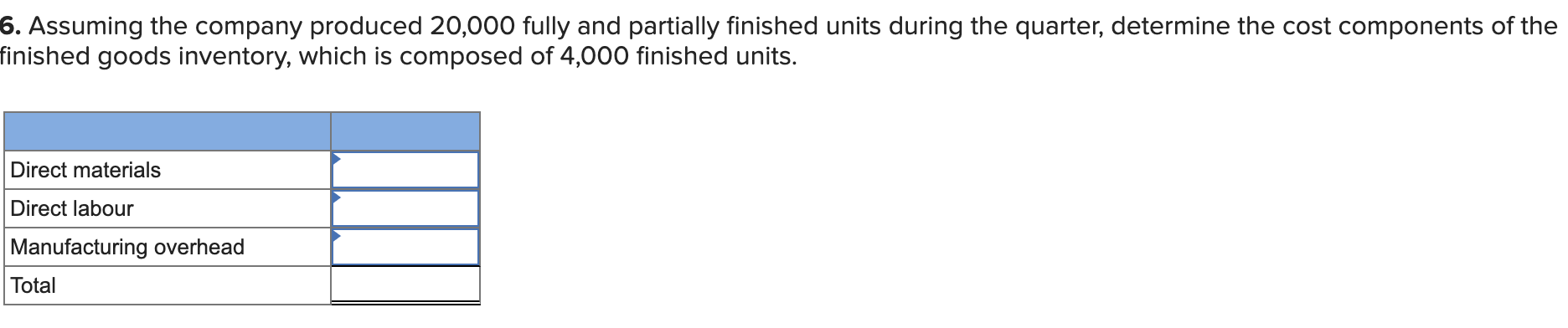

PurchasesofrawmaterialsRawmaterialsinventory,beginningRawmaterialsinventory,endingDepreciation,factoryInsurance,factoryDirectlabourMaintenance,factoryAdministrativeexpensesSalesUtilities,factorySupplies,factorySellingexpensesIndirectlabourWorkinprocessinventory,beginningWorkinprocessinventory,endingFinishedgoodsinventory,beginningFinishedgoodsinventory,ending$364,50041,20069,500175,50020,300242,100121,200282,4001,872,000109,5004,030322,700262,10028,150120,60040,450161,800 PRECIOUS PRODUCTION LIMITED Income Statement For the quarter ended xxxx \begin{tabular}{|l|r|r|} \hline Sales & & $1,872,000 \\ \hline Cost of goods sold: & & \\ \hline Finished goods inventory, beginning & $1,178,480 & \\ \hline Add: Cost of goods manufactured & 1,218,930 & \\ \hline Goods available for sale & 161,800 & \\ \hline Deduct: Finished goods inventory, ending & & \\ \hline Gross margin & & 1,872,000 \\ \hline Selling and administrative expenses: & 322,700 & \\ \hline Selling expenses & 282,400 & \\ \hline Administrative expenses & & \\ \hline Operating income & & \\ \hline \hline \end{tabular} 4. Assume that the company expects to produce 15,000 units of product during the coming quarter. What average cost per unit and what total cost would you expect the company to incur for direct materials at this level of activity? For factory insurance? (In preparing your answer, assume that direct materials is a variable cost and that factory insurance is a fixed cost.) (Round "Average cost per unit" answers to 2 decimal places.) - Assuming the company produced 20,000 fully and partially finished units during the quarter, determine the cost components of the nished goods inventory, which is composed of 4,000 finished units Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started