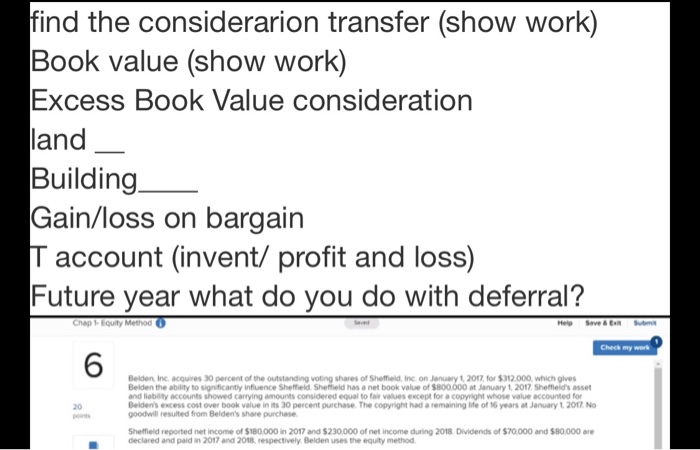

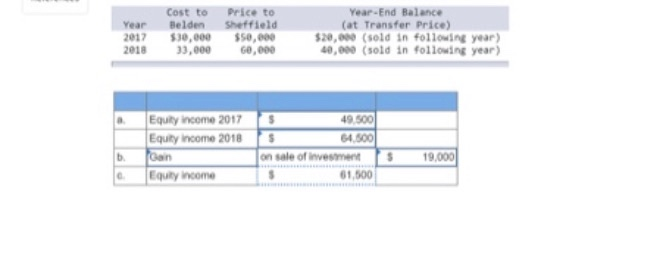

find the considerarion transfer (show work) Book value (show work) Excess Book Value consideration land Building Gain/loss on bargain T account (invent/ profit and loss) Future year what do you do with deferral? Chap 1- Equity Method Help Save & ERS Check my work Belden Inc. acquires 30 percent of the outstanding voting shares of Sheffield, Inc. on January 2017 for $312000which gives Beiden the ability to significantly influence Sheffield Sheffield has a netbook value of $800.000 at January 1, 2017 Sheffield's asset and liability accounts showed carrying amounts considered equal to fair values except for a copyright whose value accounted for Belden's excess cost over book value in its 30 percent purchase. The copyright had a remaining life of 16 years at January 1, 2017 No goodwill resulted from Belden's share purchase Sheffield reported net income of $180.000 in 2017 and $230,000 of net income during 2018 Dividends of $70,000 and $80.000 are declared and paid in 2017 and 2018 respectively Belden uses the equity method Year 2017 2018 Cost to Belden $30,000 33,000 Price to Sheffield $50,000 60,000 Year-End Balance (at Transfer Price) $20,000 (sold in following year) 40,000 (sold in following year) 491500 Equity income 2017 Equity Income 2018 Gain Equity income 64.500 on sale of investment 61,500 s 19.000 find the considerarion transfer (show work) Book value (show work) Excess Book Value consideration land Building Gain/loss on bargain T account (invent/ profit and loss) Future year what do you do with deferral? Chap 1- Equity Method Help Save & ERS Check my work Belden Inc. acquires 30 percent of the outstanding voting shares of Sheffield, Inc. on January 2017 for $312000which gives Beiden the ability to significantly influence Sheffield Sheffield has a netbook value of $800.000 at January 1, 2017 Sheffield's asset and liability accounts showed carrying amounts considered equal to fair values except for a copyright whose value accounted for Belden's excess cost over book value in its 30 percent purchase. The copyright had a remaining life of 16 years at January 1, 2017 No goodwill resulted from Belden's share purchase Sheffield reported net income of $180.000 in 2017 and $230,000 of net income during 2018 Dividends of $70,000 and $80.000 are declared and paid in 2017 and 2018 respectively Belden uses the equity method Year 2017 2018 Cost to Belden $30,000 33,000 Price to Sheffield $50,000 60,000 Year-End Balance (at Transfer Price) $20,000 (sold in following year) 40,000 (sold in following year) 491500 Equity income 2017 Equity Income 2018 Gain Equity income 64.500 on sale of investment 61,500 s 19.000