Answered step by step

Verified Expert Solution

Question

1 Approved Answer

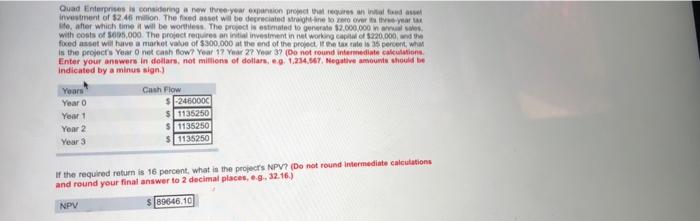

find the correct answer to the following question Quad Enterprises considering a new three year expansion pour annat investment of $2.46 milion. The ed asset

find the correct answer to the following question

Quad Enterprises considering a new three year expansion pour annat investment of $2.46 milion. The ed asset will be deprecated in love life after which time will be worthless. The project is estimated to gener 2.000.000 inwes with costs of $605.000. The project requires an investment in not working capital of 5220.000, foed asset will have a market value of $300.000 at the end of the project in totale la 35 percent, is the projects Year Onet cash flow? Year 12 Year 2? Year 37 (Do not round intermediate calculation Enter your answers in dollars, not millions of dollars, eg 1.234.647. Negative amounts should be indicated by a minus sign) Years Year Year 1 Year 2 Year Cash Flow 246000C 1135250 1135250 1135250 If the required return is 16 percent what is the projects NPV? (Do not round Intermediate calculations and round your final answer to 2 decimal places, e.g. 32.16.) NPV $189046.10) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started