find the current ratio

quick ratio

return on investment

return on assets

gross margin

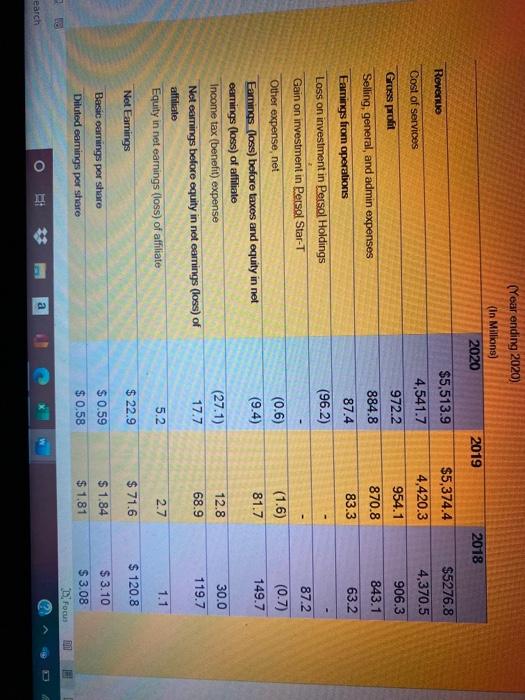

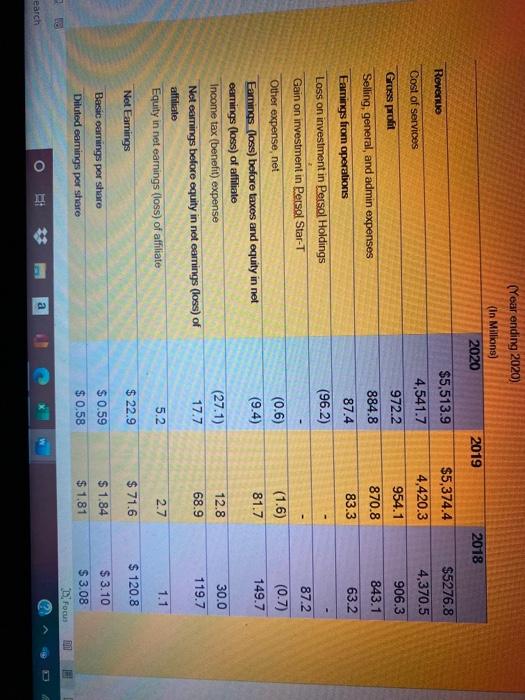

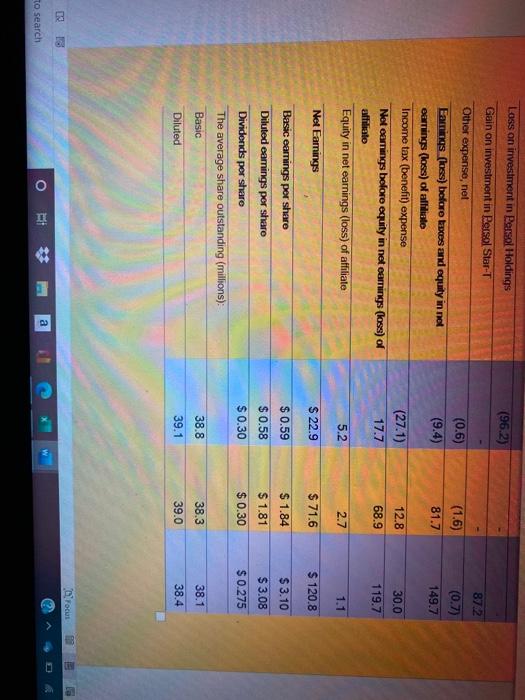

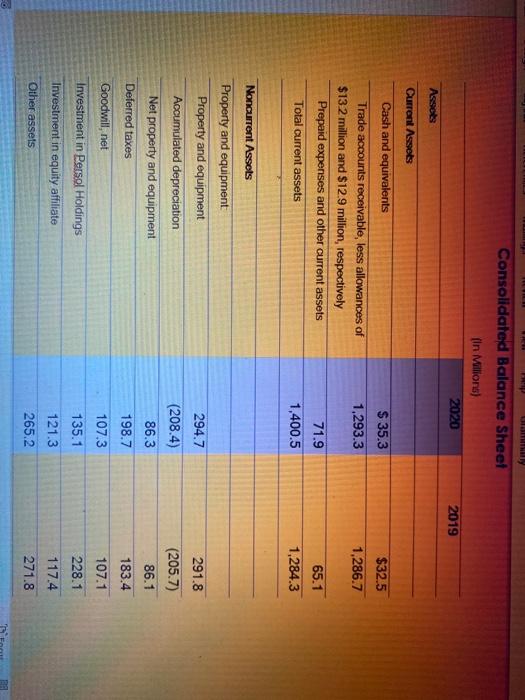

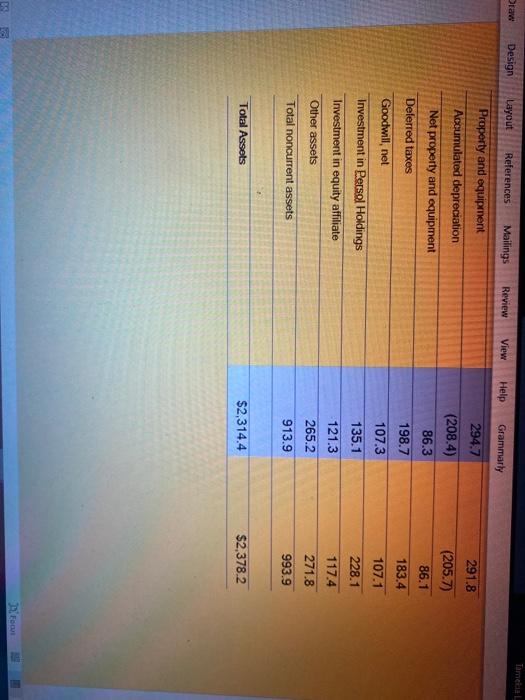

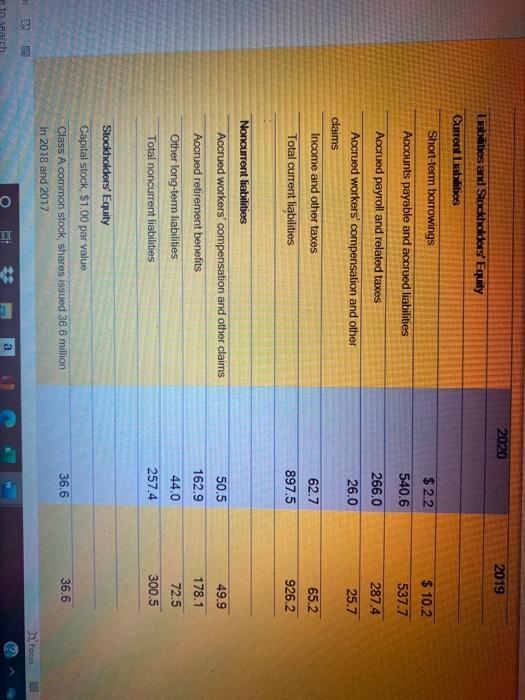

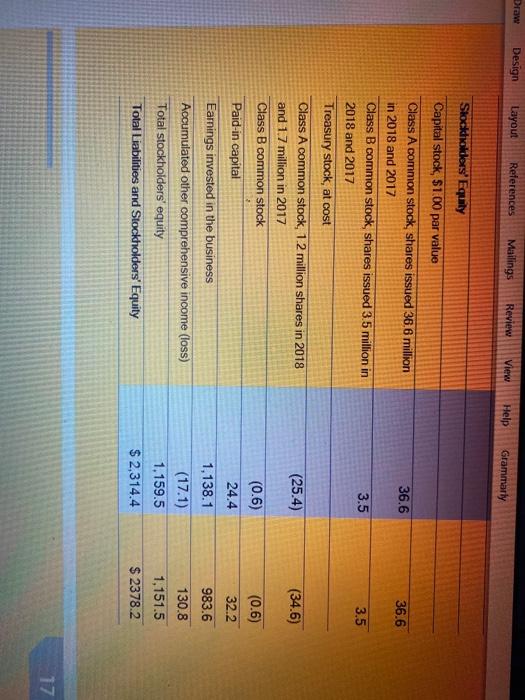

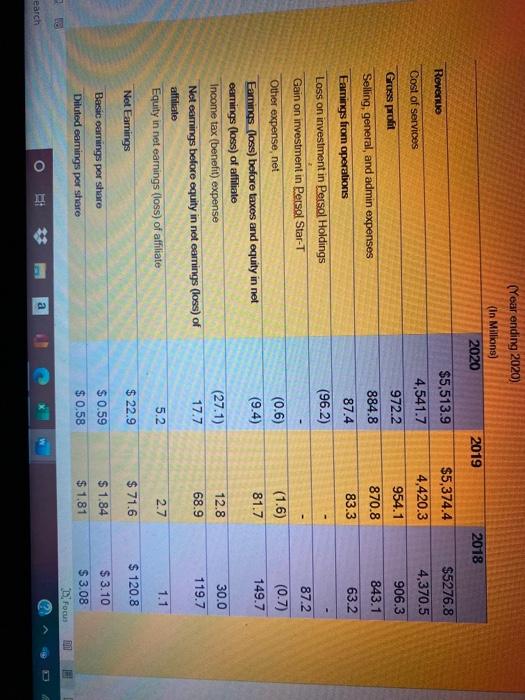

(Year ending 2020) (in Millions) 2020 2019 2018 $5276.8 Revenue $5,374.4 4,420.3 954.1 $5,513.9 4,541.7 972.2 4,370.5 Cost of services 906.3 884.8 870.8 843.1 Gross profit Selling, general, and admin expenses Earnings from operations Loss on investment in Persol Holdings 83.3 63.2 87.4 (96.2) Gain on investment in Persol Star-T (0.6) (9.4) (1.6) 81.7 87.2 (0.7) 149.7 12.8 Other expense, net Eamings (loss) boloro taxes and equity in net earnings (loss) of affiliate Income tax (benefit) expense Not earnings before equity in net earnings (loss) of affiliate Equity in net earnings (loss) of affiliate Not Earings (27.1) 17.7 30.0 119.7 68.9 5.2 2.7 1.1 $ 22.9 $ 71.6 $ 120.8 Basic earnings per sharo Diluted eamings por share $ 0.59 $ 0.58 $ 1.84 $ 1.81 $ 3.10 $ 3.08 Focus earch a (96.2) 872 Loss on investment in Persol Holdings Gain on investment in Persol Star-T Other expense, not Earnings (loss) before taxes and equity in net earrings (loss) of affiliate Income tax (benefit) expense Net camnings boloro equity in not oamings (loss) of affiliato Equity in net earnings (loss) of affiliate (0.6) (9.4) (1.6) 81.7 (0.7) 149.7 12.8 30.0 (27.1) 17.7 68.9 119.7 5.2 2.7 1.1 Not Earings $ 22.9 $ 71.6 $ 120.8 Basic eamings por share $ 0.59 $ 1.84 $ 3.10 $ 0.58 $ 1.81 $ 3.08 $ 0.30 $ 0.30 $ 0.275 Diluted earnings por share Dividends por share The average share outstanding (millions): Basic 38.8 38.3 38.1 Diluted 39.1 39.0 38.4 Focus To search O a LP Consolidated Balance Sheet (in Millions) 2020 2019 Assets Current Assets $ 35.3 Cash and equivalents Trade accounts receivable, less allowances of $132 million and $12.9 million, respectively Prepaid expenses and other current assets $32.5 1,286.7 1.293.3 71.9 1,400.5 Total current assets 65.1 1,284.3 Noncurrent Assets Property and equipment Property and equipment Accumulated depreciation Net property and equipment Deferred taxes Goodwill, net Investment in Persol Holdings Investment in equity affiliate 294.7 (208.4) 86.3 198.7 291.8 (205.7) 86.1 183.4 107.3 107.1 135.1 228.1 121.3 117.4 271.8 Other assets 265.2 Timets Design Layout References Mailings Review View Help Property and equipment Accumulated depreciation Net property and equipment Deferred taxes Grammarly 294.7 (208.4) 86.3 198.7 291.8 (205.7) 86.1 183.4 107.3 Goodwill, net Investment in Persol Holdings 135.1 Investment in equity affiliate 107.1 228.1 117.4 271.8 121.3 265.2 Other assets Total noncurrent assets 913.9 993.9 Total Assets $2,314.4 $2,378.2 2020 2019 Liabilities and Stockholders' Equity Current Labdities $ 2.2 Short-term borrowings Accounts payable and accrued liabilities $ 10.2 540.6 537.7 266.0 287.4 Accrued payroll and related taxes Accrued workers' compensation and other claims 26.0 25.7 Income and other taxes 65.2 Total current liabilities 62.7 897.5 926.2 Noncurrent liabilities Accrued workers' compensation and other claims 49.9 50.5 162.9 Accrued retirement benefits 178.1 44.0 72.5 Other long-term liabilities Total noncurrent liabilities 257.4 300.5 Stockholders' Equity Capital stock, $1.00 par value Class A common stock, shares issued 36.6 million in 2018 and 2017 36.6 36.6 Focus DO Draw Design Layout References Mailings Review View Help Grammarly Stockholders' Equity 36.6 36.6 3.5 3.5 Capital stock, $1.00 par value Class A common stock, shares issued 36,6 million in 2018 and 2017 Class B common stock, shares issued 3.5 million in 2018 and 2017 Treasury stock, at cost Class A common stock, 1.2 million shares in 2018 and 1.7 million in 2017 Class B common stock Paid-in capital Earnings invested in the business Accumulated other comprehensive income (loss) Total stockholders' equity Total Liabilities and Stockholders' Equity (25.4) (34.6) (0.6) 32.2 983.6 (0.6) 24.4 1,138.1 (17.1) 1.159.5 $ 2,314.4 130.8 1,151.5 $ 2378.2 17