Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need help with these two pages understanding them here is what I understand how to do from a previous question I had asked. thank you!

need help with these two pages understanding them

here is what I understand how to do from a previous question I had asked.

thank you!

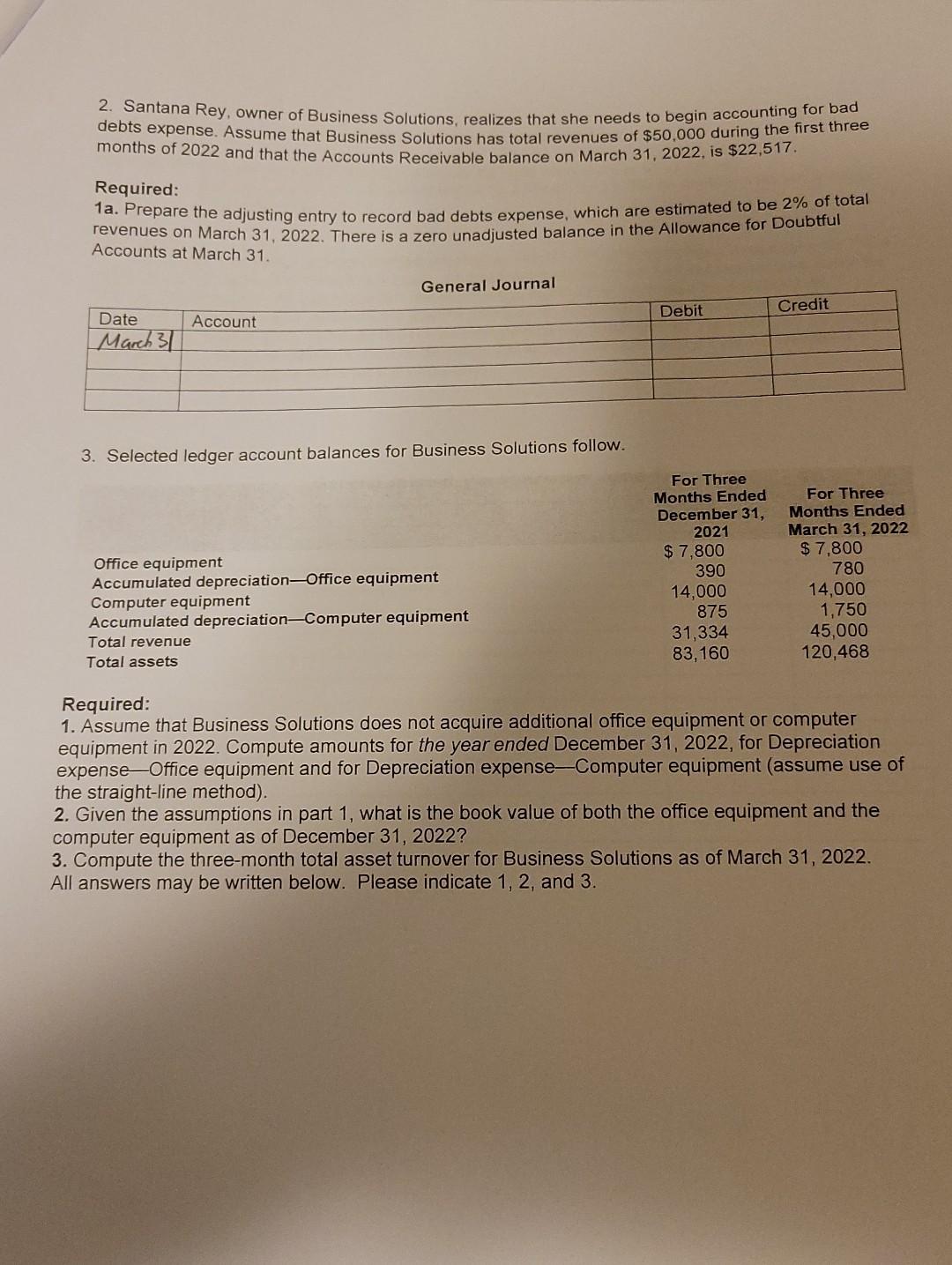

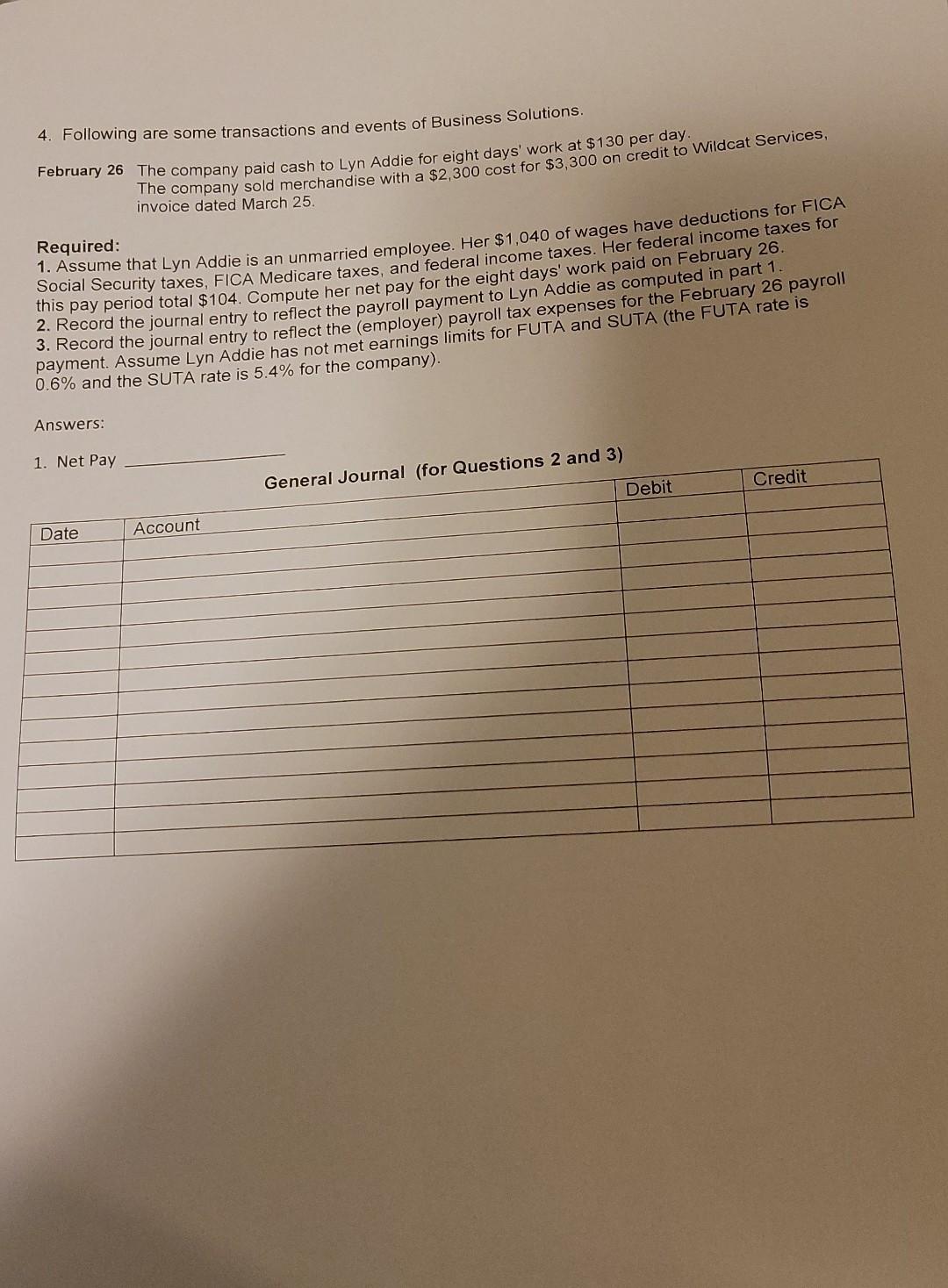

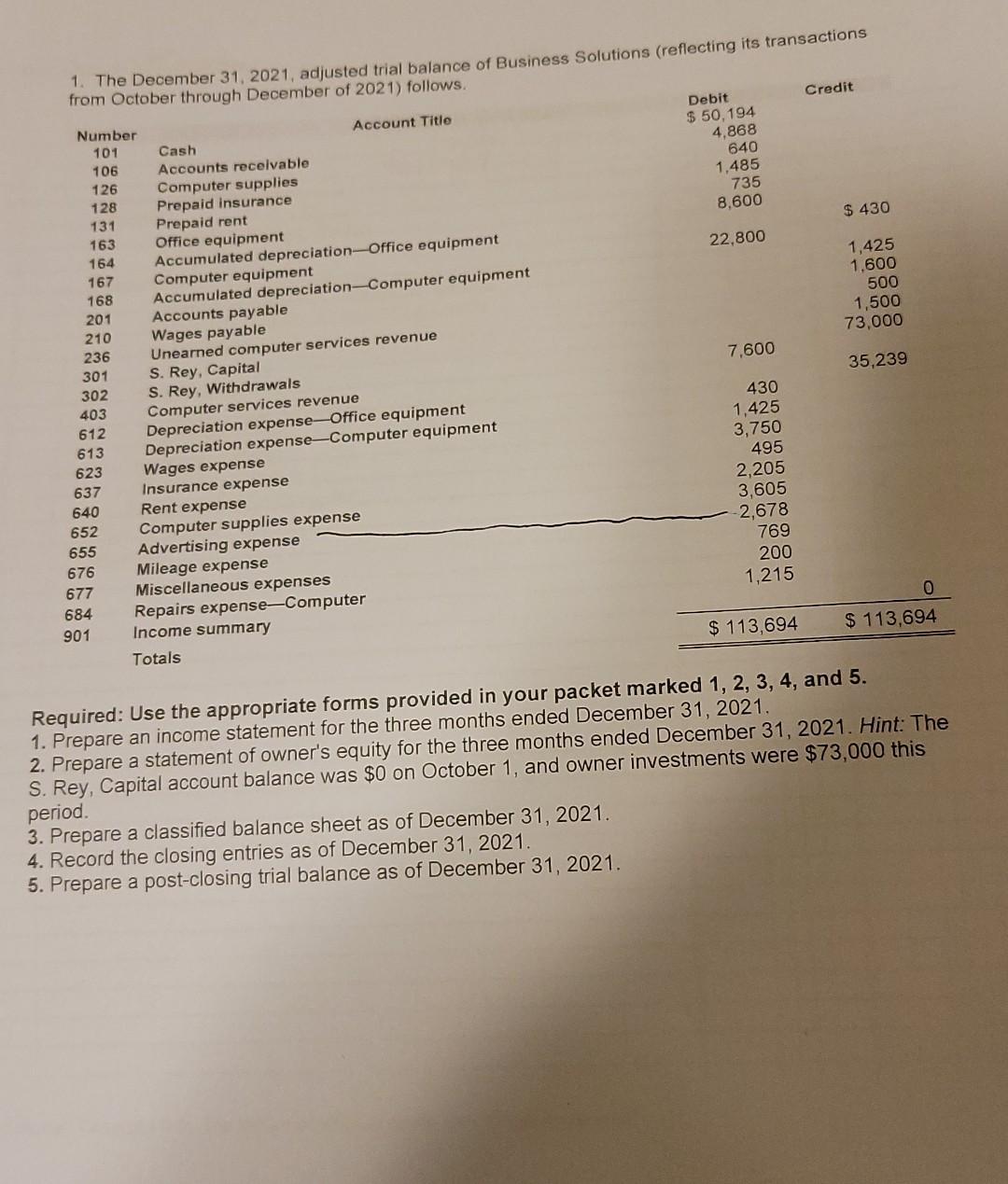

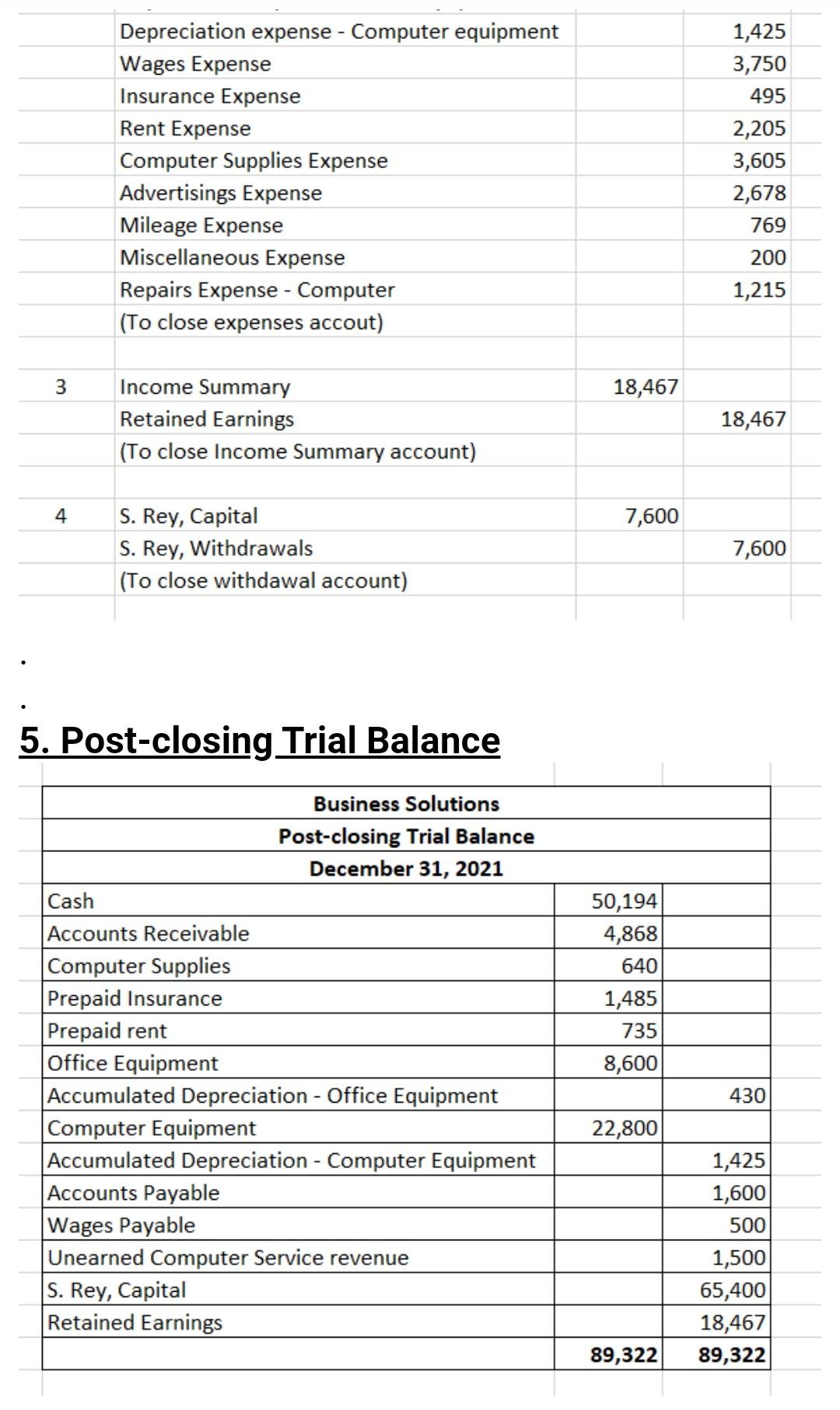

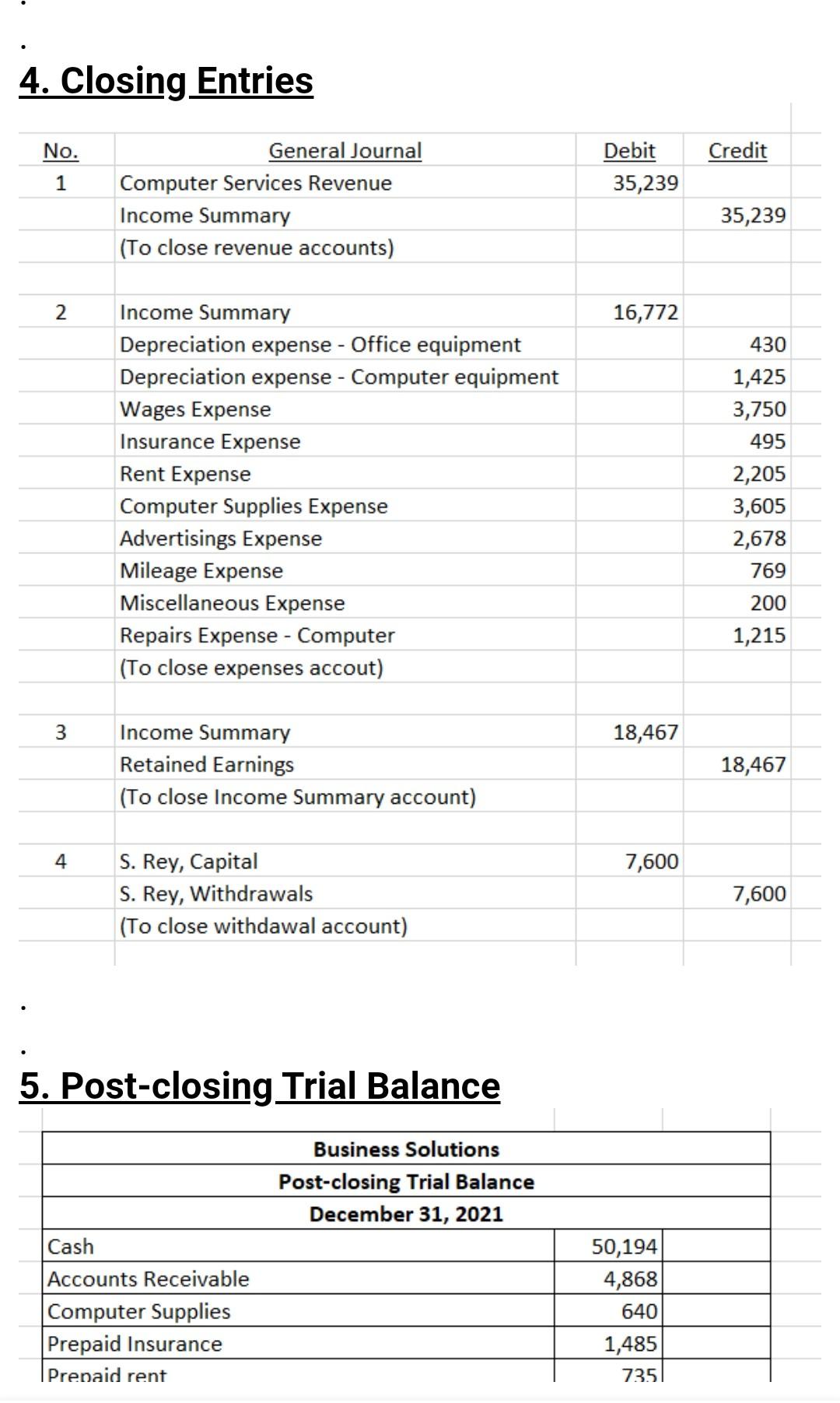

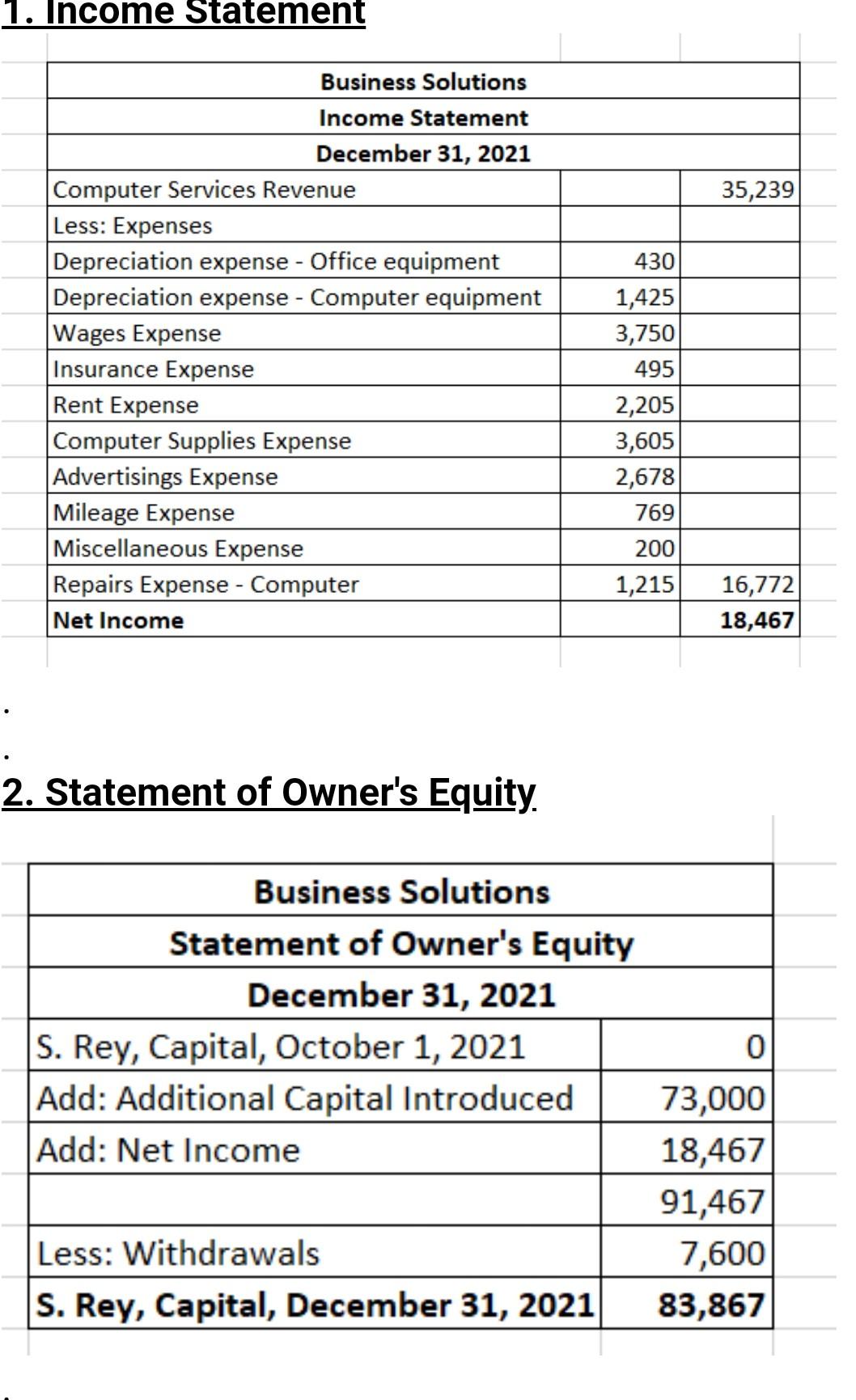

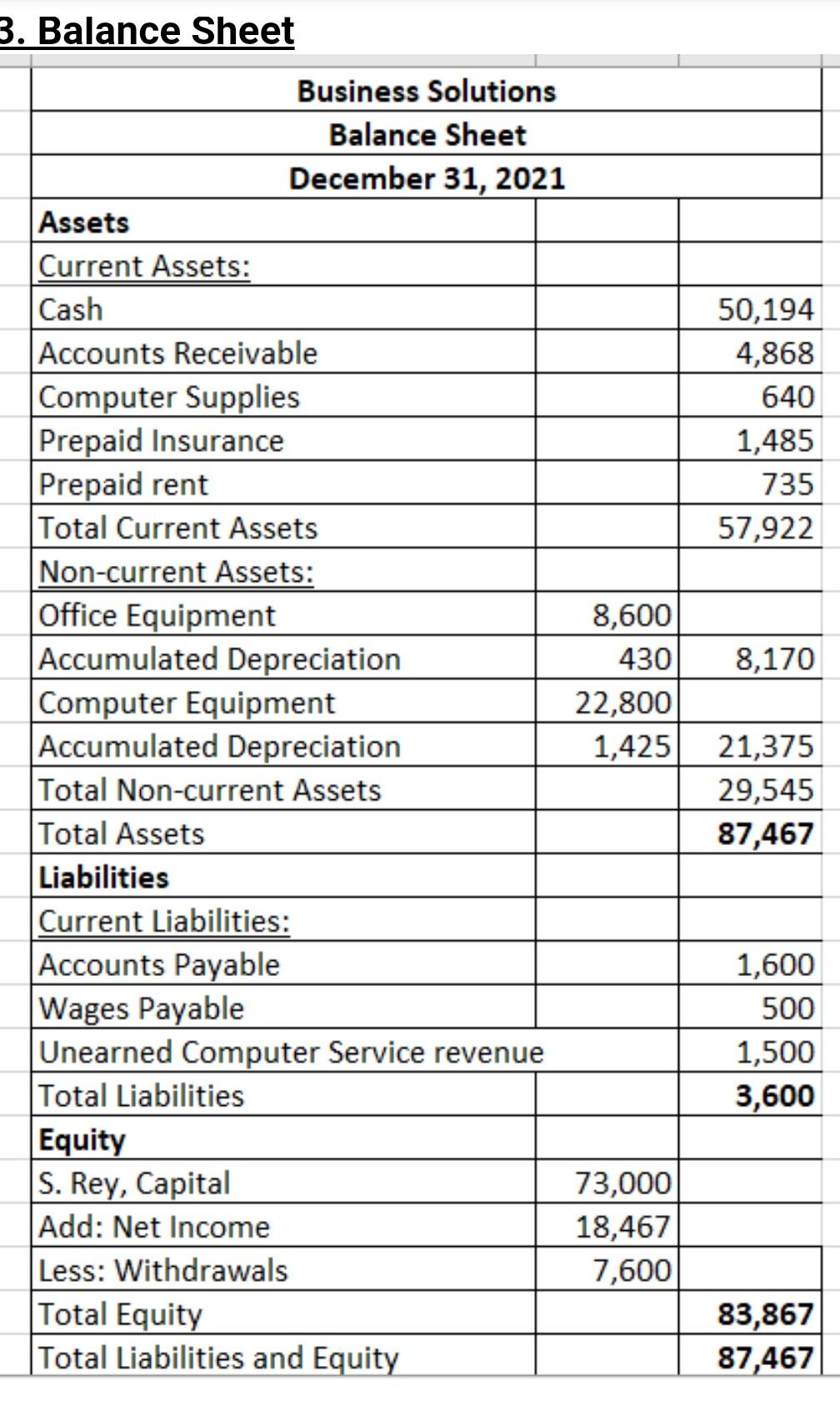

2. Santana Rey, owner of Business Solutions, realizes that she needs to begin accounting for bad. debts expense. Assume that Business Solutions has total revenues of $50,000 during the first three months of 2022 and that the Accounts Receivable balance on March 31, 2022, is $22,517. Required: 1a. Prepare the adjusting entry to record bad debts expense, which are estimated to be 2% of total revenues on March 31, 2022. There is a zero unadjusted balance in the Allowance for Doubtful Accounts at March 31. General Journal Date Debit Credit Account March 31 3. Selected ledger account balances for Business Solutions follow. Office equipment Accumulated depreciation Office equipment Computer equipment Accumulated depreciation Computer equipment Total revenue Total assets For Three Months Ended December 31, 2021 $ 7,800 390 14,000 875 31,334 83,160 For Three Months Ended March 31, 2022 $ 7,800 780 14,000 1,750 45,000 120,468 Required: 1. Assume that Business Solutions does not acquire additional office equipment or computer equipment in 2022. Compute amounts for the year ended December 31, 2022, for Depreciation expense-Office equipment and for Depreciation expense Computer equipment (assume use of the straight-line method). 2. Given the assumptions in part 1, what is the book value of both the office equipment and the computer equipment as of December 31, 2022? 3. Compute the three-month total asset turnover for Business Solutions as of March 31, 2022. All answers may be written below. Please indicate 1, 2, and 3. 4. Following are some transactions and events of Business Solutions. February 26 The company paid cash to Lyn Addie for eight days' work at $130 per day The company sold merchandise with a $2,300 cost for $3,300 on credit to Wildcat Services, invoice dated March 25 Required: 1. Assume that Lyn Addie is an unmarried employee. Her $1,040 of wages have deductions for FICA Social Security taxes, FICA Medicare taxes and federal income taxes. Her federal income taxes for this pay period total $104. Compute her net pay for the eight days' work paid on February 26. 2. Record the journal entry to reflect the payroll payment to Lyn Addie as computed in part 1 3. Record the journal entry to reflect the employer) payroll tax expenses for the February 26 payroll payment. Assume Lyn Addie has not met earnings limits for FUTA and SUTA (the FUTA rate is 0.6% and the SUTA rate is 5.4% for the company). Answers: 1. Net Pay General Journal (for Questions 2 and 3) Credit Debit Date Account 1. The December 31, 2021, adjusted trial balance of Business Solutions (reflecting its transactions from October through December of 2021) follows. Credit Debit Number Account Title 101 Cash $ 50,194 106 4.868 Accounts recelvable 640 126 Computer supplies 1,485 128 Prepaid insurance 735 131 Prepaid rent 8,600 163 Office equipment $ 430 164 Accumulated depreciation Office equipment 22,800 167 Computer equipment 1,425 168 Accumulated depreciation-Computer equipment 1.600 201 Accounts payable 500 210 Wages payable 1,500 236 Unearned computer services revenue 73,000 301 S. Rey, Capital 7,600 302 S. Rey, Withdrawals 35,239 403 Computer services revenue 430 612 Depreciation expense-Office equipment 1,425 613 Depreciation expense-Computer equipment 3,750 623 Wages expense 495 637 Insurance expense 640 Rent expense 2,205 3,605 652 Computer supplies expense 655 Advertising expense -2,678 676 Mileage expense 769 Miscellaneous expenses 200 684 Repairs expense-Computer 1,215 901 Income summary 0 Totals $ 113,694 $ 113,694 677 Required: Use the appropriate forms provided in your packet marked 1, 2, 3, 4, and 5. 1. Prepare an income statement for the three months ended December 31, 2021. 2. Prepare a statement of owner's equity for the three months ended December 31, 2021. Hint: The S. Rey, Capital account balance was $0 on October 1, and owner investments were $73,000 this period. 3. Prepare a classified balance sheet as of December 31, 2021. 4. Record the closing entries as of December 31, 2021. 5. Prepare a post-closing trial balance as of December 31, 2021. Depreciation expense - Computer equipment Wages Expense Insurance Expense Rent Expense Computer Supplies Expense Advertisings Expense Mileage Expense Miscellaneous Expense Repairs Expense - Computer (To close expenses accout) 1,425 3,750 495 2,205 3,605 2,678 769 200 1,215 3 18,467 Income Summary Retained Earnings (To close Income Summary account) 18,467 4 7,600 S. Rey, Capital S. Rey, Withdrawals (To close withdawal account) 7,600 5. Post-closing Trial Balance Business Solutions Post-closing Trial Balance December 31, 2021 Cash Accounts Receivable Computer Supplies Prepaid Insurance Prepaid rent Office Equipment Accumulated Depreciation - Office Equipment Computer Equipment Accumulated Depreciation - Computer Equipment Accounts Payable Wages Payable Unearned Computer Service revenue S. Rey, Capital Retained Earnings 50,194 4,868 640 1,485 735 8,600 430 22,800 1,425 1,600 500 1,500 65,400 18,467 89,322 89,322 4. Closing Entries No. Credit Debit 35,239 1 General Journal Computer Services Revenue Income Summary (To close revenue accounts) 35,239 2 16,772 430 Income Summary Depreciation expense - Office equipment Depreciation expense - Computer equipment Wages Expense Insurance Expense Rent Expense Computer Supplies Expense Advertisings Expense Mileage Expense Miscellaneous Expense Repairs Expense - Computer (To close expenses accout) 1,425 3,750 495 2,205 3,605 2,678 769 200 1,215 3 18,467 Income Summary Retained Earnings (To close Income Summary account) 18,467 4 7,600 S. Rey, Capital S. Rey, Withdrawals (To close withdawal account) 7,600 5. Post-closing Trial Balance Business Solutions Post-closing Trial Balance December 31, 2021 Cash Accounts Receivable Computer Supplies Prepaid Insurance Prepaid rent 50,194 4,868 640 1,485 735 1. Income Statement 35,239 Business Solutions Income Statement December 31, 2021 Computer Services Revenue Less: Expenses Depreciation expense - Office equipment Depreciation expense - Computer equipment Wages Expense Insurance Expense Rent Expense Computer Supplies Expense Advertisings Expense Mileage Expense Miscellaneous Expense Repairs Expense - Computer Net Income 430 1,425 3,750 495 2,205 3,605 2,678 769 200 1,215 16,772 18,467 2. Statement of Owner's Equity. Business Solutions Statement of Owner's Equity December 31, 2021 S. Rey, Capital, October 1, 2021 Add: Additional Capital Introduced Add: Net Income 0 73,000 18,467 91,467 7,600 83,867 Less: Withdrawals S. Rey, Capital, December 31, 2021 3. Balance Sheet 50,194 4,868 640 1,485 735 57,922 8,170 Business Solutions Balance Sheet December 31, 2021 Assets Current Assets: Cash Accounts Receivable Computer Supplies Prepaid Insurance Prepaid rent Total Current Assets Non-current Assets: Office Equipment 8,600 Accumulated Depreciation 430 Computer Equipment 22,800 Accumulated Depreciation 1,425 Total Non-current Assets Total Assets Liabilities Current Liabilities: Accounts Payable Wages Payable Unearned Computer Service revenue Total Liabilities Equity S. Rey, Capital 73,000 Add: Net Income 18,467 Less: Withdrawals 7,600 Total Equity Total Liabilities and Equity 21,375 29,545 87,467 1,600 500 1,500 3,600 83,867 87,467Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started