Answered step by step

Verified Expert Solution

Question

1 Approved Answer

find the following estimates (in millions of dollars): (Click on the following icon in order to copy its contents into a spreadsheet.) begin{tabular}{|c|c|c|c|c|c|} hline &

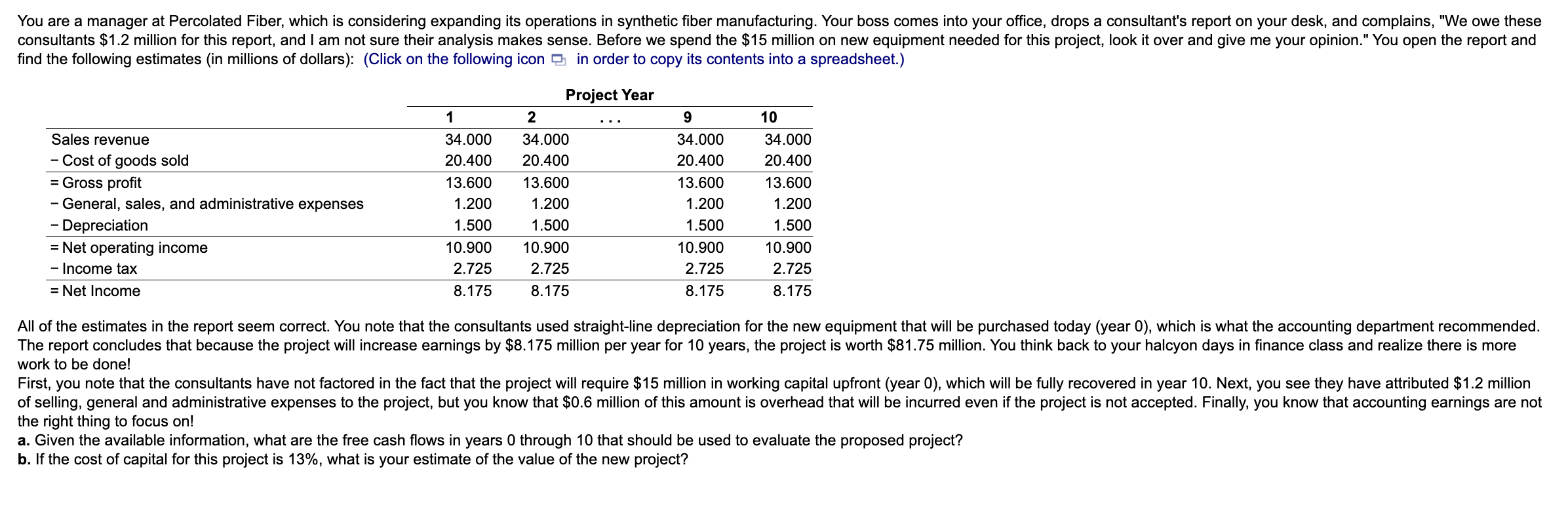

find the following estimates (in millions of dollars): (Click on the following icon in order to copy its contents into a spreadsheet.) \begin{tabular}{|c|c|c|c|c|c|} \hline & \multicolumn{5}{|c|}{ Project Year } \\ \hline & 1 & 2 & & 9 & 10 \\ \hline Sales revenue & 34.000 & 34.000 & & 34.000 & 34.000 \\ \hline - Cost of goods sold & 20.400 & 20.400 & & 20.400 & 20.400 \\ \hline= Gross profit & 13.600 & 13.600 & & 13.600 & 13.600 \\ \hline - General, sales, and administrative expenses & 1.200 & 1.200 & & 1.200 & 1.200 \\ \hline - Depreciation & 1.500 & 1.500 & & 1.500 & 1.500 \\ \hline= Net operating income & 10.900 & 10.900 & & 10.900 & 10.900 \\ \hline - Income tax & 2.725 & 2.725 & & 2.725 & 2.725 \\ \hline= Net Income & 8.175 & 8.175 & & 8.175 & 8.175 \\ \hline \end{tabular} work to be done! the right thing to focus on! a. Given the available information, what are the free cash flows in years 0 through 10 that should be used to evaluate the proposed project? b. If the cost of capital for this project is 13%, what is your estimate of the value of the new project

find the following estimates (in millions of dollars): (Click on the following icon in order to copy its contents into a spreadsheet.) \begin{tabular}{|c|c|c|c|c|c|} \hline & \multicolumn{5}{|c|}{ Project Year } \\ \hline & 1 & 2 & & 9 & 10 \\ \hline Sales revenue & 34.000 & 34.000 & & 34.000 & 34.000 \\ \hline - Cost of goods sold & 20.400 & 20.400 & & 20.400 & 20.400 \\ \hline= Gross profit & 13.600 & 13.600 & & 13.600 & 13.600 \\ \hline - General, sales, and administrative expenses & 1.200 & 1.200 & & 1.200 & 1.200 \\ \hline - Depreciation & 1.500 & 1.500 & & 1.500 & 1.500 \\ \hline= Net operating income & 10.900 & 10.900 & & 10.900 & 10.900 \\ \hline - Income tax & 2.725 & 2.725 & & 2.725 & 2.725 \\ \hline= Net Income & 8.175 & 8.175 & & 8.175 & 8.175 \\ \hline \end{tabular} work to be done! the right thing to focus on! a. Given the available information, what are the free cash flows in years 0 through 10 that should be used to evaluate the proposed project? b. If the cost of capital for this project is 13%, what is your estimate of the value of the new project Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started