Answered step by step

Verified Expert Solution

Question

1 Approved Answer

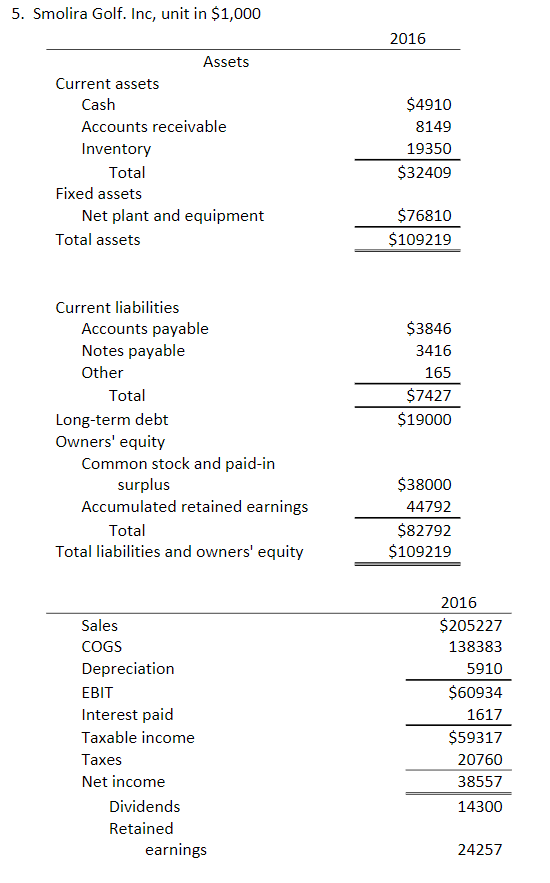

Find the following financial ratios for Smolira Golf Short-term solvency ratios: Current ratio: Quick ratio: Cash ratio: Long-term solvency ratios: Total debt ratio: Debt equity

Find the following financial ratios for Smolira Golf Short-term solvency ratios: Current ratio: Quick ratio: Cash ratio:

Long-term solvency ratios: Total debt ratio: Debt equity ratio: Equity multiplier:

Asset management ratios: Total asset turnover: Inventory turnover: Receivables turnover:

Profitability ratios: Profit margin: Return on assets (please show the DuPont Identity): Return on equity:

Market value ratios: Given the number of outstanding share is 10,000K and stock price is $20 per share PE ratios:

5. Smolira Golf. Inc, unit in $1,000 2016 Assets Current assets Cash Accounts receivable Inventory Total Fixed assets Net plant and equipment Total assets $4910 8149 19350 $32409 $76810 $109219 $3846 3416 165 $7427 $19000 Current liabilities Accounts payable Notes payable Other Total Long-term debt Owners' equity Common stock and paid-in surplus Accumulated retained earnings Total Total liabilities and owners' equity $38000 44792 $82792 $109219 Sales COGS Depreciation EBIT Interest paid Taxable income Taxes Net income Dividends Retained earnings 2016 $205227 138383 5910 $60934 1617 $59317 20760 38557 14300 24257Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started