Answered step by step

Verified Expert Solution

Question

1 Approved Answer

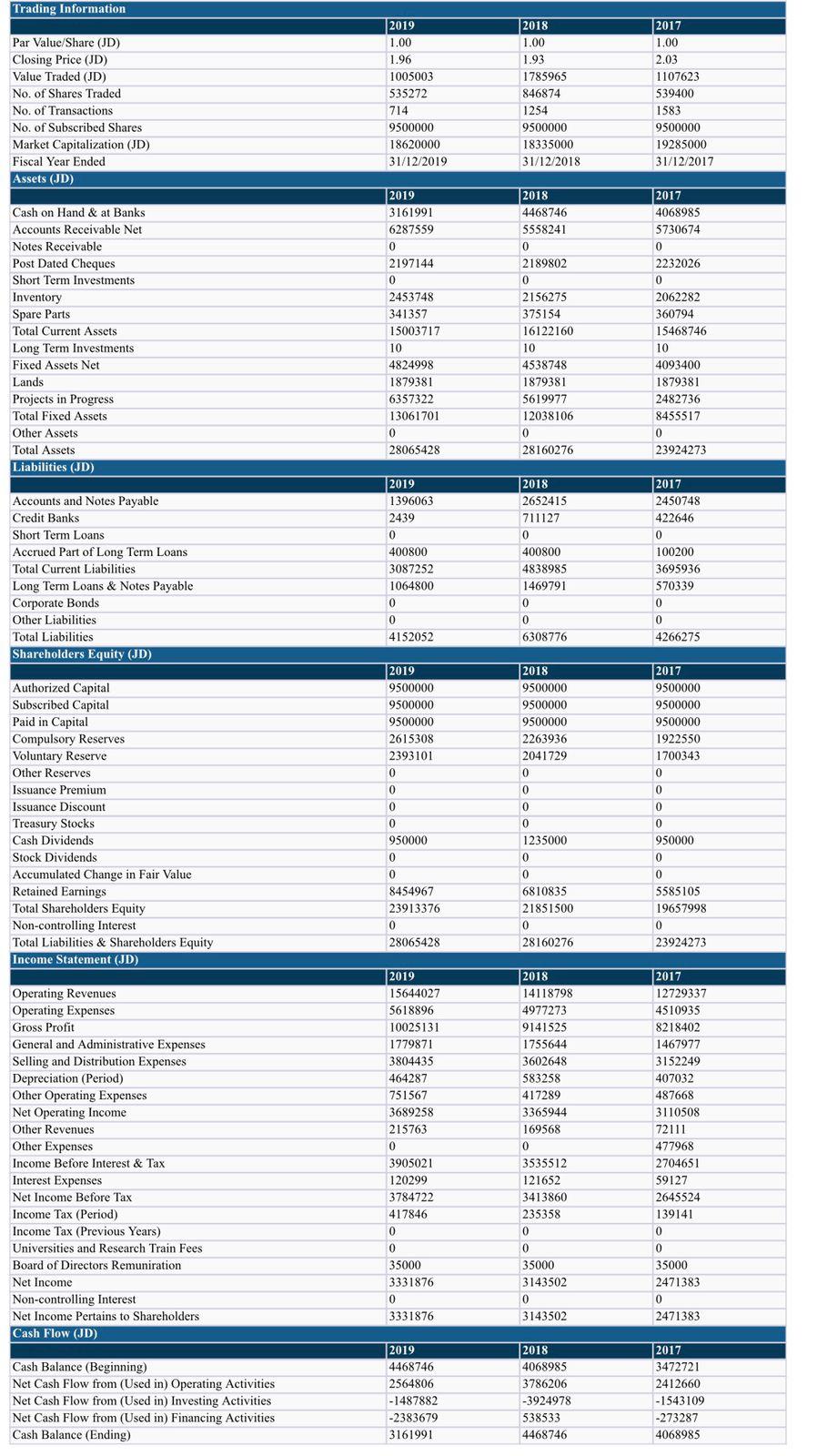

Find the following for 2019 and 2018 years ? 1-Net profit margin 2-Total asset turnover 3-Return on asset 4-Operating income margin 5-Operating assets turnover 6-Revenue

Find the following for 2019 and 2018 years ? 1-Net profit margin 2-Total asset turnover 3-Return on asset 4-Operating income margin 5-Operating assets turnover 6-Revenue on operating asset 7-Return on equity 8-Return on common equity 9-Gross profit margin 10-Sales to fixed asset 11-Return on investment 12-Return on total equity 13-Return on common equity

Trading Information Par Value/Share (JD) Closing Price (JD) Value Traded (JD) No. of Shares Traded No. of Transactions No. of Subscribed Shares Market Capitalization (JD) Fiscal Year Ended Assets (JD) 2019 1.00 1.96 1005003 535272 714 9500000 18620000 31/12/2019 2018 1.00 1.93 1785965 846874 1254 9500000 18335000 31/12/2018 2017 1.00 2.03 1107623 539400 1583 9500000 19285000 31/12/2017 Cash on Hand & at Banks Accounts Receivable Net Notes Receivable Post Dated Cheques Short Term Investments Inventory Spare Parts Total Current Assets Long Term Investments Fixed Assets Net Lands Projects in Progress Total Fixed Assets Other Assets Total Assets Liabilities (JD) 2019 3161991 6287559 0 2197144 0 2453748 341357 15003717 10 4824998 1879381 6357322 13061701 0 28065428 2018 4468746 5558241 0 2189802 0 2156275 375154 16122160 10 4538748 1879381 5619977 12038106 0 28160276 2017 4068985 5730674 0 2232026 0 2062282 360794 15468746 10 4093400 1879381 2482736 8455517 0 23924273 2018 2017 Accounts and Notes Payable Credit Banks Short Term Loans Accrued Part of Long Term Loans Total Current Liabilities Long Term Loans & Notes Payable Corporate Bonds Other Liabilities Total Liabilities Shareholders Equity (JD) 2019 1396063 2439 0 400800 3087252 1064800 0 0 4152052 2652415 711127 0 400800 4838985 1469791 0 0 6308776 2450748 422646 0 100200 3695936 570339 0 0 4266275 2019 9500000 9500000 9500000 2615308 2393101 0 0 Authorized Capital Subscribed Capital Paid in Capital Compulsory Reserves Voluntary Reserve Other Reserves Issuance Premium Issuance Discount Treasury Stocks Cash Dividends Stock Dividends Accumulated Change in Fair Value Retained Earnings Total Shareholders Equity Non-controlling Interest Total Liabilities & Shareholders Equity Income Statement (JD) 0 0 950000 0 0 8454967 23913376 0 28065428 2018 9500000 9500000 9500000 2263936 2041729 0 0 0 0 0 1235000 0 0 6810835 21851500 0 28160276 |2017 9500000 9500000 9500000 1922550 1700343 0 0 0 0 950000 0 0 5585105 19657998 0 23924273 2018 14118798 4977273 9141525 1755644 3602648 583258 417289 3365944 Operating Revenues Operating Expenses Gross Profit General and Administrative Expenses Selling and Distribution Expenses Depreciation (Period) Other Operating Expenses Net Operating Income Other Revenues Other Expenses Income Before Interest & Tax Interest Expenses Net Income Before Tax Income Tax (Period) Income Tax (Previous Years) Universities and Research Train Fees Board of Directors Remuniration Net Income Non-controlling Interest Net Income Pertains to Shareholders Cash Flow (JD) 2019 15644027 5618896 10025131 1779871 3804435 464287 751567 3689258 215763 0 3905021 120299 3784722 417846 0 0 35000 3331876 0 3331876 169568 0 3535512 121652 3413860 235358 0 0 35000 3143502 0 3143502 2017 12729337 4510935 8218402 1467977 3152249 407032 487668 3110508 72111 477968 2704651 59127 2645524 139141 0 0 35000 2471383 0 2471383 Cash Balance (Beginning) Net Cash Flow from (Used in) Operating Activities Net Cash Flow from (Used in) Investing Activities Net Cash Flow from (Used in) Financing Activities Cash Balance (Ending) 2019 4468746 2564806 - 1487882 -2383679 3161991 2018 4068985 3786206 -3924978 538533 4468746 2017 3472721 2412660 - 1543109 -273287 4068985

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started