Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Find the holding period return. If you can please write it out step by step so it is easy to understand. This is the entire

Find the holding period return. If you can please write it out step by step so it is easy to understand.

This is the entire page. no other information i can give. what is missing exactly?

If you are looking for par value of bond it is assumed the price is $1000.

I dont understand what else do you need. there is nothing more i can give.

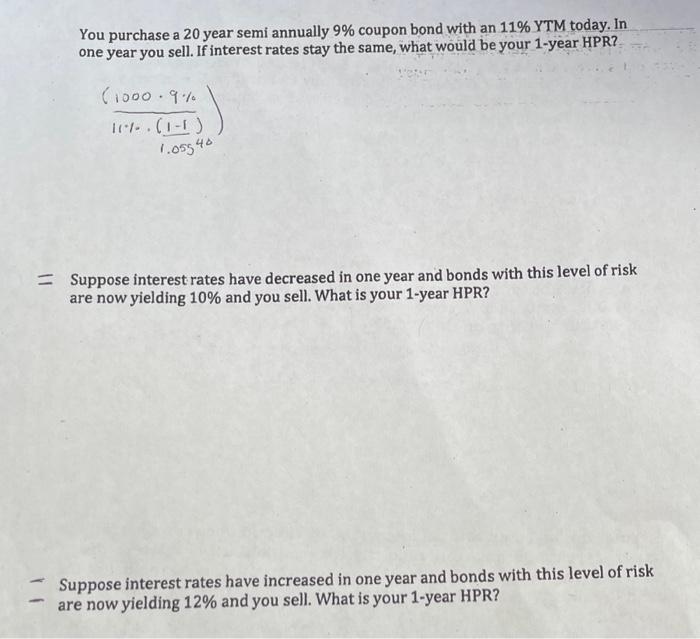

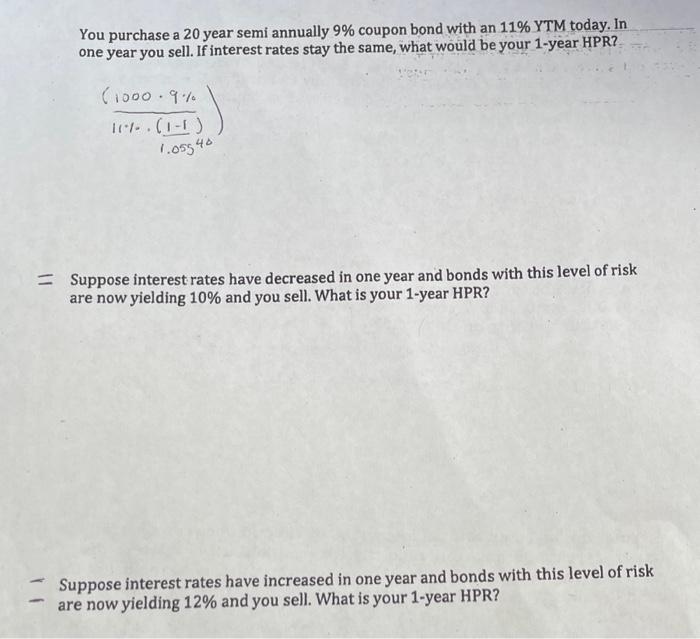

You purchase a 20 year semi annually 9% coupon bond with an 11% YTM today. In one year you sell. If interest rates stay the same, what would be your 1-year HPR? You purchase a 20 year semi annually 9% coupon bond with an 11% YTM today. In one year you sell. If interest rates stay the same, what would be your 1-year HPR? 11%1.055(11)40(10009%) = Suppose interest rates have decreased in one year and bonds with this level of risk are now yielding 10% and you sell. What is your 1-year HPR? - Suppose interest rates have increased in one year and bonds with this level of risk are now yielding 12% and you sell. What is your 1-year HPR Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started