Answered step by step

Verified Expert Solution

Question

1 Approved Answer

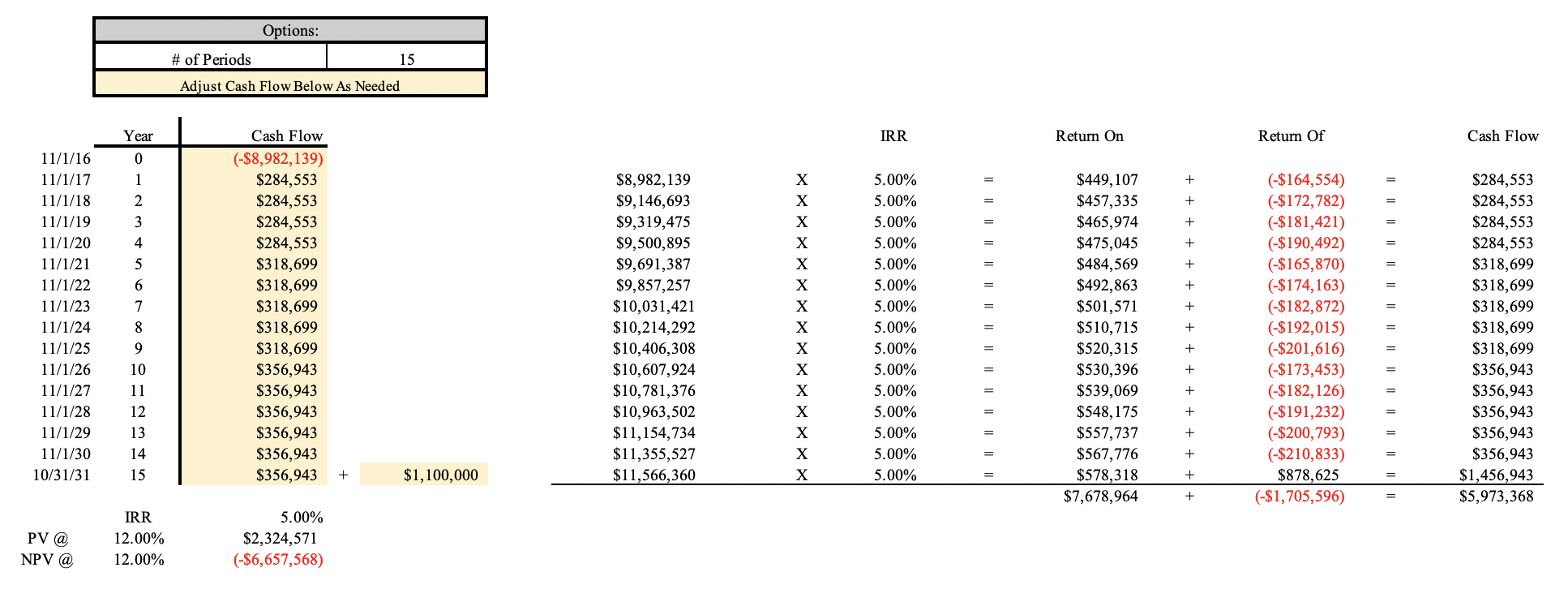

Find the NPV (net present value) of lease payments if we use a discount rate of 5% with a November 1, 2020 start date. Current

Find the NPV (net present value) of lease payments if we use a discount rate of 5% with a November 1, 2020 start date. Current monthly rent is $23,712.75 and increases 11/1/21 by CPI not to exceed 12 %. Lets assume 12% increase at 11/1/21 and 11/1/26. Lease expires on 10/31/31.

The monthly starting lease: $23,712.75

Options: # of Periods 15 Adjust Cash Flow Below As Needed Year IRR Return On Return Of Cash Flow 0 1 + + + + 2 3 4 5 6 7 8 + + 11/1/16 11/1/17 11/1/18 11/1/19 11/1/20 11/1/21 11/1/22 11/1/23 11/1/24 11/1/25 11/1/26 11/1/27 11/1/28 11/1/29 11/1/30 10/31/31 Cash Flow (-$8,982,139) $284,553 $284,553 $284,553 $284,553 $318,699 $318,699 $318,699 $318,699 $318,699 $356,943 $356,943 $356,943 $356,943 $356,943 $356,943 + $8,982,139 $9,146,693 $9,319,475 $9,500,895 $9,691,387 $9,857,257 $10,031,421 $10,214,292 $10,406,308 $10,607,924 $10,781,376 $10,963,502 $11,154,734 $11,355,527 $11,566,360 X X X X X X X X X X X X X X X 5.00% 5.00% 5.00% 5.00% 5.00% 5.00% 5.00% 5.00% 5.00% 5.00% 5.00% 5.00% 5.00% 5.00% 5.00% + $449,107 $457,335 $465,974 $475,045 $484,569 $492,863 $501,571 $510,715 $520,315 $530,396 $539,069 $548,175 $557,737 $567,776 $578,318 $7,678,964 (-$164,554) (-$172,782) (-$181,421) (-$190,492) (-$165,870) (-$174, 163) (-$182,872) (-$192,015) (-$201,616) (-$173,453) (-$182,126) (-$191,232) (-$200,793) (-$210,833) $878,625 (-$1,705,596) $284,553 $284,553 $284,553 $284,553 $318,699 $318,699 $318,699 $318,699 $318,699 $356,943 $356,943 $356,943 $356,943 $356,943 $1,456,943 $5,973,368 9 + 10 + + + 11 12 13 14 15 + + + $1,100,000 + = + PV @ NPV @ IRR 12.00% 12.00% 5.00% $2,324,571 (-$6,657,568) Options: # of Periods 15 Adjust Cash Flow Below As Needed Year IRR Return On Return Of Cash Flow 0 1 + + + + 2 3 4 5 6 7 8 + + 11/1/16 11/1/17 11/1/18 11/1/19 11/1/20 11/1/21 11/1/22 11/1/23 11/1/24 11/1/25 11/1/26 11/1/27 11/1/28 11/1/29 11/1/30 10/31/31 Cash Flow (-$8,982,139) $284,553 $284,553 $284,553 $284,553 $318,699 $318,699 $318,699 $318,699 $318,699 $356,943 $356,943 $356,943 $356,943 $356,943 $356,943 + $8,982,139 $9,146,693 $9,319,475 $9,500,895 $9,691,387 $9,857,257 $10,031,421 $10,214,292 $10,406,308 $10,607,924 $10,781,376 $10,963,502 $11,154,734 $11,355,527 $11,566,360 X X X X X X X X X X X X X X X 5.00% 5.00% 5.00% 5.00% 5.00% 5.00% 5.00% 5.00% 5.00% 5.00% 5.00% 5.00% 5.00% 5.00% 5.00% + $449,107 $457,335 $465,974 $475,045 $484,569 $492,863 $501,571 $510,715 $520,315 $530,396 $539,069 $548,175 $557,737 $567,776 $578,318 $7,678,964 (-$164,554) (-$172,782) (-$181,421) (-$190,492) (-$165,870) (-$174, 163) (-$182,872) (-$192,015) (-$201,616) (-$173,453) (-$182,126) (-$191,232) (-$200,793) (-$210,833) $878,625 (-$1,705,596) $284,553 $284,553 $284,553 $284,553 $318,699 $318,699 $318,699 $318,699 $318,699 $356,943 $356,943 $356,943 $356,943 $356,943 $1,456,943 $5,973,368 9 + 10 + + + 11 12 13 14 15 + + + $1,100,000 + = + PV @ NPV @ IRR 12.00% 12.00% 5.00% $2,324,571 (-$6,657,568)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started