Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Find the optimal portfolio for a target Active Risk of 5% per year, assuming that short-positions are allowed, but now adding the constrains that the

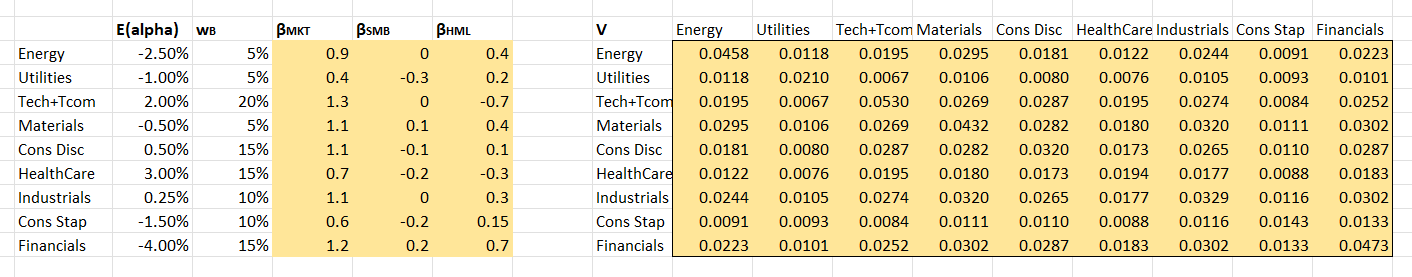

Find the optimal portfolio for a target Active Risk of 5% per year, assuming that short-positions are allowed, but now adding the constrains that the beta of the optimal portfolio with respect to the HML Risk Factor (aka Value Risk Factor) has to be "small". More specifically, such beta has to be between -0.1 and +0.1. calculate Information Ratio of such portfolio

E(alpha) WB SMB BHML V Energy Utilities Energy -2.50% 5% 0.9 0 0.4 Energy Utilities -1.00% 5% 0.4 -0.3 0.2 Tech+Tcom 2.00% 20% 1.3 0 -0.7 Materials -0.50% 5% 1.1 0.1 0.4 Cons Disc 0.50% 15% 1.1 -0.1 0.1 HealthCare 3.00% 15% 0.7 -0.2 -0.3 Industrials 0.25% 10% 1.1 0 0.3 Cons Stap -1.50% 10% 0.6 -0.2 0.15 Utilities Tech+Tcom Materials Cons Disc HealthCare Industrials Cons Stap Financials -4.00% 15% 1.2 0.2 0.7 Financials Tech+Tcom Materials Cons Disc HealthCare Industrials Cons Stap Financials 0.0458 0.0118 0.0195 0.0295 0.0181 0.0122 0.0244 0.0091 0.0223 0.0118 0.0210 0.0067 0.0106 0.0080 0.0076 0.0105 0.0093 0.0101 0.0195 0.0067 0.0530 0.0269 0.0287 0.0195 0.0274 0.0084 0.0252 0.0295 0.0106 0.0269 0.0432 0.0282 0.0180 0.0320 0.0111 0.0302 0.0181 0.0080 0.0287 0.0282 0.0320 0.0173 0.0265 0.0110 0.0287 0.0122 0.0076 0.0195 0.0180 0.0173 0.0194 0.0177 0.0088 0.0183 0.0244 0.0105 0.0274 0.0320 0.0265 0.0177 0.0329 0.0116 0.0302 0.0091 0.0093 0.0084 0.0111 0.0110 0.0088 0.0116 0.0143 0.0133 0.0223 0.0101 0.0252 0.0302 0.0287 0.0183 0.0302 0.0133 0.0473

Step by Step Solution

★★★★★

3.47 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Answer To find the optimal portfolio for a target Active Risk of 5 per year with ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

6642bb2314c80_975195.pdf

180 KBs PDF File

6642bb2314c80_975195.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started