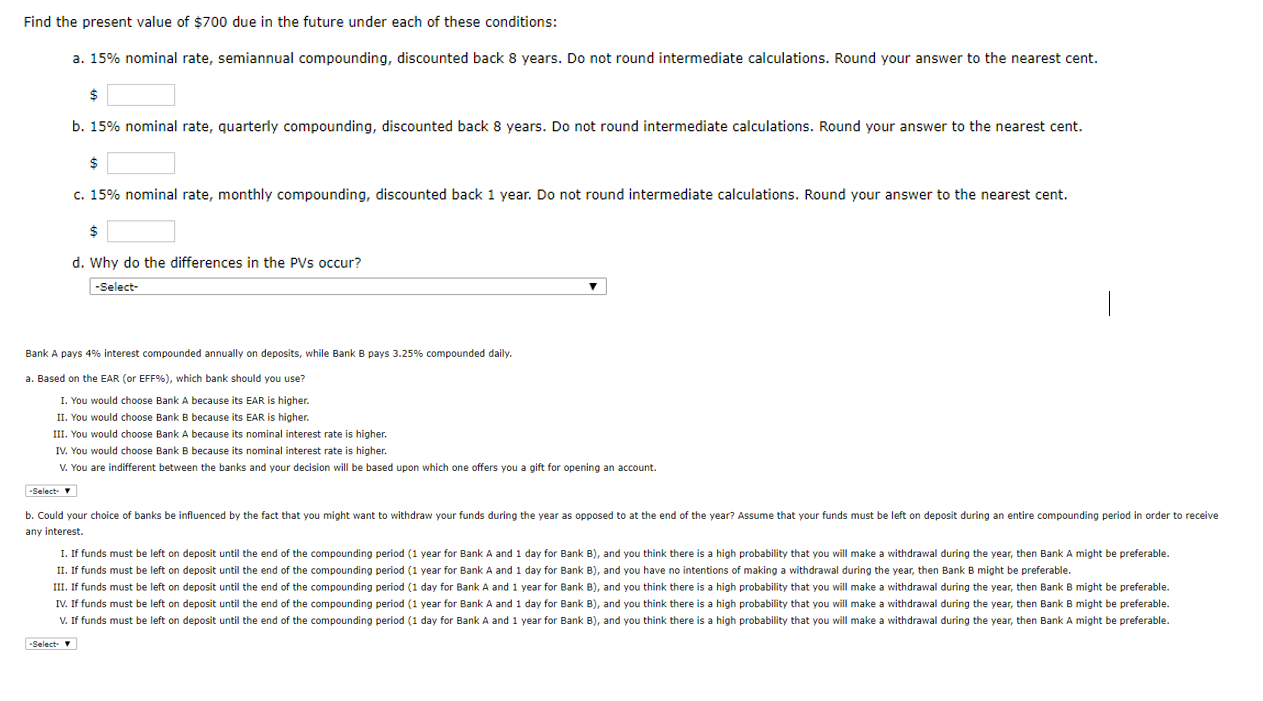

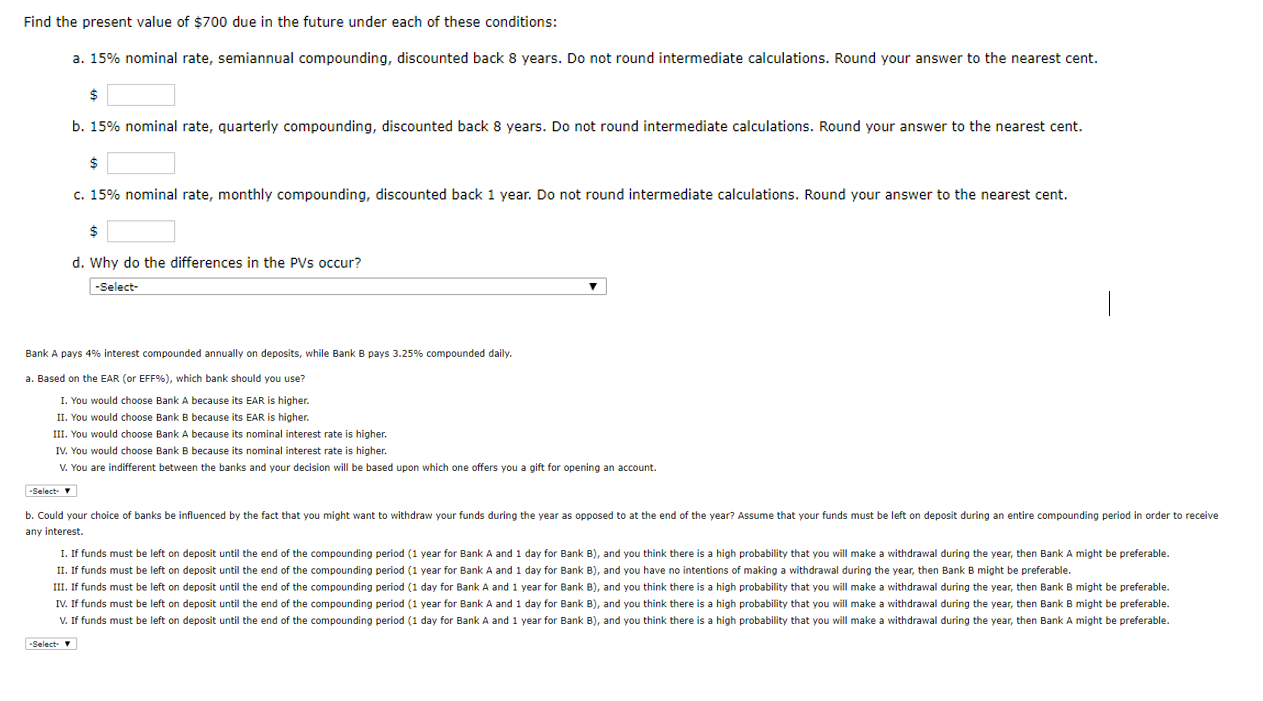

Find the present value of $700 due in the future under each of these conditions: a. 15% nominal rate, semiannual compounding, discounted back 8 years. Do not round intermediate calculations. Round your answer to the nearest cent. b. 15% nominal rate, quarterly compounding, discounted back 8 years. Do not round intermediate calculations. Round your answer to the nearest cent. c. 15% nominal rate, monthly compounding, discounted back 1 year. Do not round intermediate calculations. Round your answer to the nearest cent. d. Why do the differences in the PVs occur? -Select- Bank A pays 4% interest compounded annually on deposits, while Bank B pays 3.25% compounded daily. a. Based on the EAR (or EFF%), which bank should you use? I. You would choose Bank A because its EAR is higher. II. You would choose Bank B because its EAR is higher. III. You would choose Bank A because its nominal interest rate is higher. IV. You would choose Bank B because its nominal interest rate is higher. V. You are indifferent between the banks and your decision will be based upon which one offers you a gift for opening an account. - Select b. Could your choice of banks be influenced by the fact that you might want to withdraw your funds during the year as opposed to at the end of the year? Assume that your funds must be left on deposit during an entire compounding period in order to receive any interest. I. If funds must be left on deposit until the end of the compounding period (1 year for Bank A and 1 day for Bank B), and you think there is a high probability that you will make a withdrawal during the year, then Bank A might be preferable. II. If funds must be left on deposit until the end of the compounding period (1 year for Bank A and 1 day for Bank B), and you have no intentions of making a withdrawal during the year, then Bank B might be preferable. III. If funds must be left on deposit until the end of the compounding period (1 day for Bank A and 1 year for Bank B), and you think there is a high probability that you will make a withdrawal during the year, then Bank B might be preferable. IV. If funds must be left on deposit until the end of the compounding period (1 year for Bank A and 1 day for Bank B), and you think there is a high probability that you will make a withdrawal during the year, then Bank B might be preferable. V. If funds must be left on deposit until the end of the compounding period (1 day for Bank A and 1 year for Bank B), and you think there is a high probability that you will make a withdrawal during the year, then Bank A might be preferable. -Select